Investing in precious metals has always been a popular choice for those looking to diversify their portfolios and protect their wealth. One particular investment option that has gained significant attention in recent years is silver shot at spot.

In this article, we will explore the concept of silver shot at spot, its origins, and why it has become an attractive investment opportunity for many.

Introduction to the concept of silver shot at spot

Silver shot at spot refers to purchasing industrial silver directly from a dealer or platform at the current market price, also known as the “spot price.” Unlike other forms of silver investments that come with additional premiums or fees, buying silver shot at spot allows investors to acquire pure silver without any extra costs.

Investing in silver shot at spot offers several advantages. Firstly, it provides affordability since there are no additional expenses associated with design or craftsmanship, making it a cost-effective option compared to coins or bars. Secondly, the transparency of the transaction ensures fair pricing based on real-time market rates.

Thirdly, it offers flexibility as investors can buy as much or as little silver as they desire without being constrained by fixed quantities.

Furthermore, investing in silver shot at spot provides liquidity benefits due to the high demand for industrial-grade silver. This means investors have the option to sell their holdings quickly if needed, converting their investment into cash easily.

In summary, purchasing silver shot at spot is a straightforward and cost-effective way for investors to acquire pure silver without additional premiums or fees. It offers affordability, transparency, flexibility, and liquidity benefits that make it an attractive choice for those looking to invest in this precious metal.

Understanding the Basics of Investing in Precious Metals

Investing in precious metals like gold and silver is a popular way to diversify portfolios and protect wealth. Silver, in particular, is an attractive option due to its affordability compared to gold and its high demand in industries such as electronics, healthcare, and renewable energy.

When buying silver shot at spot, investors can purchase industrial silver directly from dealers or platforms without any additional markups. This allows them to acquire silver at its current market price, potentially maximizing their returns by eliminating unnecessary costs.

In summary, investing in precious metals offers benefits such as diversification and preservation of wealth. Silver shot at spot allows investors to buy industrial silver without extra fees, making it a cost-effective investment option.

