Investing in the stock market can be a lucrative venture, especially when you have knowledge about emerging industries and their potential for growth. One such sector that has been on the rise in recent years is the battery industry, with Chinese battery stocks taking center stage.

In this article, we will explore why Chinese battery stocks are gaining prominence and discuss some top companies to consider investing in.

Introduction to the Growing Importance of Batteries in Various Industries

Batteries have become essential across industries, powering everything from smartphones to electric vehicles. They play a crucial role in storing renewable energy from solar panels and wind turbines, driving the shift towards cleaner and more sustainable power sources.

The demand for batteries is soaring as they enable longer-lasting electronics, support the growth of electric vehicles, and ensure uninterrupted functionality in aerospace and defense applications. Manufacturers are constantly improving battery technologies to meet increasing demands for higher energy density, faster charging, and improved safety.

The growing importance of batteries signifies our collective commitment to a greener future.

Overview of China’s Dominance in the Battery Market

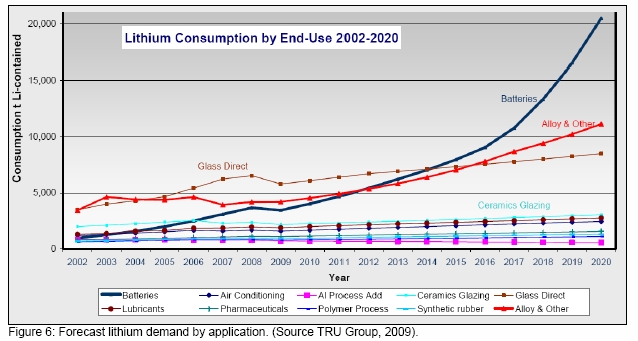

China has become a dominant player in the global battery market due to its comprehensive supply chain, access to key raw materials like lithium and cobalt, economies of scale, and commitment to research and development.

With abundant reserves of lithium and strategic partnerships for cobalt sourcing, Chinese manufacturers have a competitive advantage. Their large-scale operations enable them to produce batteries at a lower cost while maintaining high quality.

As a result, China is not only a major consumer but also an exporter of batteries, solidifying its position as a leading force in the industry.

Understanding the Potential of Chinese Battery Stocks

China’s commitment to clean energy and electric vehicles has created a favorable environment for battery manufacturers. The demand for batteries is driven by the increasing shift towards electric vehicles worldwide and the need for efficient energy storage systems for renewable energy sources like solar and wind.

China’s incentives and subsidies for EV adoption have led to a surge in battery demand. With ambitious targets for renewable energy generation, Chinese battery stocks hold significant growth potential. Investors can tap into this thriving market by capitalizing on China’s focus on clean energy and electric vehicles.

Top Chinese Battery Stocks to Consider Investing In

China’s position as a global leader in the battery industry presents exciting investment opportunities. BYD, a leading Chinese battery manufacturer, has a strong presence in electric vehicles and energy storage. Their partnerships with major automakers solidify their market position.

Albemarle, a global leader in lithium production, supplies lithium products to battery manufacturers and has a significant presence in China. Panasonic, known for consumer electronics, also has a notable presence in the battery market and delivers consistent returns to investors.

When considering these stocks, evaluate their competitive advantages and potential risks such as intense competition and regulatory changes. Chinese battery stocks offer promising growth potential in the emerging markets of electric vehicles and energy storage.

Tips for Successful Investing in Chinese Battery Stocks

Investing in Chinese battery stocks requires careful consideration and understanding of the market dynamics. Here are some key tips to help you make informed investment decisions:

-

Diversify Your Portfolio: Spread your investments across multiple battery companies to mitigate risks associated with individual stock performance.

-

Stay Informed: Keep up-to-date with industry news and market developments to identify emerging trends or potential risks that may impact your investments.

-

Long-term Perspective: Understand that the growth potential of Chinese battery stocks may take several years to realize. Patience and a long-term investment strategy are key to successful investing in this sector.

By following these tips, you can position yourself for successful investing in Chinese battery stocks. However, always conduct thorough research and seek professional advice before making any investment decisions in this dynamic and rapidly evolving sector.

Conclusion

[lyte id=’W0pdRM5rfYE’]