In the world of investing, there are a multitude of options available to traders looking to maximize their gains. One such option that has gained popularity in recent years is the 3x leveraged ETF. These unique investment vehicles offer the potential for amplified returns, but they also come with their fair share of risks.

In this article, we will delve into the world of 3x leveraged ETFs, exploring what they are, how they work, and what you need to know before diving in.

What are 3x leveraged ETFs?

An exchange-traded fund (ETF) is an investment fund that trades on stock exchanges, mirroring the performance of a specific index or sector. However, a 3x leveraged ETF takes this concept to another level. It aims to provide investors with three times the exposure to the daily performance of its underlying index or sector.

The idea behind a 3x leveraged ETF is simple yet powerful. If the underlying index increases by 1%, the 3x leveraged ETF strives to amplify that gain and rise by 3%. On the flip side, if the index experiences a decline of 1%, the ETF aims to magnify that loss and decrease by 3%.

To put it into perspective, let’s consider an example. Suppose there is a technology-focused index that rises by 2% in a day. In this scenario, a regular ETF tracking this index would aim to increase by approximately 2%. However, a 3x leveraged ETF would strive to triple this gain and increase by around 6%.

It’s important to note that while these products offer potential for significantly higher returns in bullish markets, they also come with increased risk. The leverage factor works both ways, meaning that if the underlying index experiences losses, they will be amplified as well.

Investing in 3x leveraged ETFs requires careful consideration and monitoring. Due to their inherent volatility, they are often considered more suitable for experienced traders who can actively manage their positions and adjust their strategies accordingly.

In summary, 3x leveraged ETFs provide investors with an opportunity to multiply their exposure to the daily performance of an underlying index or sector. However, it’s crucial to weigh the potential rewards against the increased risks associated with these products before incorporating them into an investment portfolio.

