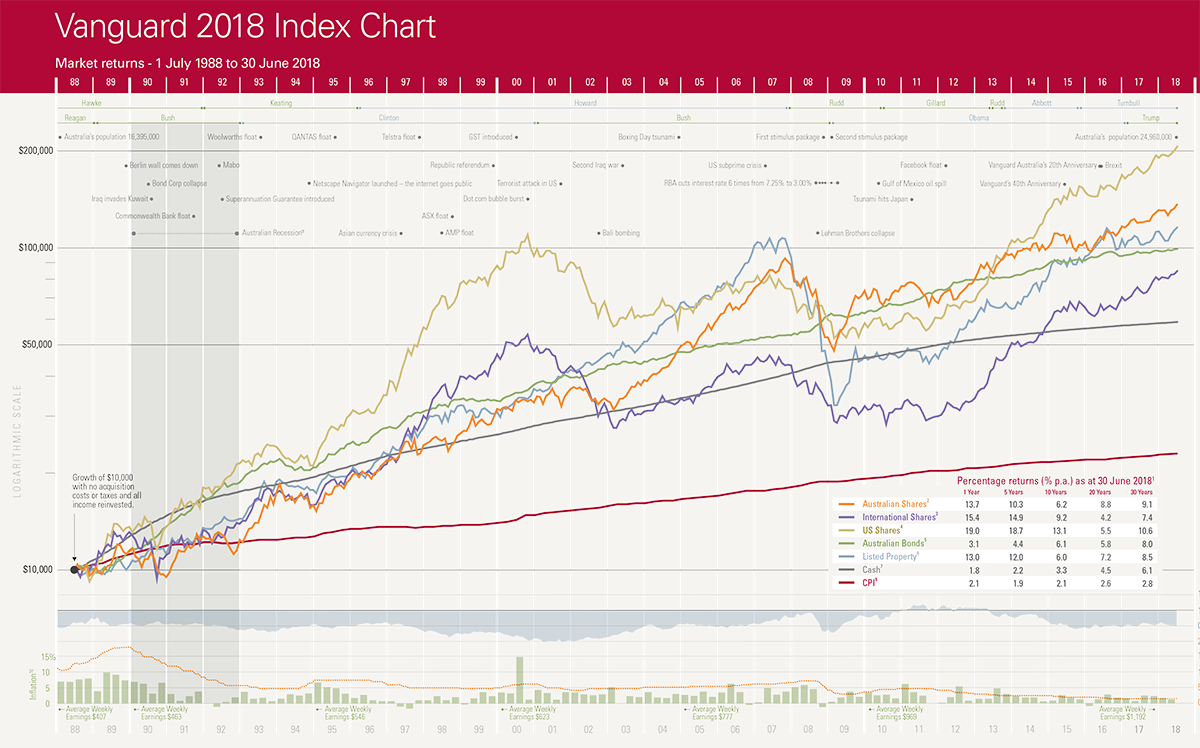

Investing can be overwhelming with countless options and strategies to consider. But building a diversified portfolio doesn’t have to be complex or time-consuming. With just four well-chosen Vanguard ETFs, you can achieve diversification and keep costs low.

The Benefits of Simplicity and Cost Efficiency

Investing doesn’t have to be complicated. Simplifying your strategy by focusing on a few key Exchange-Traded Funds (ETFs) reduces the risk of poor decision-making based on a complex portfolio. Vanguard ETFs offer low expense ratios, meaning more money stays in your pocket instead of going towards fees.

This streamlined approach also allows for effective diversification, minimizing risk while maximizing returns. Embracing simplicity and cost efficiency in investing can lead to better comprehension, informed choices, and potentially more rewarding financial outcomes.

The Importance of Diversification

Diversification is a key principle in investing that helps to minimize risk and maximize returns. By spreading your investments across different asset classes, such as stocks, bonds, real estate, and commodities, you can reduce the impact of any single investment’s performance on your overall portfolio.

This approach allows you to benefit from potential gains in one area while cushioning potential losses in another. Diversification not only protects your capital but also provides opportunities for growth and helps to smooth out market volatility. It is a critical strategy for investors looking to achieve long-term financial success.

