The world is undergoing a revolution in transportation, and electric vehicles (EVs) are at the forefront of this transformation. As more people recognize the environmental and economic benefits of EVs, investing in EV stocks has gained significant popularity.

In this article, we will explore what exactly an EV stock is, why they differ from traditional automotive stocks, and the factors that influence their performance. We will also delve into key players in the EV market, such as Tesla and NIO, and explore investment opportunities beyond cars.

Additionally, we will discuss the benefits and risks of investing in EV stocks and provide strategies for investors looking to capitalize on this exciting industry.

Understanding the EV Revolution

Electric vehicles (EVs) have revolutionized the automotive industry by offering a sustainable alternative to gasoline-powered cars. With advancements in battery technology and charging infrastructure, EVs have become more accessible for everyday use.

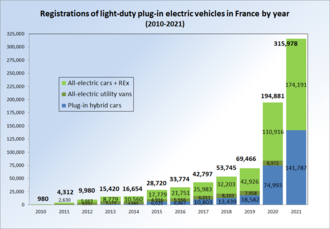

They produce lower carbon emissions and have prompted governments to implement stricter emission regulations. The growing demand for electric vehicles has forced traditional car manufacturers to focus on electrification. Investing in EV stocks offers both financial rewards and support for the clean energy revolution.

The future of transportation is being transformed by the EV revolution, contributing to a greener and more sustainable future.

What Exactly is an EV Stock?

An EV stock refers to shares of companies directly involved in manufacturing or supporting electric vehicles and their components. Unlike traditional automotive stocks, EV stocks focus solely on electric mobility, providing an advantage in technological innovation and meeting the demands of environmentally-conscious consumers.

Popular EV stocks include Tesla (NASDAQ: TSLA), NIO (NYSE: NIO), and BYD Company Limited (HKG: 1211), known for visionary leadership, technological advancements, and potential market domination. Investing in these stocks supports sustainable transportation solutions while offering potential financial gain in a rapidly expanding market.

Factors Influencing the Performance of EV Stocks

Government policies and regulations, technological advancements, and consumer demand all have a significant impact on the performance of EV stocks.

Supportive government regulations such as tax incentives and subsidies can boost demand for electric vehicles and drive the growth of companies in this sector.

Technological advancements in battery technology, charging infrastructure, autonomous driving capabilities, and energy storage systems greatly influence investor sentiment towards EV stocks. Companies that innovate within these areas are more likely to attract attention and capture market share.

Consumer demand for sustainable transportation options is growing as more people seek eco-friendly alternatives to conventional cars. Companies that cater to this demand are expected to experience significant growth in their stock value.

In summary, government policies, technological advancements, and consumer demand all play crucial roles in shaping the performance of EV stocks.

Key Players in the EV Market and Their Stocks

Tesla, founded in 2003, is a pioneer in the electric vehicle industry. Led by CEO Elon Musk, Tesla has revolutionized the automotive sector with innovative EV models like the Model S, Model 3, and Model X. Tesla’s stock (NASDAQ: TSLA) has experienced remarkable growth but also volatility due to market competition and uncertainties.

However, many investors believe in Tesla’s long-term growth potential.

NIO is a Chinese EV manufacturer known for providing premium electric mobility experiences. With features like swappable batteries and autonomous driving capabilities, NIO follows a user-centric business model. NIO’s stock (NYSE: NIO) has gained attention due to its sales growth and strong presence in China’s EV market.

As China promotes clean transportation solutions, NIO has promising prospects.

In summary, Tesla and NIO are key players in the EV market driving innovation. Their stocks reflect their impact on the industry, with both experiencing growth and volatility. Nonetheless, these companies continue to shape the future of transportation with their commitment to technology advancements and customer-centric approaches.

Beyond Cars: Exploring Other Electric Vehicle Stocks

The growth of electric vehicles (EVs) presents investment opportunities beyond car manufacturers. Two areas worth exploring are charging infrastructure companies and electric bus manufacturers.

Charging infrastructure plays a crucial role in EV adoption, with reliable and convenient charging stations becoming essential. Promising companies like ChargePoint, Blink Charging, and Electrify America are expanding their networks to support the increasing number of EVs on the road.

Electric buses offer a sustainable solution for public transportation, reducing carbon emissions and improving air quality. Leading manufacturers like Proterra and BYD Company Limited (HKG: 1211) have positioned themselves well in this industry, providing investment opportunities aligned with environmental goals.

By looking beyond traditional car manufacturers like Tesla, investors can tap into the growing market of EV-related industries. Charging infrastructure and electric bus manufacturing present promising prospects for financial growth while contributing to a greener future.

The Benefits and Risks of Investing in EV Stocks

Investing in EV stocks offers the potential for high growth due to increasing global demand for electric vehicles. This aligns with environmental consciousness, supporting clean energy initiatives while potentially generating attractive financial returns.

However, risks include market competition, technological uncertainties leading to stock price volatility, and potential regulatory changes impacting the industry. It’s crucial for investors to carefully assess these risks and stay informed about industry developments to navigate this dynamic market successfully.

| Potential Benefits | Risks Associated |

|---|---|

| – High-growth potential driven by increasing demand | – Volatility due to market competition and technological uncertainties |

| for electric vehicles | – Potential regulatory changes impacting the industry |

| – Environmental sustainability as a key driving factor |

Strategies for Investing in EV Stocks

Investing in EV stocks requires careful planning and strategic approaches. For long-term investors, conducting thorough research on company fundamentals, industry trends, and competitors is vital. Diversifying investments across different segments of the EV market helps mitigate risks.

Short-term traders can benefit from staying updated on market trends and news related to EVs, such as product launches or government announcements. Implementing stop-loss orders can protect investments during periods of volatility. By adopting these strategies, investors can position themselves for success in the growing EV industry.

Tips for New Investors in EV Stocks

For new investors interested in venturing into the world of electric vehicle (EV) stocks, here are some valuable tips to consider:

-

Educate yourself about the basics of investing: Familiarize yourself with concepts like risk tolerance, diversification, and portfolio management. Online tutorials, books, investment forums, and reputable financial websites offer valuable insights and educational materials.

-

Stay updated with market news: Follow reliable financial news sources and subscribe to newsletters or alerts related to the EV industry. Staying informed about the latest developments will help you make well-informed investment decisions.

-

Seek advice from financial professionals: Consider consulting with a qualified financial advisor who can provide personalized guidance based on your investment goals and risk tolerance. They can help assess investment opportunities, diversify portfolios, and develop long-term strategies.

-

Conduct thorough due diligence: Before making any investment decisions, research companies, analyze their financials, evaluate management teams, and assess potential risks associated with specific investments. Careful evaluation is key to making informed choices.

By following these tips, new investors can position themselves for success when investing in EV stocks.

[lyte id=’T5S7jjsK_6o’]