In the world of investing, there are countless opportunities to explore. From stocks and bonds to real estate and commodities, investors have a wide range of options to choose from. One such investment opportunity that has been gaining traction in recent years is copper.

This versatile metal, with its myriad industrial applications, has become an attractive option for those looking to diversify their portfolios. In this article, we will delve into the world of investing in copper, exploring its historical performance, understanding the copper market, evaluating risks, and timing your entry into the market.

Why Copper is an Attractive Investment

Investing in copper offers numerous advantages. As a vital component in various industries, it provides opportunities to benefit from industrial demand and economic growth. Copper’s usage in construction, manufacturing, electronics, and renewable energy ensures steady demand.

Additionally, fluctuations in copper prices serve as indicators of overall economic health. By investing strategically in copper, individuals can diversify their portfolios and potentially reap long-term returns from rising demand and limited supply.

Overall, copper presents an attractive investment opportunity due to its versatile applications and its ability to reflect broader economic trends.

Historical Performance of Copper Investments

Examining the historical performance of copper investments is crucial before diving into this asset class. Copper has proven to be resilient, showcasing substantial returns over the years. For instance, between 2001 and 2011, copper prices surged by over 400%.

While past performance doesn’t guarantee future results, it indicates the potential for profitable returns. However, investors should consider current market conditions, supply and demand dynamics, geopolitical influences, and maintain a diversified portfolio to mitigate risk and maximize long-term financial growth.

Understanding the Copper Market

To make informed investment decisions in copper, it’s crucial to understand the factors impacting its supply and demand dynamics. Global production and consumption trends shape the market landscape. Infrastructure development, renewable energy transition, and the electric vehicle revolution contribute to increasing demand for copper.

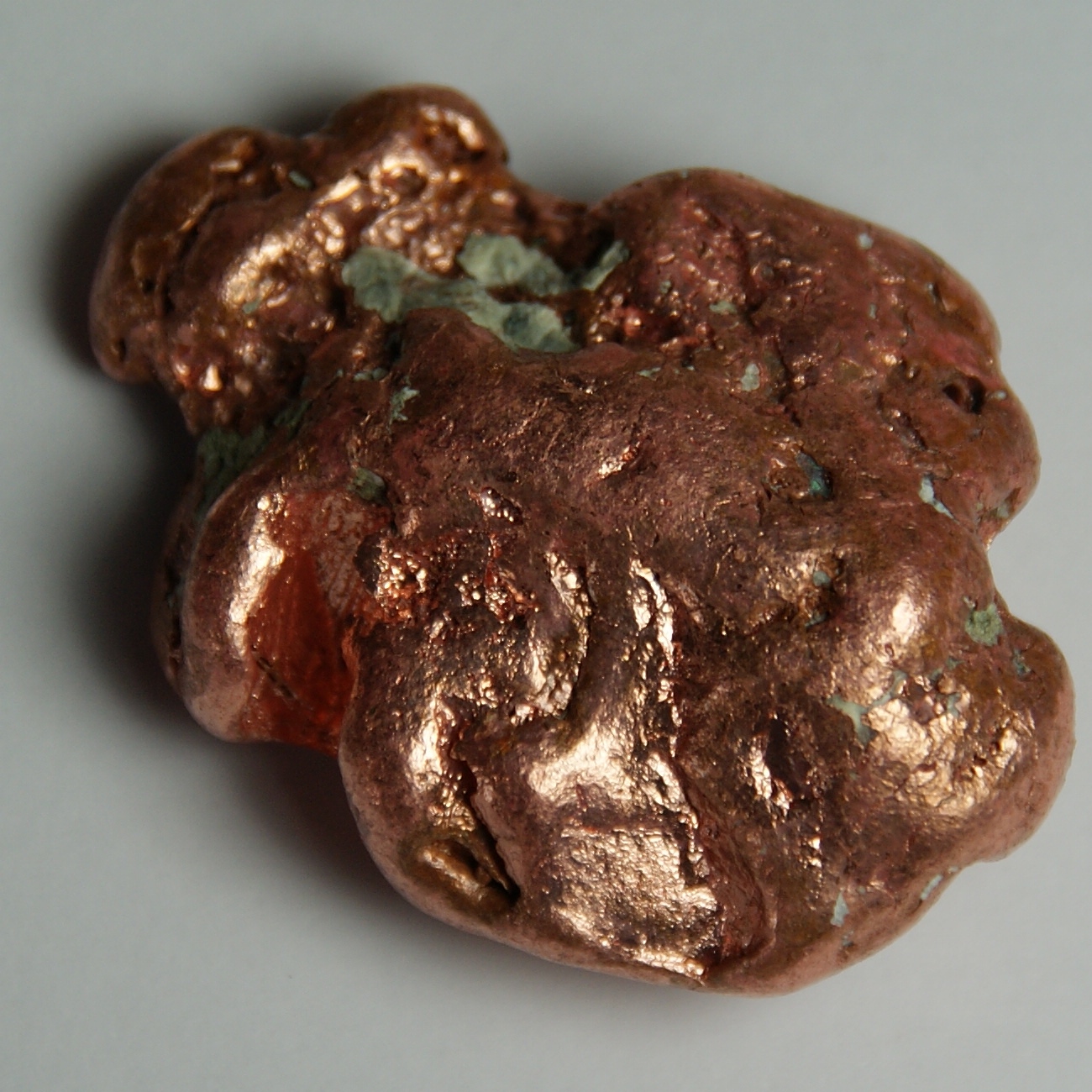

Investors can consider investing in physical copper or through ETFs for convenience and liquidity. Major mining companies offer stability, while junior mining companies involved in exploration projects present higher risks and rewards. Understanding these factors helps investors maximize returns and manage risk effectively in the copper market.

Evaluating the Risks of Investing in Copper

Investing in copper comes with risks that need careful evaluation. Geopolitical factors, such as trade wars and political instability in key producing countries like Chile and Peru, can disrupt supply chains and impact prices.

Macroeconomic influences, including inflationary pressures and global economic growth forecasts, also play a significant role in determining copper’s value as an investment. Monitoring these factors allows investors to make informed decisions and navigate potential fluctuations in the market.

Timing Your Entry into the Market

Investing in copper requires careful consideration of when to enter the market. Timing is crucial for maximizing profits and minimizing risks. Short-term strategies involve capitalizing on price volatility, while long-term strategies focus on sustained growth.

Factors such as global demand, economic indicators, and technological advancements influence copper prices. Analyzing market trends, industry forecasts, and risk tolerance helps determine the best entry points. Staying informed through research and expert opinions is essential for successful investing in the copper market.

Related Investing Topics

Investing in copper is just one aspect of the broader mining and metal sector. Exploring related topics like investing in mining or metal stocks can provide valuable insights for diversifying portfolios and expanding knowledge.

Investing in mining stocks involves considering various factors that impact the industry, such as the performance of different metals extracted by companies. Understanding market trends and dynamics is crucial for making informed investment decisions.

Similarly, exploring metal stocks offers opportunities beyond copper, including aluminum, nickel, zinc, and more. Each metal has unique supply-demand dynamics influenced by factors like industrial demand and environmental regulations.

Diversifying investments across different types of mining or metal stocks helps mitigate risk and capitalize on emerging trends. Staying updated with market developments allows investors to identify potential opportunities within this evolving landscape.

[lyte id=’R_2HSb9nA9Q’]