Representing Different Asset Classes with 4 ETFs

Vanguard offers a streamlined solution for representing various asset classes with only four ETFs. These carefully selected funds allow for broad diversification across domestic and international stocks and bonds.

Included in this lineup are U.S. & International Bond ETFs, which add stability and balance to the portfolio by mitigating risk and providing consistent income streams. By strategically combining these ETFs, investors can achieve a well-diversified investment portfolio that effectively represents different asset classes.

The Role of Bond ETFs in a Diversified Portfolio

Bonds are vital for balancing risk in an investment portfolio, providing stability and acting as a buffer during market volatility. Vanguard’s bond ETFs offer flexibility and allow you to choose the level of risk and duration that align with your investment goals.

These ETFs provide income through interest payments, diversify your portfolio, offer liquidity advantages, and are cost-efficient compared to actively managed funds. By incorporating bond ETFs into your diversified portfolio, you optimize risk management strategies and gain stability during market fluctuations.

Vanguard’s Offerings for U.S. and International Bond Exposure

When it comes to building a diversified investment portfolio, including bonds is vital. Bonds offer stability and income potential, making them an essential component of any well-rounded strategy.

Vanguard understands the importance of bond exposure, and they provide investors with an extensive range of options for both U.S. and international markets.

For those seeking the reliability and familiarity of U.S. bonds, Vanguard offers a variety of U.S. bond ETFs. These funds allow investors to gain exposure to different sectors within the U.S. bond market, such as government bonds, corporate bonds, or municipal bonds.

With Vanguard’s U.S. bond ETFs, investors can customize their portfolio based on their risk tolerance and investment objectives.

However, if you’re looking for potential higher returns in international markets, Vanguard has you covered as well. They offer a selection of international bond ETFs that provide access to various countries’ bond markets worldwide.

Investing in international bonds allows you to diversify your portfolio beyond domestic markets and potentially benefit from different economic cycles and interest rate movements.

Vanguard’s international bond offerings span across developed and emerging economies, allowing investors to choose from different regions and currencies based on their preferences and risk appetite.

Whether you’re interested in European government bonds or Asian corporate bonds, Vanguard provides options that cater to your specific investment needs.

By offering a comprehensive selection of U.S. and international bond ETFs, Vanguard ensures that investors have ample choices to diversify their portfolios effectively. The flexibility provided by these funds enables individuals to adjust their exposure depending on market conditions or personal preferences.

The Importance of Including Both U.S. and International Stocks

To build a well-diversified portfolio, it’s crucial to invest in both U.S. and international stocks. While the U.S. market offers stability and growth potential, international markets provide access to diverse economies and industries that can enhance overall returns.

By including international stocks, you can mitigate risks associated with relying solely on the performance of the U.S. market and tap into sectors that may not be well-represented domestically. However, investing internationally requires careful consideration of factors like currency exchange rates and foreign regulations.

Working with experienced financial advisors can help navigate these challenges while maximizing opportunities for higher returns through global diversification.

