Investing in precious metals has long been a popular choice for those looking to diversify their portfolios and protect their wealth. Among the various options available, silver stands out for its historical value, stability, and potential for growth.

In this article, we will explore the world of buying silver from the government and the benefits it offers to investors.

We will delve into the product range offered by government mints, discuss different purchasing options, highlight factors to consider when buying government-issued silver coins, provide guidance on storing and protecting your investment, and offer insights on monitoring the value of your investment over time.

Whether you’re a seasoned investor or just starting out in the world of investing, this article will provide you with valuable information to make informed decisions about buying silver from the government.

The Allure of Investing in Silver

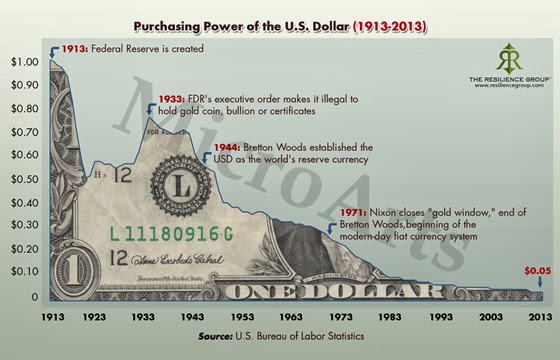

Silver has a timeless appeal for investors due to its historical value and stability. It has served as a reliable store of wealth for centuries, maintaining its worth over time. Unlike paper currency that can be easily manipulated or subject to inflation, silver holds its value during economic uncertainty and market volatility.

It also offers diversification benefits by having low correlation with other assets like stocks or bonds. Additionally, the increasing demand from industries such as technology and healthcare presents investment opportunities.

Overall, investing in silver provides a secure and potentially lucrative option for investors seeking stability and diversification in their portfolios.

Government Mints and Their Offerings

Government mints worldwide produce high-quality silver coins sought after by investors. The United States Mint is renowned for its American Silver Eagle program, featuring coins backed by the U.S. government and valued for their quality and liquidity.

The Royal Canadian Mint offers Canadian Silver Maple Leaf coins known for exceptional purity and intricate maple leaf designs. These government-issued silver coins provide a secure and authentic investment option, combining historical significance with tangible value in the global silver market.

Purchasing Options for Government-Issued Silver Coins

When it comes to investing in government-issued silver coins, buyers have two main options: direct purchase from government mints or buying from authorized dealers and online marketplaces.

Direct purchases from government mints offer authenticity and quality assurance. Buyers can acquire coins directly from the source, eliminating the risk of counterfeits. This option also provides access to newly minted releases and limited editions.

On the other hand, authorized dealers and online marketplaces offer convenience and a wider selection. These platforms provide a range of government-issued silver coins sourced directly from mints or reputable suppliers. They often feature transparent pricing information and customer reviews to assist buyers in making informed decisions.

In summary, investors seeking government-issued silver coins can choose between purchasing directly from mints for authenticity or exploring authorized dealers and online marketplaces for convenience and variety.

Factors to Consider When Buying Government-Issued Silver Coins

When purchasing government-issued silver coins, there are important factors to consider. First, be aware of price premiums over the spot price of silver, as these can vary based on rarity and condition. Additionally, factor in shipping costs and any taxes that may apply.

To ensure a secure transaction, research reputable sellers with positive reviews and a track record of delivering genuine products. Look for certification or authentication from government mints to guarantee authenticity. By taking these factors into account, you can make an informed investment decision and protect yourself from counterfeit coins.

Storing and Protecting Your Government-Issued Silver Coins

To ensure the long-term preservation and value of your government-issued silver coins, proper storage and protection are crucial. Consider these factors when choosing the best storage method:

-

Home Storage in a Safe: Investing in a high-quality safe offers convenience and personal control over your coins. However, there is a risk of theft or damage at home.

-

Secure Bank Storage: Utilizing secure storage at a bank provides maximum security and protection from natural disasters. However, access may be limited, and additional fees might apply.

In addition to proper storage, take these steps to protect your coins:

-

Use protective sleeves or capsules designed for individual coins to prevent physical damage.

-

Explore insurance coverage options to safeguard your investment against potential damage or theft.

By prioritizing the safety of your government-issued silver coins through appropriate storage methods and protective measures, you can ensure their longevity and potentially enhance their value over time.

Monitoring the Value of Your Investment Over Time

Investors who hold silver as a part of their portfolio understand the importance of monitoring the value of their investment over time. By keeping a close eye on silver prices, investors can make informed decisions regarding buying, selling, or holding onto their government-issued silver coins.

Silver prices are not static; they are subject to market fluctuations influenced by various factors. These include supply and demand dynamics, economic indicators, geopolitical events, and investor sentiment. Understanding these influences is crucial for interpreting silver price trends accurately.

To stay well-informed about silver prices, there are several resources available to investors. Live price charts and financial news websites provide real-time updates on silver prices, allowing investors to track changes in value throughout the day.

These platforms offer valuable insights into market trends and help investors gauge the overall sentiment surrounding silver.

For those seeking convenience and accessibility, specialized apps dedicated to tracking precious metals can be an excellent tool. These apps provide convenient access to price data on-the-go, enabling investors to monitor their investments from anywhere at any time.

Interpreting silver price trends is essential for making informed decisions about buying or selling government-issued silver coins. By analyzing historical data and identifying patterns in price movements, investors can better understand the market’s behavior and anticipate potential shifts in value.

Selling Your Government-Issued Silver Coins

When selling your government-issued silver coins, there are important factors to consider. Evaluate market conditions and timing carefully for maximum return on investment. Decide whether selling to local coin shops or utilizing online platforms aligns better with your preferences and goals.

Research the condition, rarity, and historical significance of your coins to accurately assess their value. Choose a reputable buyer or platform to ensure a successful sale. Consider convenience versus maximizing profits when making your decision.

In summary, selling government-issued silver coins requires evaluating market conditions, choosing the right selling method, researching coin value, and selecting a reputable buyer or platform.

Conclusion

[lyte id=’xO5JJkdjplo’]