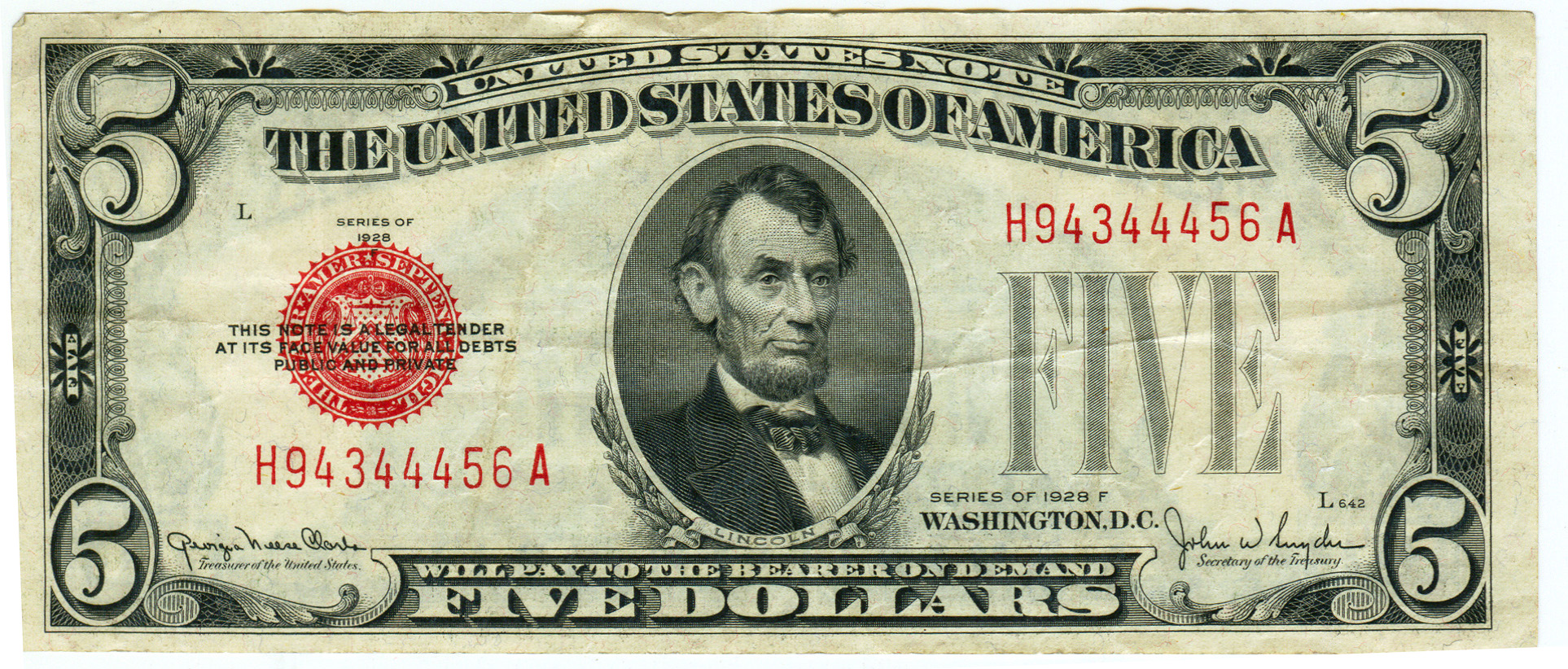

Investing doesn’t always require large sums of money. In fact, even a humble five dollar investment can have the potential to grow into something significant. In this article, we will explore the power of small investments and how they can pave the way for financial success.

Whether you’re a seasoned investor or just starting out, this article will provide you with valuable insights on how to make the most of your five dollar investment.

The Story of a Five Dollar Investment

Many believe that investing is only for the wealthy, but small investments have proven to be effective in building wealth over time. A five dollar investment may seem insignificant, but its potential should not be underestimated.

By putting just five dollars into stocks, bonds, or mutual funds, you can start your journey towards financial independence. Through the power of compounding returns, these small investments can accumulate and multiply into substantial sums.

This accessible and low-risk investment serves as a stepping stone for individuals who want to dip their toes into investing. It teaches discipline and patience while nurturing positive saving habits. Don’t underestimate the power of a five dollar investment – take that first step today towards a prosperous future.

Understanding Investing Basics

Investing is a fundamental concept that allows individuals to make their money work for them and generate returns over time. Its purpose extends beyond preserving wealth; it also aims to grow it by taking calculated risks.

When considering investing, there are various options available, each with its own characteristics and potential advantages. Stocks, for example, represent ownership in a company and offer significant growth potential. However, they also come with higher risks due to market volatility.