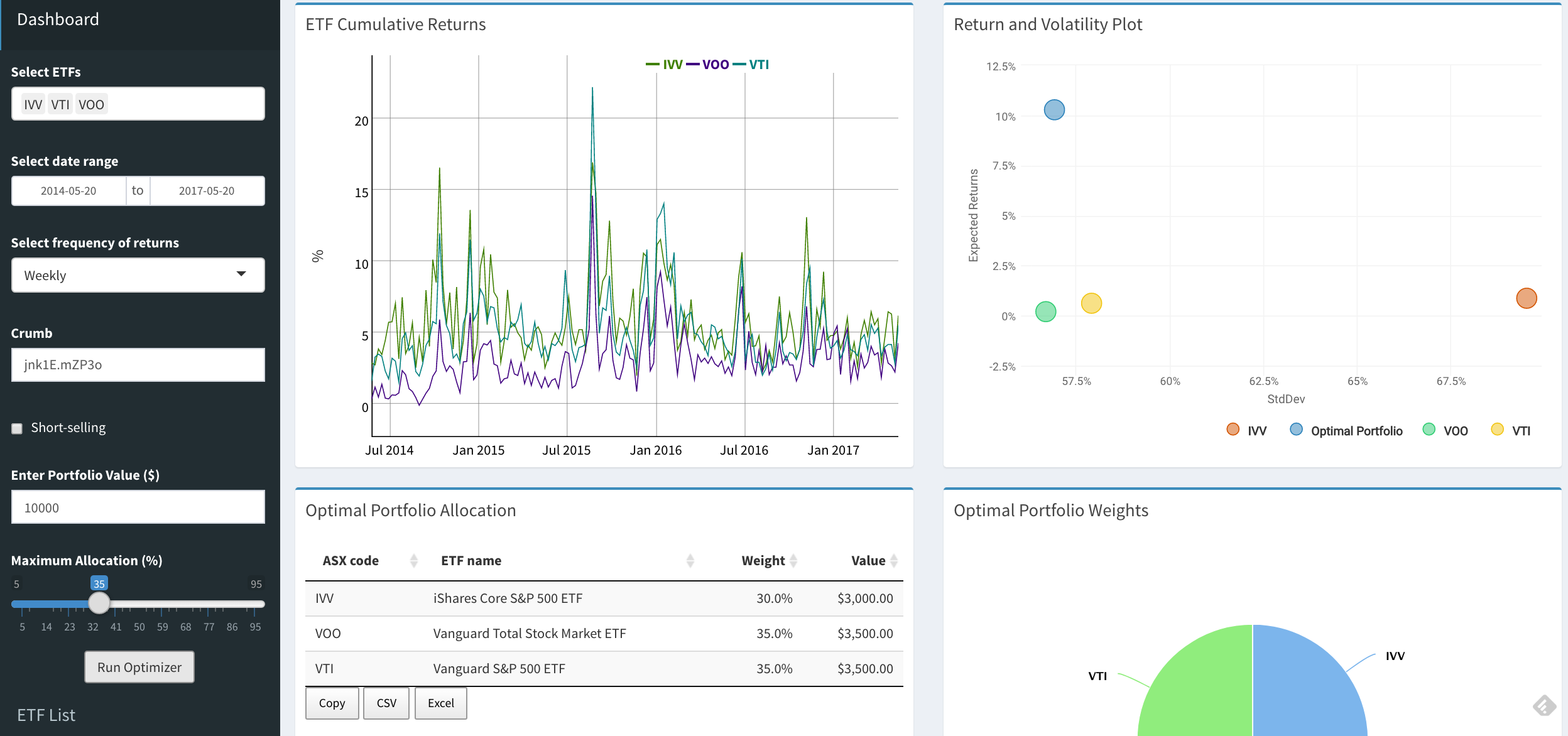

Vanguard’s Stock ETF Options for Broad Market Coverage

Vanguard, a leading investment management company, offers a diverse range of stock ETFs that provide extensive market coverage across various sectors and regions. These carefully selected funds allow investors to capture growth opportunities in both domestic and international markets while minimizing the risks associated with individual stocks.

With Vanguard’s stock ETF options, investors can gain exposure to a wide range of assets, including large-cap, mid-cap, and small-cap stocks. This comprehensive coverage ensures that your portfolio is well-positioned to benefit from the performance of different segments of the market.

One notable advantage of investing in Vanguard’s stock ETFs is their commission-free nature. This means that you can buy and sell these funds without incurring any transaction costs or fees. This can be particularly beneficial for long-term investors who want to avoid unnecessary expenses and maximize their returns.

Moreover, Vanguard’s stock ETFs are designed to replicate the performance of well-known market indexes such as the S&P 500 or the Russell 2000. By doing so, they provide investors with a cost-effective way to gain exposure to a broad range of stocks within a specific market segment or sector.

To further enhance diversification, Vanguard also offers international stock ETFs that allow you to tap into global markets. These funds enable you to invest in companies located outside your home country and take advantage of opportunities beyond your local market.

In summary, Vanguard’s stock ETF options offer investors a convenient and cost-effective way to achieve broad market coverage across various sectors and regions. With their commission-free structure and focus on replicating established indexes, these funds can play an essential role in building a well-diversified investment portfolio.

Whether you are looking for exposure to domestic or international markets, Vanguard has a range of stock ETFs that can help you achieve your investment goals effectively.

[lyte id=’B7_xV8ryQx0′]