In today’s digital landscape, online privacy and security have become growing concerns for individuals and businesses alike. With the increasing threats of data breaches and surveillance, protecting personal information has never been more crucial. This is where Virtual Private Networks (VPNs) come into play.

VPNs provide a secure and private connection by encrypting internet traffic and masking users’ IP addresses. As the demand for online privacy continues to rise, investing in VPN stocks presents a promising opportunity for investors.

The Growing Importance of VPNs in Today’s Digital Landscape

In today’s increasingly connected world, Virtual Private Networks (VPNs) play a crucial role in protecting our online privacy and security. As internet usage continues to surge, so does the sharing of personal information online. This creates vulnerabilities that cybercriminals exploit.

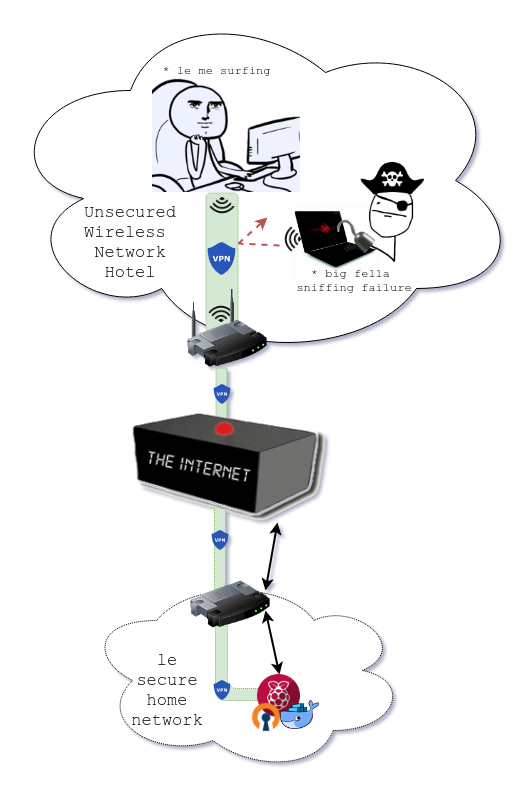

With concerns over privacy and security at an all-time high, VPNs offer a solution by establishing secure connections between users’ devices and the internet. By encrypting data and masking IP addresses, VPNs ensure that sensitive information remains hidden from prying eyes.

Additionally, they provide added security when using public Wi-Fi networks, safeguarding against potential threats. In summary, VPNs are essential tools for maintaining privacy and peace of mind in our digital age.

Overview of the VPN Market: Current Trends and Projections

The VPN market is booming due to rising privacy concerns in various sectors, particularly as businesses adopt remote work policies. With an increasing number of data breaches and surveillance scandals, individuals are more conscious about protecting their personal information online.

This has led to a growing demand for VPN services that provide anonymity, data encryption, and protection against unauthorized access.

Emerging markets present untapped opportunities for VPN providers as internet penetration rates rise and individuals seek ways to safeguard their online privacy. Projections indicate sustained growth in the VPN industry, driven by the increasing reliance on digital technologies and advancements such as 5G networks and IoT devices.

In summary, the global VPN market is experiencing significant growth fueled by escalating privacy concerns. Businesses’ remote work policies and individuals’ awareness of online privacy rights drive the demand for secure connections offered by VPNs.

Emerging markets offer potential for expansion, while projections point towards continued growth in the industry.

Key Factors to Consider When Investing in VPN Stocks

Investing in VPN stocks requires careful consideration of key factors. Evaluating the financial performance and growth potential of VPN providers is essential. Look for companies with consistent revenue growth, indicating increasing demand for their services. Assess profitability and debt levels to gauge financial strength.

Companies with healthy profit margins and manageable debt are better positioned for long-term success. By analyzing these factors, investors can make informed decisions in the competitive VPN market.

Top VPN Providers: Evaluating Financial Performance and Growth Potential

XYZ Corporation is a leading VPN provider with a robust network serving individuals and enterprises. Their competitive pricing and strong market presence make them stand out.

Analyzing XYZ Corporation’s financial performance provides insights into revenue growth, profitability ratios, and overall stability. Consistent growth in user subscriptions or enterprise contracts indicates a promising future.

Experts believe that XYZ Corporation’s commitment to innovation sets them apart from competitors. Their dedication to enhancing security features positions them well for sustained success.

ABC Inc.’s unique value proposition lies in their focus on user simplicity without compromising security standards. Their user-friendly interface appeals to consumers seeking hassle-free protection.

Evaluating ABC Inc.’s financial stability is crucial to gauge investment attractiveness. Assess factors like revenue growth, cash flow, and customer retention rates for informed decisions.

Partnerships and acquisitions can significantly impact a VPN provider’s growth potential. Evaluate ABC Inc.’s strategic alliances or recent acquisitions for market expansion opportunities.

Promising Investment Opportunities in the VPN Industry: VPN Stocks to Watch

Investing in the VPN industry provides exciting prospects for financial growth. As online privacy concerns rise, the demand for VPN services is increasing rapidly. Several VPN providers have shown strong financial performance, positioning them well to capitalize on this growing market.

Analyzing the financial statements of these promising VPN stocks is crucial for identifying attractive investment opportunities. Evaluating revenue growth, profitability margins, and debt levels helps determine their potential for success.

A consistent increase in revenue indicates a growing customer base and market share. Higher profit margins demonstrate efficient operations, while low debt levels provide stability and flexibility for future growth.

By carefully assessing the financial performance and growth potential of these promising VPN stocks, investors can make informed decisions based on market trends and industry outlooks.

Investing in the VPN industry offers a chance to benefit from the increasing demand for online privacy. Thorough research and analysis are essential when considering investment options within this sector.

Risks and Challenges in the VPN Industry: Factors That May Impact Investments

The VPN industry presents risks and challenges that can significantly impact investments. Regulatory landscapes vary across jurisdictions, posing potential risks for investors. Understanding data privacy laws is crucial.

Additionally, competition within the market is intense, with factors like market saturation, pricing strategies, and technological advancements influencing investment decisions. Assessing these factors ensures informed decision-making in this dynamic industry.

Conclusion: Making Informed Decisions for Investing in VPN Stocks

Investing in VPN stocks allows you to protect your investments while capitalizing on the growing need for online privacy and security. The VPN market is expanding rapidly, driven by concerns over data breaches and surveillance. By adding VPN stocks to your portfolio, you align with the rising demand for secure internet connections.

Thorough research and due diligence are crucial when investing in VPN stocks. Stay updated on market trends, financial indicators, and regulations to make informed decisions. Consider companies with a strong track record, customer retention rates, and revenue growth.

[lyte id=’Quljl-wKYBE’]