How compounding and volatility impact these ETFs

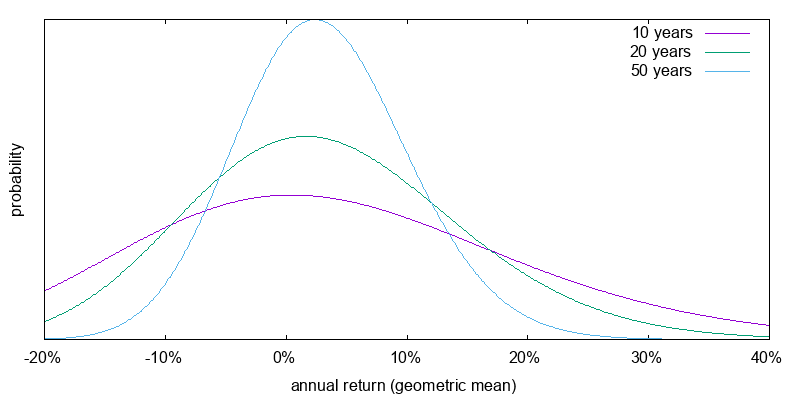

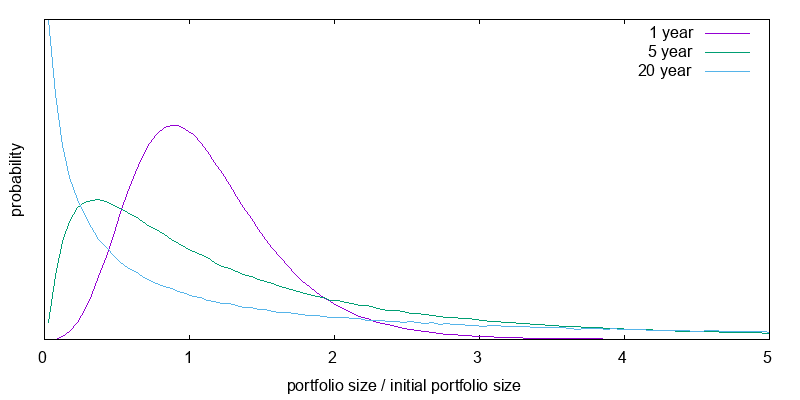

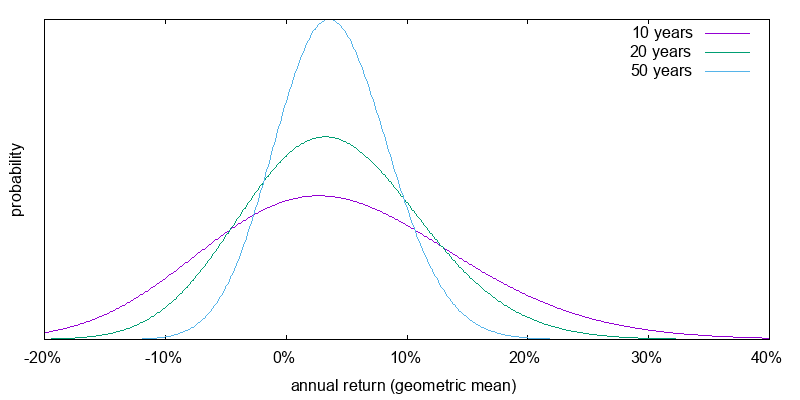

Compounding and volatility significantly influence the performance of ETFs. Compounding, which aligns daily performance, can either work for or against investors. In stable markets, compounding leads to long-term gains, while during high volatility, it amplifies losses quickly. Monitoring positions is crucial to avoid unexpected losses.

Volatility refers to price fluctuations, and during turbulent times, ETF prices become more volatile. Diversification across assets helps mitigate risks associated with increased volatility. Understanding how compounding and volatility impact ETFs is vital for informed investment decisions.

The Constant Leverage Trap and Its Implications

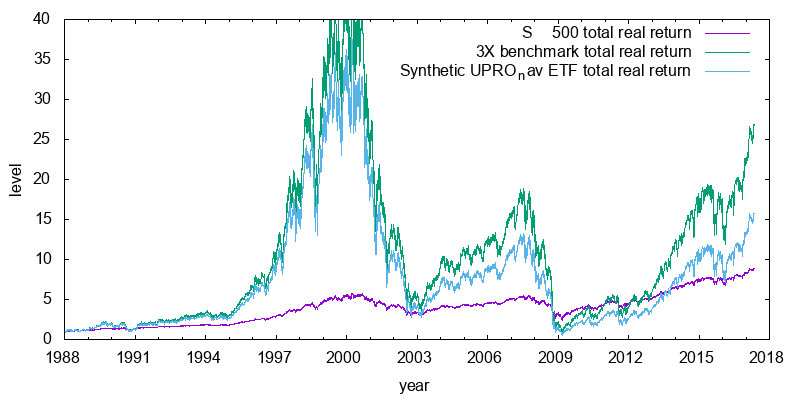

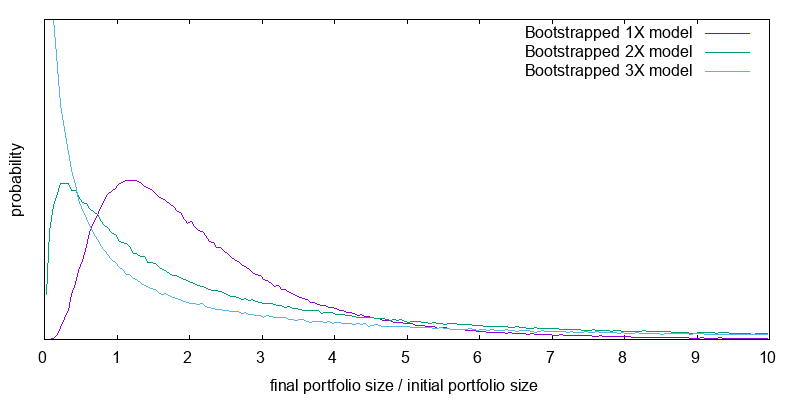

Investing in 3x leveraged ETFs comes with the concept of the constant leverage trap, which has important implications for investors. This trap arises due to the daily resets that these ETFs undergo, meaning that over longer periods, they may not always provide three times the returns as expected.

To understand this trap, let’s consider a scenario where an underlying index experiences significant volatility over a week, with alternating gains and losses. In such cases, a 3x leveraged ETF would likely end up with less than three times the returns of the index. This is primarily due to compounding losses during down days.

The constant leverage trap can catch investors off guard and lead to unexpected outcomes if they are not actively monitoring their positions. It’s important to recognize that these leveraged ETFs rely on daily rebalancing to maintain their intended leverage ratio.

Consequently, compounding effects can cause divergence from the expected returns over time.

While these funds offer potential for amplified gains in favorable market conditions, they also expose investors to increased risk during volatile periods. Understanding the constant leverage trap is crucial for making informed investment decisions when considering 3x leveraged ETFs.

