Investing in the stock market can be a daunting task, especially for beginners.

With thousands of stocks to choose from, how do you know which ones are worth your investment? This is where the Zacks #1 Rank Stocks come into play. In this article, we will explore what the Zacks #1 Rank is and why it’s significant as a strong buy. We will also delve into the benefits of investing in these highly ranked stocks.

Explanation of the Zacks #1 Rank and Its Significance as a Strong Buy

The Zacks #1 Rank is a powerful tool for investors to identify top-performing stocks. It signifies that a stock has been assigned the highest rank by Zacks Investment Research, indicating strong growth potential and outperformance compared to other stocks in its sector.

Zacks determines the #1 Rank through a comprehensive analysis of factors like earnings estimates revisions, earnings surprises, and positive earnings momentum. By considering these indicators, Zacks provides valuable insights into which stocks have the best chance of delivering impressive returns.

Earnings estimate revisions reflect increased confidence in a stock’s future performance. Earnings surprises occur when actual earnings exceed consensus estimates, signaling outperformance. Positive earnings momentum indicates consistent growth over time.

Overall, the Zacks #1 Rank serves as an endorsement from experts and guides investors towards stocks with high potential for solid returns.

Benefits of Investing in Zacks #1 Rank Stocks

Investing in Zacks #1 Rank Stocks offers numerous advantages that can potentially enhance your portfolio’s performance. These stocks have undergone meticulous analysis and evaluation by industry experts at Zacks Investment Research, ensuring that you are making informed decisions based on reliable information.

One significant benefit is the historical track record of Zacks #1 Rank Stocks. Over time, these stocks have consistently outperformed their peers, exhibiting resilience even during challenging market conditions. This consistent outperformance provides investors with the potential for substantial gains and the opportunity to maximize their returns.

The rigorous analysis conducted by Zacks also assists investors in minimizing their risk exposure. By focusing on top-ranked stocks, you can make investment decisions based on solid fundamentals and promising growth prospects.

This thorough evaluation increases the likelihood of selecting stocks that have a higher probability of delivering positive results.

Moreover, investing in Zacks #1 Rank Stocks grants you access to expert analysis from industry professionals. The extensive research conducted by Zacks Investment Research enables you to leverage their expertise and benefit from their insights.

This level of analysis empowers you to make well-informed investment choices aligned with your financial goals.

In summary, investing in Zacks #1 Rank Stocks offers multiple advantages such as access to expert analysis, a history of consistent outperformance, and the potential for significant gains. By incorporating these top-ranked stocks into your portfolio, you position yourself for success in the dynamic world of investing.

Overview of how stocks are ranked by Zacks

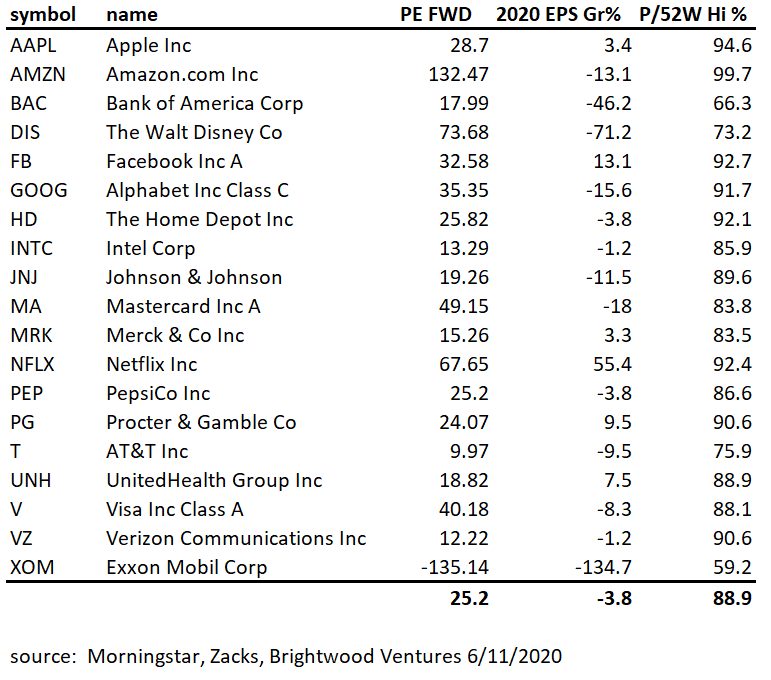

Zacks ranks stocks using a comprehensive system that considers quantitative and qualitative factors. These include earnings estimates revisions, earnings surprises, and positive earnings momentum. Positive revisions indicate increased confidence in a company’s future prospects, while earnings surprises show outperformance compared to expectations.

Stocks with positive momentum exhibit consistent growth in earnings over time. Rankings range from #1 (Strong Buy) to #5 (Strong Sell), with #1 representing the highest probability of market outperformance. This ranking system helps investors make informed decisions and maximize their returns in the stock market.

Importance of the #1 Rank in Identifying Top-Performing Stocks

When it comes to identifying top-performing stocks, the #1 Rank holds significant importance for investors. This coveted rank serves as a powerful indicator of strong buy potential and sets these stocks apart from others within their respective sectors.

Investors who consider investing in a stock with the #1 Rank can have confidence that it has undergone rigorous evaluation and analysis by industry experts at Zacks Investment Research. This level of scrutiny helps to ensure that only the most promising stocks receive this prestigious ranking.

By relying on the expertise of Zacks Investment Research, investors gain access to valuable information that can guide their investment decisions. The thorough evaluation process considers numerous factors such as earnings estimates, revenue growth projections, profitability, and valuation metrics.

These comprehensive analyses provide investors with a clear picture of a stock’s potential for future success.

The #1 Rank not only indicates that a stock has been thoroughly vetted but also suggests that it possesses qualities that set it apart from its competitors. Whether it is exceptional financial performance, innovative products or services, or strong market positioning, stocks with this rank are likely to outperform others in their sector.

Furthermore, by considering stocks with the #1 Rank, investors increase their chances of achieving favorable returns on their investments. While no investment is entirely risk-free, focusing on top-ranked stocks minimizes uncertainty and provides a higher probability of success.

In summary, the importance of the #1 Rank cannot be overstated when it comes to identifying top-performing stocks. The meticulous evaluation process conducted by industry experts at Zacks Investment Research ensures that only the most promising stocks receive this distinguished ranking.

By considering these top-ranked stocks, investors can make more informed investment decisions and increase their likelihood of achieving favorable returns on their investments.

[lyte id=’jZ7rMAQV3nI’]