Investing in precious metals has always held a certain allure. From their historical significance to their role in various industries, these valuable metals have captivated the attention of investors for centuries.

In this article, we will delve into the world of valuable metal prices, exploring the factors that influence them and uncovering the investment potential they hold.

Introduction to the Concept of Valuable Metals

Valuable metals, such as gold and silver, possess unique properties that make them highly sought after. These include rarity, durability, and intrinsic beauty. Precious metals are scarce compared to other materials, which increases their desirability. They are also highly resistant to corrosion, making them durable for various purposes.

Additionally, the visual appeal of gold and silver adds aesthetic value beyond their monetary worth. These qualities make valuable metals indispensable in industries like electronics and photography while also serving as stable investment options in uncertain economic times.

Historical Significance and Cultural Importance of Precious Metals

Throughout history, precious metals like gold and silver have played a vital role in shaping civilizations worldwide. From being used as currency to symbolizing wealth and power, these metals hold immense cultural importance. They have been revered as symbols of prosperity and status, with their allure driving exploration and trade routes.

Beyond their material value, precious metals are also associated with religious rituals and mythological beliefs. Inherited as heirlooms or treasured for their symbolic meaning, they continue to captivate investors today due to their beauty, rarity, durability, and historical significance.

Role of Valuable Metals in Various Industries

Precious metals have always played a vital role in diverse industries. Gold’s conductivity makes it indispensable in electronics manufacturing, while silver’s antimicrobial properties find applications in healthcare settings. Platinum and palladium are essential components in catalytic converters used to reduce emissions in automobiles.

By examining how these metals are utilized across different sectors, we gain a deeper understanding of their demand dynamics.

| Metal | Application |

|---|---|

| Gold | Electronics manufacturing, conductivity |

| Silver | Healthcare settings, antimicrobial properties |

| Platinum | Catalytic converters, chemical industry catalyst |

| Palladium | Catalytic converters |

From electronics to healthcare and environmental conservation, gold, silver, platinum, and palladium contribute significantly to advancements in various sectors. Their remarkable properties make them crucial commodities that shape the modern world.

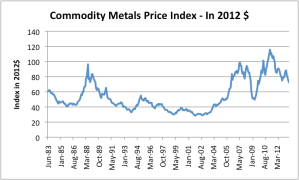

Factors Influencing Metal Prices

To comprehend how metal prices fluctuate, we must consider both supply and demand dynamics as well as external factors that can influence market conditions.

Exploration and mining processes significantly impact the supply of precious metals. The discovery of new deposits or advancements in extraction techniques can result in increased supply, subsequently affecting prices.

On the other hand, demand for these metals is influenced by factors such as economic growth, technological advancements, and shifts in consumer preferences.

Geopolitical events can have a profound impact on metal prices. Political instability within a significant mining region can disrupt supply chains and create price volatility. Trade wars and tariffs imposed on certain countries can also affect metal prices, as they influence international trade dynamics and market sentiment.

By understanding these factors, investors, miners, manufacturers, and consumers can make better-informed decisions regarding metal-related investments or purchases.

Gold: The Timeless Investment Choice

Gold, with its enduring value, is a safe haven investment that has stood the test of time. Its historical significance spans thousands of years, making it a timeless choice for investors. Gold’s unique properties, such as resistance to corrosion and malleability, make it an attractive option for preserving and growing wealth.

Central bank policies, interest rates, inflation, currency fluctuations, and economic uncertainties all impact gold prices. Changes in these factors can influence investor sentiment towards gold as a store of value. By understanding these dynamics and staying informed on market conditions, investors can navigate the gold market effectively.

Incorporating gold into an investment portfolio provides diversification and stability during turbulent times. With the potential for substantial returns and long-term growth opportunities, gold remains a valuable asset for investors seeking financial security.

Overall, gold continues to be a timeless investment choice due to its enduring value and ability to withstand economic uncertainties. By considering the factors impacting gold prices and incorporating it into an investment strategy, individuals can preserve and grow their wealth while diversifying their holdings.

Silver: The Versatile Metal with Industrial Potential

Silver, often overshadowed by gold, possesses unique characteristics that make it valuable in various industries. It is highly conductive and reflective, making it essential in electronics and photography. Its historical use as currency adds to its worth as a store of value.

Technological advancements and its relationship with gold prices influence the market value of silver. Overall, silver’s versatility and industrial applications make it a valuable asset to consider.

Conclusion: The Enduring Value of Precious Metals

[lyte id=’c3OyzXmeZ7c’]