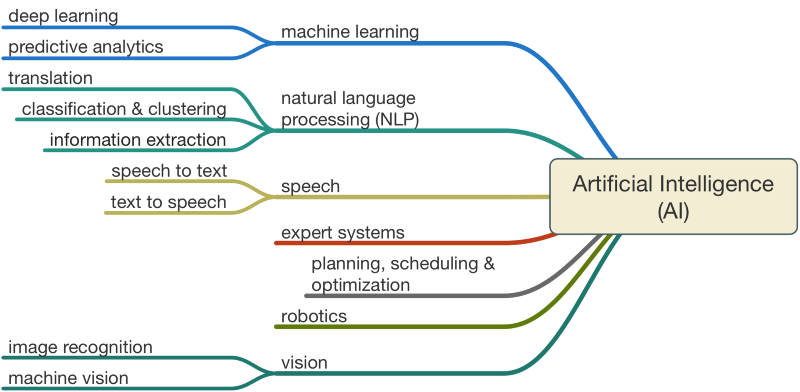

Artificial Intelligence (AI) has emerged as a game-changer in various industries, revolutionizing the way we live and work. With its ability to analyze vast amounts of data, learn from patterns, and make informed decisions, AI technology has become an indispensable tool for businesses worldwide.

In this article, we will explore the growth and potential of the AI industry, discuss why investing in AI stocks is worth considering, highlight some top AI companies to buy stocks in 2023, assess the risks associated with such investments, and provide expert insights to help you get started.

The Rise of AI: How Artificial Intelligence is Transforming Industries

Artificial intelligence (AI) has revolutionized industries, from healthcare to finance, with its rapid advancements. Thanks to big data and improved computing power, AI technology is streamlining operations, boosting productivity, and unlocking growth opportunities.

In healthcare, AI algorithms analyze medical images faster than humans for early disease detection. In finance, AI-powered trading systems identify patterns and execute trades swiftly. Retail gets personalized recommendations, transportation optimizes routes, and manufacturing benefits from predictive maintenance.

As more industries embrace AI’s benefits, the demand for innovative solutions continues to rise. This transformative technology enhances customer experiences and drives cross-industry collaboration for unprecedented advancements in automation processes.

With AI’s continued evolution, its impact on industries will reshape the future of work and innovation.

Investing in the Future: Why AI Stocks are Worth Considering

Investing in AI stocks offers immense potential returns in a rapidly growing market. As more companies adopt AI technologies to gain a competitive edge or improve efficiency, those who invest in AI stocks can benefit from their success.

These innovative companies constantly push boundaries and develop cutting-edge solutions, disrupting industries and driving growth. Additionally, AI stocks provide opportunities to diversify investment portfolios beyond traditional sectors.

By aligning with global trends and contributing to shaping the future, investing in AI stocks is a strategic choice for long-term success.

Top AI Stocks to Buy in 2023

Investing in AI stocks in 2023 presents a promising opportunity. NVIDIA, known for its advanced GPUs, has become a leader in the field of AI. Its GPUs are favored by researchers and data scientists worldwide. IBM’s Watson platform, which utilizes natural language processing and machine learning, offers valuable insights across various sectors.

Microsoft’s investments in AI, particularly through its Azure cloud computing platform, make it an attractive option as well. With strong market presence and ongoing advancements, these top AI companies are worth considering for potential investments in 2023.

Assessing Risks: Potential Pitfalls When Investing in AI Stocks

Investing in AI stocks comes with unique risks that require careful consideration. Regulatory hurdles surrounding data privacy and security can impact the growth potential of AI companies. Intense competition within the industry may lead to market consolidation or disruption by new entrants.

Thorough research on financials, competitive positioning, and long-term growth prospects is essential to mitigate these risks. Diversifying investments beyond AI stocks can also help reduce reliance on a single technology or sector’s success or failure.

By assessing and managing these potential pitfalls, investors can make informed decisions when venturing into the dynamic world of AI stock investments.

Diversification is Key: Building a Well-rounded Portfolio with AI Stocks

Investing solely in AI stocks can be risky, so it’s important to diversify your portfolio. By adding investments from other sectors such as healthcare (biotechnology), renewable energy (solar power), or e-commerce (online retail), you reduce the impact of volatility and increase potential growth opportunities.

For example, biotech companies incorporating AI technology offer growth potential in healthcare, while solar power companies utilizing AI optimize clean energy production. Additionally, investing in e-commerce platforms leveraging AI algorithms taps into the expanding online retail sector.

Diversification across multiple sectors ensures a balanced approach that maximizes returns while managing risk effectively.

Expert Insights: What Analysts are Saying About Investing in AI Stocks

Investing in the stocks of artificial intelligence (AI) companies has become a hot topic among reputable investment analysts. These experts believe that the AI industry is still in its early stages, presenting significant growth potential for investors.

The increasing adoption of AI technologies across various industries is driving the demand for AI stocks.

Analysts predict that several catalysts will drive the growth of AI stocks. Advancements in deep learning algorithms, which enable machines to learn and improve from experience, are expected to play a crucial role.

Additionally, the availability of vast amounts of data and advancements in data analysis techniques are fueling the development and application of AI.

Regulatory developments also hold sway over AI stock investments. As governments worldwide recognize the transformative impact of AI on various sectors, regulations surrounding its use are being established.

Analysts anticipate that these regulations will create opportunities for investors as companies navigate compliance requirements and invest heavily in research and development.

Investors considering AI stocks should be aware that while there is immense potential for growth, there are inherent risks involved. The landscape is highly competitive, with numerous players vying for market dominance.

Additionally, technological advancements can be unpredictable, making it essential to conduct thorough research before making investment decisions.

In conclusion, investment analysts strongly recommend considering AI stocks due to their promising future prospects. The industry’s ongoing advancements in deep learning algorithms, increasing availability of data, and regulatory developments make investing in AI an attractive option for those seeking long-term growth opportunities.

| Catalysts for Growth |

|---|

| Advancements in deep learning algorithms |

| Increased data availability |

Investing in the Future: How to Get Started with AI Stocks

Investing in AI stocks requires careful planning and research. Here’s a step-by-step guide to help you get started:

- Educate Yourself: Learn how the stock market works and the basics of investing.

- Define Your Goals: Determine your investment timeline, risk tolerance, and financial objectives.

- Research Companies: Analyze financial performance, competitive advantages, and growth prospects of top AI companies.

- Assess Financial Indicators: Evaluate factors like revenue growth, profitability, debt levels, and market share.

- Choose an Approach: Decide between investing in individual stocks or AI-focused ETFs.

- Monitor News: Stay updated on industry trends, product releases, partnerships, and regulatory changes.

- Seek Advice: Consult with a financial advisor who specializes in technology investments.

By following these steps, you can navigate the world of AI stocks and make informed investment decisions for the future.

Embracing the Power of AI through Strategic Investments

Investing in top AI companies allows individuals and organizations to embrace the potential of artificial intelligence while reaping long-term benefits. The rapid growth of the AI industry, coupled with advancements in technology and increasing adoption across sectors, makes AI stocks worth considering for investors.

By diversifying investment portfolios with AI stocks and complementary investments from other sectors, one can capitalize on multiple growth areas while managing risk effectively. Thorough research, staying informed about market trends, and seeking expert advice are essential.

Embrace the future of investing by exploring the opportunities presented by AI stocks. Stay ahead in technological advancements and position yourself for long-term success through strategic investments in this transformative industry.

[lyte id=’6z-SNRbAuFg’]