The space industry has captivated human imagination for centuries, and now it’s capturing the attention of investors too. With advancements in technology and renewed global interest, investing in space stocks offers significant growth potential. However, it also comes with challenges like regulatory hurdles and unpredictable market dynamics.

To navigate this exciting sector, investors must understand both the opportunities and risks involved. Thorough research, staying updated on regulations, and analyzing market trends are essential for making informed investment decisions in this new frontier.

SpaceX: Revolutionizing Space Exploration and Investment Opportunities

SpaceX, led by Elon Musk, has transformed the space industry with its ambitious goals and groundbreaking achievements. Musk’s vision to make humanity a multi-planetary species has garnered global attention and investor enthusiasm.

The company’s success in developing reusable rockets and delivering payloads to orbit has positioned it as a major player in commercial space.

Financially, SpaceX has attracted significant investment capital from venture capitalists and institutional investors. Its valuation has skyrocketed as its ambitious projects gain momentum. With a healthy backlog of contracts from government agencies and private entities, SpaceX showcases its reliability as a partner for space missions.

However, investing in SpaceX comes with risks. The competitive nature of the space industry poses challenges, along with potential regulatory hurdles and the need for ongoing technological innovation. Investors must carefully evaluate these risks alongside potential rewards before committing to SpaceX investments.

In summary, SpaceX’s revolutionary approach to space exploration offers enticing investment opportunities. However, investors should be aware of the risks associated with this highly competitive industry and thoroughly assess them before making investment decisions related to SpaceX.

Blue Origin: Jeff Bezos’ Ambitious Space Venture

Blue Origin, founded by Amazon CEO Jeff Bezos, aims to revolutionize space exploration by making it more accessible and affordable. The company has achieved significant milestones in reusable rocket technology and plans to venture into human spaceflight.

With a focus on sustainability and partnerships with government agencies and private entities, Blue Origin has the financial backing and market potential to reshape the space industry. Under Bezos’ leadership, Blue Origin is poised to make a lasting impact on the future of space exploration.

Virgin Galactic: Making Space Tourism a Reality

Virgin Galactic, led by Richard Branson, is pioneering commercial space travel for tourists worldwide. Their progress in spacecraft development brings the dream of suborbital space journeys closer to reality. This unique venture presents an exciting investment opportunity for those interested in the nascent space tourism industry.

Evaluating Virgin Galactic’s financials and market positioning is crucial for understanding its potential growth. As the race to conquer commercial space travel intensifies, Virgin Galactic remains committed to pushing boundaries and fulfilling humanity’s dream of venturing beyond Earth’s atmosphere.

With Branson at the helm and impressive technological advancements, their vision of democratizing access to outer space becomes closer to becoming a reality.

Lockheed Martin: Bridging Defense with Space Exploration

Lockheed Martin, a leading aerospace and defense company, has successfully merged its expertise in military defense with space exploration initiatives. By combining cutting-edge technologies, the company plays a significant role in both sectors.

This unique approach positions Lockheed Martin as a key player in the space industry while offering investors a stable opportunity for growth. Government contracts and strategic partnerships further enhance their financial stability and drive advancements in space technology.

With their seamless integration of defense and exploration, Lockheed Martin continues to push boundaries and contribute to the progress of both industries.