On the other hand, bonds are debt securities where investors lend money to corporations or governments in exchange for regular interest payments and eventual repayment of the principal amount invested.

Another investment vehicle worth considering is mutual funds. These funds pool money from multiple investors to create a diversified portfolio of stocks, bonds, or other assets. This diversification helps spread the risk associated with investing and can be a suitable option for those seeking a balanced approach.

Regardless of the amount being invested, diversification plays a crucial role in mitigating risk. By spreading investments across different assets and sectors, individuals reduce the likelihood of suffering significant losses if one asset underperforms.

Diversification allows investors to capture potential gains while safeguarding against excessive exposure to single investments.

In summary, understanding investing basics is essential for anyone looking to make their money work harder and achieve long-term financial goals.

By defining the purpose of investing and exploring different investment vehicles such as stocks, bonds, and mutual funds, individuals can make informed decisions about how best to allocate their resources. Emphasizing the importance of diversification reinforces the need for a well-rounded investment strategy that balances risk and reward.

The Power of Compound Interest

Compound interest, often hailed as the eighth wonder of the world, has the potential to significantly boost your investment returns over time. It works by allowing your initial investment to earn interest, which then compounds and generates even more interest. Even a small investment can grow into something substantial when given enough time.

By reinvesting earnings and starting early, you can maximize the power of compound interest and achieve long-term financial growth. However, it’s important to be mindful of high-interest debt, as compound interest can work against you in that case. Embrace the power of compound interest and pave the way for a brighter financial future.

Finding Opportunities for a Five Dollar Investment

When it comes to investing with just five dollars, there are several strategies you can employ to find opportunities with growth potential. Thorough research is essential in identifying low-cost stocks that have strong potential but are currently undervalued by the market.

Before diving into any investment, it’s crucial to do your due diligence and conduct thorough research. Take the time to understand the company’s financials, its competitive position in the market, and any potential risks it may face. This will help you make informed decisions and mitigate potential losses.

Thanks to technological advancements, there are now numerous online platforms that allow investors to buy fractional shares of stocks. These platforms provide an opportunity for those with limited funds to invest in high-priced stocks with just a small amount of money.

By carefully selecting these affordable stocks with growth potential, you can maximize your returns even with a modest initial investment.

One effective strategy for growing your five dollar investment is to consistently invest small amounts over time. By contributing five dollars every day for 30 years, assuming an average annual return of 7%, you could potentially accumulate over six figures.

The power of compound interest allows your investment to grow exponentially over time, making even small contributions worthwhile.

Risks and Rewards of a Five Dollar Investment

Investing just five dollars comes with risks due to market volatility and limited diversification options. The stock market’s ups and downs can be particularly risky for small investments, requiring a long-term perspective. With only five dollars, achieving proper diversification becomes challenging, increasing the overall investment risk.

However, success stories demonstrate that disciplined investing can yield substantial wealth over time. Although starting small may not lead to instant riches, consistent contributions and informed choices can gradually grow your investment.

Approach your investment with realistic expectations and focus on long-term growth for potential success, regardless of the initial amount invested.

Strategies for Growing Your Five Dollar Investment

Investing just five dollars may seem small, but with the right strategies, you can maximize its potential. During market downturns, stay committed and focus on long-term goals. Use downturns as an opportunity to buy quality stocks at discounted prices. Set realistic expectations for returns and understand that wealth accumulation takes time.

To increase your investment over time, consider setting aside regular contributions and reinvesting dividends or profits. By implementing these strategies, your five dollar investment can grow significantly in the long run.

Expanding Your Knowledge in Investing

Expanding your knowledge in investing is essential for making informed financial decisions and maximizing your growth potential. Luckily, there are cost-effective resources available to help you develop a solid foundation of investment knowledge:

-

Free online courses or tutorials: Platforms like Coursera and Khan Academy offer free courses that cover the basics of investing, providing valuable insights without any financial burden.

-

Blogs or books by successful investors: Learn from experienced investors through their blogs or books, gaining practical advice and real-life examples to navigate the world of investing.

-

Financial podcasts and YouTube channels: Stay updated on market trends and gain insights from industry experts by listening to financial podcasts or watching educational YouTube channels dedicated to investing.

Remember to continuously explore new resources and stay informed about industry news and trends to enhance your understanding of investing and make well-informed decisions aligned with your financial goals.

How a Five Dollar Investment Can Become More Than Just Money

Investing goes beyond financial gains; it also offers personal growth and continuous learning. Actively managing investments develops critical thinking, decision-making, and discipline. Inspiring stories of individuals who started with small investments show that anyone can achieve financial success, regardless of the initial investment size.

Investing is not just about money; it’s an opportunity for personal development and wealth creation.

[lyte id=’Jh4JGZxixsc’]