Investing in the financial markets can be a lucrative endeavor, but it requires a deep understanding of various trading strategies. One such strategy that has gained popularity among experienced traders is volume spread analysis (VSA).

In this article, we will explore how VSA can be applied to scalping, a short-term trading technique, and discuss its benefits and advantages.

What is Volume Spread Analysis (VSA)?

Volume Spread Analysis (VSA) is a methodology used by traders to analyze price movements based on the interplay between volume and spread. By examining these two factors, traders gain valuable insights into market dynamics and make informed trading decisions.

VSA provides a holistic view of market behavior, allowing traders to identify potential turning points or trends with greater accuracy. Understanding volume and spread reveals the participation of buyers and sellers in the market, indicating strong or weak market activity.

Analyzing these patterns helps traders anticipate trend reversals or continuations and differentiate between genuine price movements and manipulations by institutional investors. VSA is an essential tool for traders seeking a comprehensive understanding of market dynamics.

Scalping using VSA

Scalping, a widely adopted trading technique, involves capitalizing on small price movements within short timeframes. By incorporating Volume Spread Analysis (VSA) principles into scalping strategies, traders can take advantage of quick opportunities in the market to maximize potential profits.

When employing VSA for scalping, traders focus on identifying specific entry and exit points based on volume and spread analysis. They actively seek out situations characterized by high buying or selling pressure coupled with narrow spreads, which indicate strong momentum aligning with their anticipated direction.

This approach enables them to enter trades at optimal levels and swiftly capitalize on small price fluctuations for gains.

Successful scalpers utilizing VSA pay close attention to volume patterns and the relationship between volume and price. They aim to identify instances where significant buying or selling is occurring, as this suggests a change in market sentiment and potential trading opportunities.

Additionally, they consider the spread, which reflects the difference between bid and ask prices. A tight spread indicates high liquidity and typically leads to more accurate price discovery.

By combining these elements of VSA with scalping techniques, traders can effectively navigate volatile markets and exploit short-term price movements for profit. This strategy requires discipline, as rapid decision-making is crucial when executing trades based on real-time market conditions.

In summary, scalping using VSA involves leveraging Volume Spread Analysis principles to identify favorable entry and exit points for quick trades that capture small price fluctuations.

Traders who master this approach can potentially generate consistent profits by capitalizing on momentary market imbalances driven by strong buying or selling pressure combined with narrow spreads.

Benefits of Scalping with VSA

Scalping with Volume Spread Analysis (VSA) offers traders several advantages. Firstly, it presents high-profit opportunities within a short period by capitalizing on small price movements. This allows for efficient use of capital and increases potential returns.

Secondly, scalping with VSA enables traders to avoid prolonged market risks associated with longer-term trading strategies, reducing exposure to unexpected events or unfavorable market conditions. Additionally, this approach carries lower risk as scalp trades are held briefly, minimizing the impact of adverse price movements.

Lastly, scalping with VSA provides frequent trading opportunities and increased liquidity, thanks to swift execution and precise entry and exit points based on volume analysis. Overall, scalping with VSA is an attractive strategy for risk-conscious traders seeking quick profits in the market.

Getting Started with Scalping using VSA

Scalping, a popular trading strategy, involves making quick trades to take advantage of small price movements. When implementing scalping techniques with Volume Spread Analysis (VSA), it is crucial to have the right brokerage platform and a well-organized trading workspace.

To effectively scalp using VSA, selecting a brokerage platform that offers real-time data feeds and a user-friendly interface is essential. Real-time data ensures traders have access to up-to-date information necessary for making timely trading decisions.

This enables them to analyze volume and price patterns accurately, which are fundamental aspects of VSA. Additionally, a user-friendly platform streamlines the process of executing trades swiftly, allowing scalpers to capitalize on short-lived opportunities.

Some recommended brokerage platforms for scalping with VSA include Interactive Brokers, TD Ameritrade’s thinkorswim platform, and TradeStation. These platforms provide advanced charting tools and customizable layouts specifically designed for active traders engaged in scalping strategies.

With these features, scalpers can easily monitor volume trends, identify supply and demand imbalances, and make informed trade entries and exits.

Once the right brokerage platform is selected, setting up an efficient trading workspace becomes essential. Efficient analysis is key when scalping with VSA as traders need to quickly identify patterns and make informed decisions within seconds.

Organizing charts, indicators, and other tools in a way that allows for easy identification of key market signals is crucial. Customizing the workspace according to personal preferences enhances efficiency by ensuring all necessary information is readily available at one’s fingertips.

This way, traders can react swiftly to market movements and execute trades without hesitation.

By focusing on the combination of the right brokerage platform offering real-time data feeds and a user-friendly interface along with a well-organized trading workspace tailored to individual preferences, traders can set themselves up for success when implementing scalping strategies using VSA.