Space ETFs: Diversifying Investment Options for the Cosmic Boom

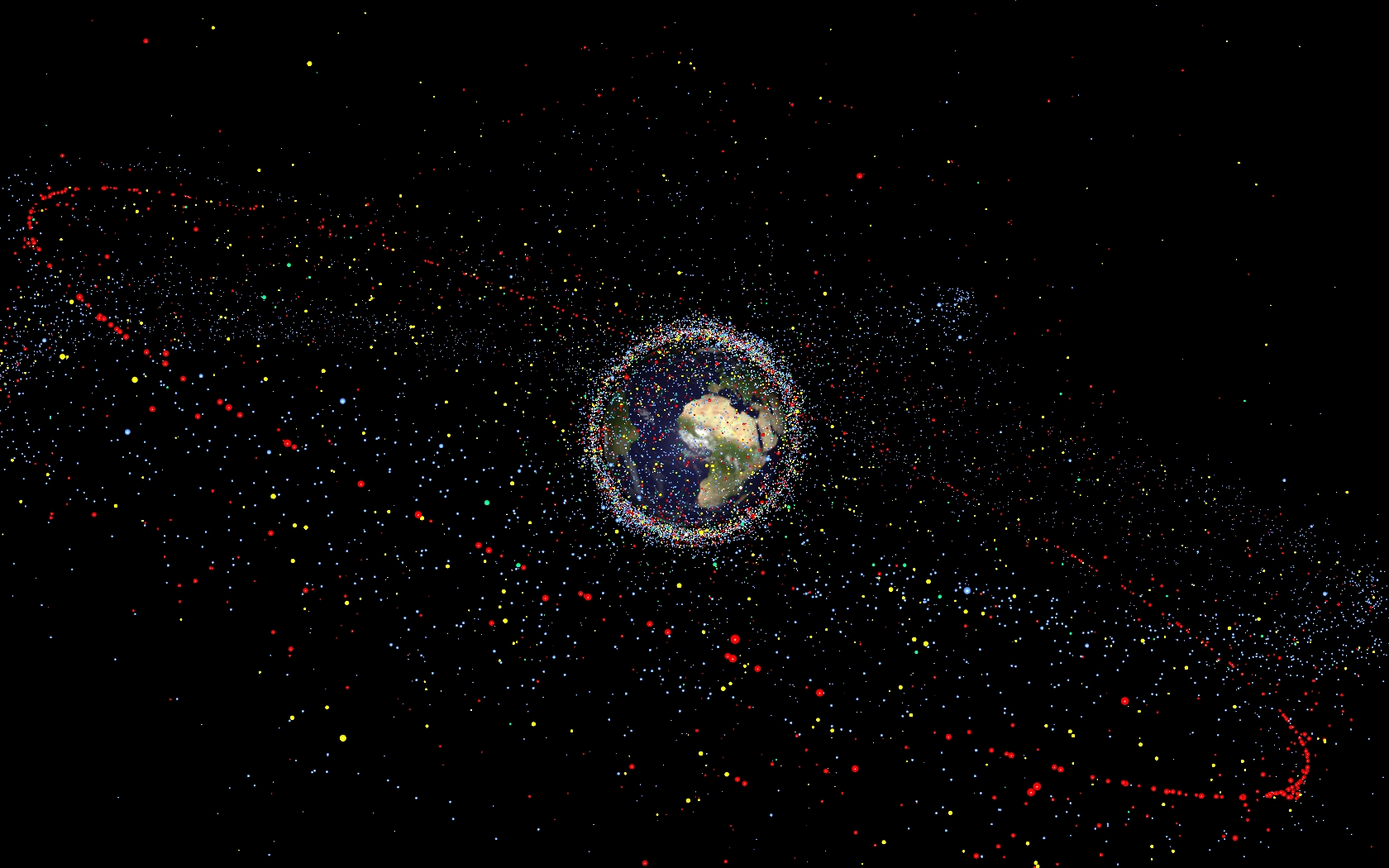

As interest in the space industry continues to soar, investors are turning to Space Exchange-Traded Funds (ETFs) to diversify their investment options. These funds provide exposure to a range of companies involved in space exploration and related industries, allowing investors to spread their risk across multiple stocks.

With the ease of trading on stock exchanges and the potential for gains from successful companies within the sector, space-themed ETFs offer a convenient and diversified way to participate in the cosmic boom. However, investors should be mindful of management fees and limited control over individual stock selection when considering these funds.

The Future of Space Stocks: Trends and Predictions

The future of space stocks is driven by emerging trends in the industry. Private space companies like SpaceX, Blue Origin, and Virgin Galactic are leading the way with innovative technologies and ambitious missions.

The commercialization of space exploration is creating new investment opportunities, while advancements in satellite technology are fueling demand for services in various industries. Factors such as technological advancements, government policies, partnerships between companies, and market demand will influence the growth potential of space stocks.

Staying informed and agile is crucial to capitalize on the opportunities presented by this exciting frontier.

Conclusion: The Final Frontier Awaits Your Investment

[lyte id=’_bx4oMjsoxU’]

.png)

.jpg)