To mitigate the risks associated with this trap, investors should carefully analyze market trends and closely monitor their positions. Regularly assessing the performance of these leveraged ETFs against their underlying indices can help identify any deviations caused by compounding and volatility.

What Happens When a 3x Leveraged ETF Goes to Zero?

Investing in 3x leveraged exchange-traded funds (ETFs) can be tempting for those seeking higher returns. However, it’s important to recognize the risks involved, including the possibility of these ETFs hitting zero.

While rare, this can occur when the underlying index or sector experiences a prolonged downturn. The leverage magnifies both gains and losses, meaning even a modest decline can lead to significant losses for investors.

If a 3x leveraged ETF reaches zero, it indicates a total loss of investment. Investors may face financial ruin as a result. Consequently, it’s crucial to assess risk tolerance before venturing into this type of investment.

Compounding and volatility play significant roles in leveraged ETF performance. Compounding multiplies daily returns over time, either enhancing gains or worsening losses. Volatility refers to fluctuating prices of underlying assets.

During market volatility and bearish periods, compounding and heightened sensitivity can cause rapid erosion in value. It is advisable for investors to closely monitor investments and prepare for potential downside risks.

Diversification becomes vital to mitigate losses if these highly leveraged instruments hit zero. Spreading investments across different asset classes and using risk management strategies help minimize exposure and protect portfolios.

In summary, investing in 3x leveraged ETFs carries inherent risks, including the possibility of them reaching zero. Understanding leverage dynamics, compounding, volatility, and employing diversification strategies are essential for informed decision-making and effective navigation within the market.

Understanding Amplified Losses in Volatile Markets

Volatility plays a significant role in the performance of 3x leveraged ETFs. While these funds can generate amplified gains during market upswings, they can also result in substantial losses during downturns. In highly volatile markets, where prices swing wildly, the compounding effect of these ETFs can work against investors.

To mitigate the potential for amplified losses, it is crucial to have a risk management strategy in place. This strategy should include diversification, setting stop-loss orders, and monitoring market conditions closely. Understanding volatility and assessing its sustainability is also essential when considering investments in 3x leveraged ETFs.

Overall, being mindful of the risks and rewards associated with these funds is vital for navigating volatile markets successfully.

Examining the Correlation Between Underlying Index and ETF Performance

When evaluating 3x leveraged exchange-traded funds (ETFs), it is important to consider the correlation between their performance and the underlying index or sector. These ETFs aim to provide three times the daily returns of their benchmark, but factors like tracking error and fees can impact their effectiveness.

Investors should examine the historical correlation between a 3x leveraged ETF and its underlying index to determine how closely it tracks its intended benchmark. A strong correlation indicates that the ETF moves in line with market trends, while a weaker correlation suggests deviations may occur due to external factors.

Tracking error, which arises from imperfect replication or timing differences in rebalancing, can also affect correlation. Additionally, fees associated with managing these ETFs can erode overall returns if not carefully considered.

Potential for Amplified Gains during Market Upswings

One key advantage of 3x leveraged ETFs is their potential for amplified gains during market upswings. These investments can generate substantial returns that outpace traditional ETFs when markets are consistently trending upwards. However, these gains come with increased risk, especially during volatile periods.

It’s important to carefully evaluate risk tolerance and conduct thorough research before incorporating 3x leveraged ETFs into a portfolio. Diversification and staying informed about market conditions can help mitigate risks associated with these specialized investment instruments.

Utilizing 3x Leveraged ETFs for Short-Term Trading Strategies

Short-term traders often favor 3x leveraged exchange-traded funds (ETFs) due to their daily reset feature. These specialized investment vehicles allow traders to potentially multiply their gains within a shorter time frame compared to traditional investments.

With the ability to capitalize on intraday price movements and short-lived trends, 3x leveraged ETFs offer an attractive option for active short-term trading strategies.

However, it’s important to consider the risks associated with these investments. Volatility plays a significant role, as amplified returns come with increased exposure to market fluctuations. Traders must carefully evaluate market conditions and implement risk management techniques to mitigate potential losses.

By staying informed and exercising caution, traders can effectively utilize 3x leveraged ETFs in their short-term trading strategies for accelerated gains within a compressed timeframe.

[lyte id=’-qXI4k2xI0o’]