Key Indicators for Volume Spread Analysis

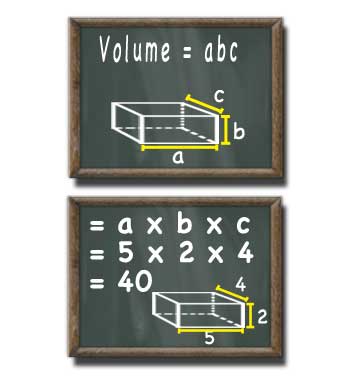

Volume Spread Analysis (VSA) utilizes key indicators that provide valuable insights into market dynamics. One important indicator is the On-Balance Volume (OBV), which measures buying and selling pressure based on cumulative volume. Traders can interpret OBV patterns to identify potential buying or selling opportunities.

Another crucial indicator is bid/ask spread analysis, which reflects market liquidity and helps traders find favorable entry points with lower transaction costs. By understanding these indicators, traders can make informed decisions based on solid data analysis rather than relying solely on price movements.

Analyzing Market Trends and Patterns with VSA

The use of Volume Spread Analysis (VSA) is a powerful technique for analyzing market trends and patterns. By delving into the intricacies of market behavior, VSA provides valuable insights into the accumulation/distribution zones and reversal signals that can guide traders towards profitable trading opportunities.

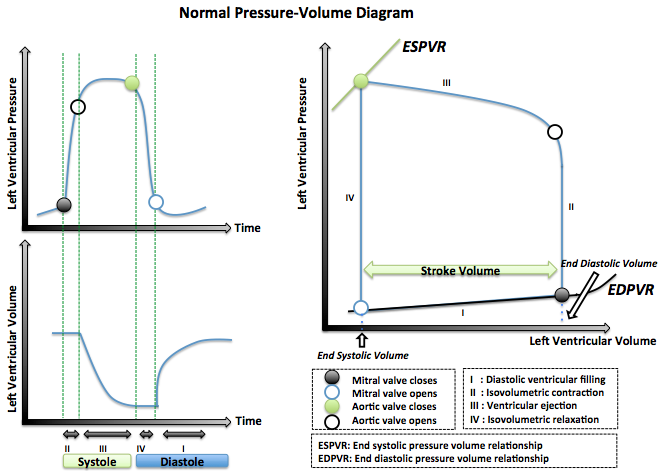

Accumulation/distribution zones are pivotal areas on a chart where buying or selling pressure consolidates before price embarks on a particular direction. These zones represent periods of market indecision, offering glimpses into future price movements.

Within these zones, recognizing patterns becomes crucial for traders seeking to identify potential profit opportunities. For instance, if an accumulation zone displays high volume alongside narrow spreads, it may indicate that buyers are accumulating shares in preparation for an upward price move.

Price/volatility analysis serves as another indispensable tool for traders aiming to spot trend reversals. By closely examining price action combined with volatility indicators, traders can detect potential shifts in market direction.

A significant increase in volume and wide spreads during a price decline could signal the exhaustion of selling pressure, potentially paving the way for a reversal.

Employing VSA techniques enables traders to effectively identify these reversal signals and enter trades at optimal levels, thereby maximizing their profit potential. With a comprehensive understanding of market trends and patterns gained through VSA analysis, traders gain an edge in navigating the complexities of the financial markets.

Strategies for Successful Scalping with VSA

Scalping, a popular trading technique, offers quick profits through short-term price movements. When combined with Volume Spread Analysis (VSA), traders can enhance their scalping success. Two effective strategies incorporate VSA principles: breakout and pullback trading.

Breakout patterns occur when prices surpass support or resistance levels, indicating a shift in market sentiment. By analyzing volume and spread dynamics during breakouts, traders using VSA can capitalize on these patterns.

Clear entry and exit points based on VSA principles allow traders to capture substantial price movements within a short timeframe.

Pullbacks are temporary reversals against the prevailing trend within a larger market move. By applying VSA techniques to analyze volume and spread dynamics during pullbacks, traders can identify favorable entry points. This strategy enables scalpers to ride the trend as it resumes its original direction while minimizing counter-trend risks.

Successful scalping with VSA requires skillful execution of breakout and pullback strategies. Traders who integrate volume spread analysis into their approach can identify favorable entry points, capitalize on short-term price movements, and enhance profitability in the fast-paced world of scalping.

Risk Management in Scalping with VSA

Scalping, a popular trading strategy, offers quick profits but carries inherent risks. Proper risk management is essential to protect capital and minimize losses. Setting stop-loss orders limits potential losses if the trade moves against you. Calculating risk-to-reward ratios ensures potential profits outweigh potential losses.

Position sizing techniques prevent excessive risk exposure. Implementing these techniques is crucial for successful scalping with VSA.

Table: Risk Management Techniques in Scalping with VSA

| Technique | Description |

|---|---|

| Stop-Loss Orders | Placing predetermined levels to limit potential losses if the market moves unfavorably. |

| Risk-to-Reward Ratios | Assessing potential profit against potential loss to ensure profitable opportunities outweigh risks. |

| Position Sizing | Allocating capital based on account size, risk tolerance, and market conditions to avoid excessive risk exposure. |

In summary, effective risk management is vital in scalping with VSA. Utilizing stop-loss orders, calculating risk-to-reward ratios, and applying position sizing techniques protect capital and enhance success in scalping.

[lyte id=’Lml_ojSA4Fw’]