The world is at a critical juncture when it comes to addressing the challenges of climate change and transitioning to a sustainable future. In this pursuit, hydrogen energy has emerged as a promising solution that offers clean, renewable, and efficient power generation.

As a result, there has been a surge of investment opportunities in hydrogen energy companies in the USA.

Exploration of the Recent Surge in Hydrogen Energy Investments

Investors are increasingly recognizing the growth potential in hydrogen energy companies. The projected $2.5 trillion market for hydrogen by 2050 presents a significant opportunity for early adopters. Several factors contribute to this surge in investment.

Firstly, the global focus on renewable energy and combating climate change has led to increased support for hydrogen as a clean fuel source. Governments and organizations worldwide are investing in research, infrastructure, and policies that promote its adoption. This support boosts investor confidence.

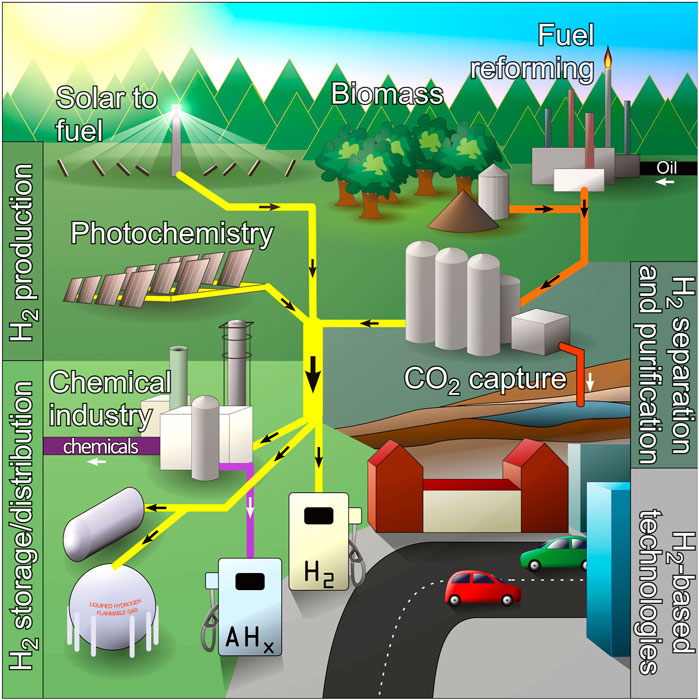

Technological advancements have also played a crucial role. Innovations in electrolysis, fuel cells, storage solutions, and production methods have made hydrogen more accessible and cost-effective. As these technologies improve, the commercial viability of hydrogen becomes evident, attracting investors seeking scalable solutions.

The transportation sector’s shift towards decarbonization further drives investment opportunities in hydrogen energy. Hydrogen-powered vehicles offer advantages such as longer range capabilities and faster refueling times compared to electric cars.

Major automotive manufacturers are investing heavily in this area, enticing investors looking to tap into a growing market.

International collaborations and partnerships between countries have contributed to the surge in investment opportunities within the hydrogen energy sector. Joint initiatives accelerate research and deployment efforts globally, creating an environment conducive to investor confidence.

Analysis of Factors Contributing to a Favorable Investment Climate

Governments globally are prioritizing clean energy solutions, with the USA leading the way. Through funding programs and tax incentives, they are accelerating the development and adoption of hydrogen energy technologies. This creates a favorable investment climate as investors capitalize on the growing demand for sustainable energy sources.

Technological advancements have made hydrogen production more efficient and cost-effective, further enhancing its appeal as an investment opportunity. Additionally, international efforts and collaborative partnerships drive innovation in the clean energy sector, creating opportunities for investors looking to capitalize on emerging markets.

Promising Hydrogen Energy Companies in the USA

In the United States, several companies are leading the way in advancing hydrogen technologies and infrastructure development. Company A has been at the forefront, developing breakthrough technologies and infrastructure to support widespread adoption.

They partner with major players in transportation and power generation, spearheading projects like hydrogen fueling stations and collaborations with automotive manufacturers.

Company B takes a unique approach, streamlining hydrogen production and distribution with innovative solutions. Their focus on efficiency and scalability sets them apart from competitors, driving adoption across different sectors.

Company C specializes in hydrogen fuel cell technology, making advancements in efficiency and cost-effectiveness. Their partnerships with automotive manufacturers position them as key players in the future of transportation.

These companies play vital roles in driving innovation and adoption within the hydrogen energy sector in the USA. Through their pioneering technologies, innovative solutions, and specialization, they are paving the way for a cleaner and greener future.

Evaluating Investment Opportunities in Hydrogen Energy Companies

Before investing in the hydrogen energy sector, careful evaluation of potential opportunities is essential. Factors such as company financials, revenue growth, market trends, competition, and future growth potential should be considered. Additionally, risks associated with investing in a new industry should be evaluated.

By conducting thorough research and analysis, investors can make informed decisions and capitalize on the promising prospects this industry offers.

Tips for Investing Successfully in Hydrogen Energy Companies

To invest successfully in hydrogen energy companies:

- Diversify your portfolio across the sector to manage risk and maximize returns.

- Stay updated on industry news, government policies, and technological advancements.

- Conduct thorough research and seek advice from financial advisors specialized in this field.

- Consider the long-term growth potential of hydrogen energy companies.

By following these tips, you can position yourself for successful investments in this emerging sector.

Conclusion

[lyte id=’0C_BLJifZHc’]