Industrial Silver – Grain/Shot

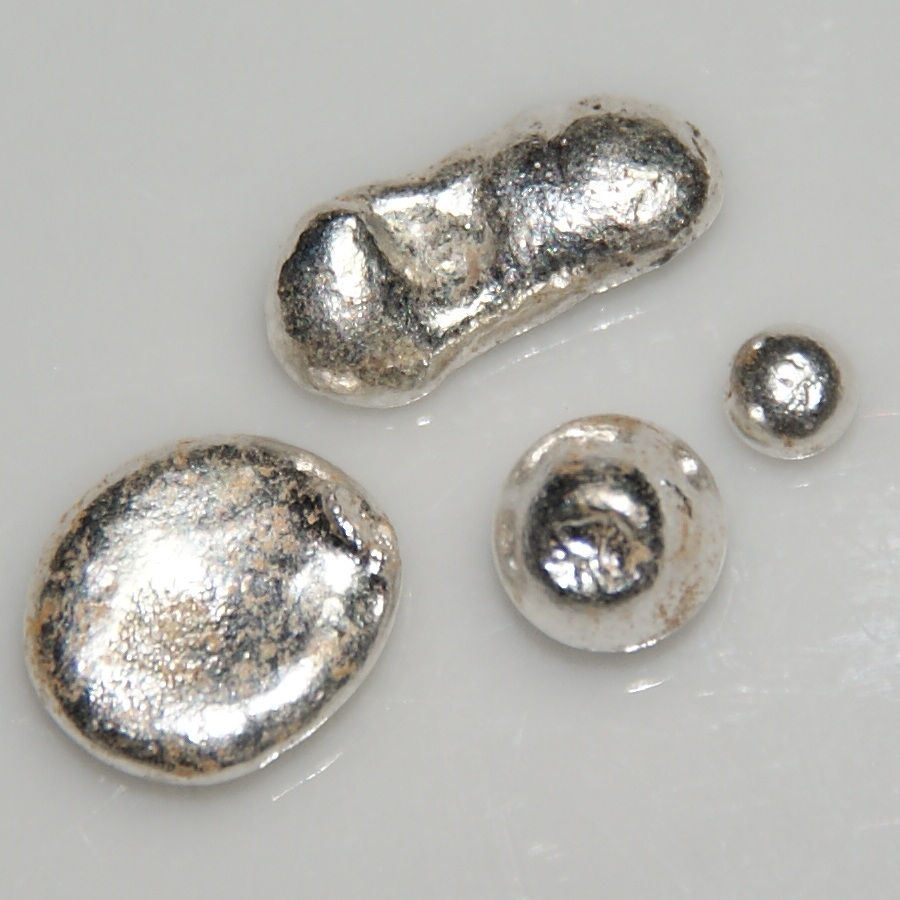

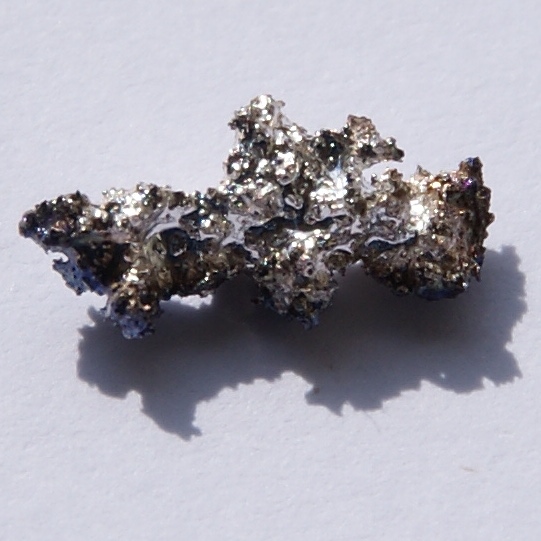

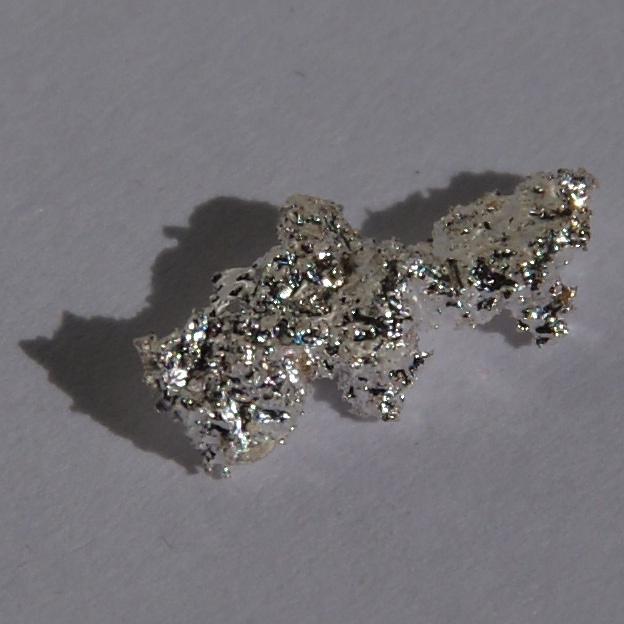

Industrial silver, known for its high electrical conductivity and antibacterial qualities, is used in various sectors such as electronics, solar panels, and medical devices. When it comes to investing in industrial silver, there are two common forms: grain and shot.

Grain silver refers to small beads or pellets, while shot silver consists of tiny spheres. Both forms offer similar investment opportunities but differ in shape and size.

Investors are attracted to industrial silver because of its growth potential. As industries expand and technological advancements drive demand for products, the need for industrial silver remains steady. This sustained demand creates a favorable environment for investors looking to capitalize on their investments.

Grain silver offers advantages in terms of storage and handling convenience. Its compact beads make it easier to manage and store compared to the smaller spheres of shot silver. Additionally, grain silver’s consistent weight allows for accurate measurements using conventional scales.

The Advantages of Silver Shot at Spot

Investing in silver shot at spot offers several advantages over other forms of silver investments. One major advantage is the lower premiums compared to coins or bars, allowing investors to acquire pure industrial silver at the current market price without additional costs.

Additionally, silver shot at spot provides easier liquidity and selling options, ensuring that investors can access their funds quickly when needed. Another advantage is the lower initial investment costs, making it more accessible for a wider range of investors to enter the silver market and potentially earn higher returns.

Overall, these benefits make silver shot at spot an attractive option for those looking to capitalize on the silver market.

How to Get Silver Shot at Spot

To acquire silver shot at spot, start by researching reputable dealers and platforms. Look for established entities with positive customer reviews and transparent pricing structures. Compare prices across different options to ensure you get the best value. Prioritize safety by using insured shipping methods or secure storage facilities.

By conducting thorough research, comparing prices, and prioritizing safety, you can successfully acquire silver shot at spot while minimizing risks.

Factors to Consider Before Investing in Silver Shot at Spot

Before investing in silver shot at spot, there are several important factors to consider:

-

Volatility and Risks: Understand that investing in precious metals like silver comes with inherent volatility and risks. Prices can fluctuate due to economic factors or geopolitical events. Take a long-term perspective when investing.

-

Diversification: Diversify your investment portfolio to mitigate potential losses or market fluctuations. Spread your investments across different asset classes and seek advice from a financial advisor for optimal allocation.

-

Financial Goals and Time Horizon: Evaluate your financial objectives and determine if investing in silver shot at spot aligns with your strategy. Assess the level of risk you are comfortable with and if it fits within your desired timeline for achieving goals.

-

Stay Informed: Keep up with market trends and stay informed about economic indicators, global events, and other factors that may impact the price of silver shot at spot.

-

Storage Options: Consider storage options for physical silver, ensuring they meet your security needs while providing convenient access when necessary.

-

Transaction Costs and Taxes: Account for transaction costs and potential tax implications associated with buying, selling, or holding physical silver.

By considering these factors, you can make more informed decisions when investing in silver shot at spot that align with your financial goals and risk tolerance. Regularly review your investment strategy to adapt to changing circumstances in the market.

Real-Life Success Stories: Investors Who Benefited from Silver Shot at Spot

Real-life success stories from investors who have benefited from silver shot at spot provide valuable insights into the potential gains of this investment strategy. In-depth interviews with successful investors reveal their strategies, challenges faced, and lessons learned.

By learning from their experiences, readers can navigate obstacles and make informed decisions when investing in silver shot at spot. These stories highlight effective approaches and offer inspiration for achieving favorable outcomes.

By applying proven strategies, readers increase their chances of reaping substantial rewards from their investments in silver shot at spot.

Expert Advice: Tips for Investing in Silver Shot at Spot

Investing in silver shot at spot offers opportunities for diversifying investment portfolios and potentially reaping financial rewards. Seeking advice from industry experts is essential to make informed decisions.

These professionals provide valuable insights on the benefits, risks, and common mistakes associated with investing in silver shot at spot.

Experts emphasize the advantages of this strategy, such as stability and protection against inflation or economic downturns. However, they also caution investors about market volatility and fluctuations in silver prices that pose risks. By understanding both sides, investors can make well-informed choices.

For beginners, expert recommendations serve as valuable guidelines. Professionals advise conducting thorough research on reputable dealers, understanding market trends, setting realistic goals, and creating a diversified investment plan based on risk tolerance levels.

Following these recommendations boosts confidence when entering the world of silver shot at spot investments.

Moreover, experts shed light on common mistakes to avoid. This includes failing to conduct proper due diligence before investing, blindly following market trends without understanding their implications, and making emotionally driven decisions rather than relying on rational analysis.

In summary, seeking expert advice is crucial when considering investments in silver shot at spot. These professionals offer insights into the benefits, risks, and mistakes to avoid. Incorporating their advice enhances the chances of success in the dynamic realm of silver shot at spot investment.

[lyte id=’46zw_6RcYKk’]