Investing in the stock market can be a challenging but rewarding endeavor. As an investor, it’s crucial to identify emerging trends and industries with significant growth potential. One such industry that has been gaining immense traction is electric vehicles (EVs).

With a global shift towards sustainable transportation solutions, the demand for EV battery stocks has skyrocketed. In this article, we will explore the world of EV battery stocks, understanding their types and technologies, analyzing key players in the market, discussing strategies for investment, and highlighting potential risks and challenges.

So let’s dive in!

The Rise of Electric Vehicles and the Growing Demand for EV Battery Stocks

In the last decade, electric vehicles (EVs) have experienced a remarkable surge in adoption worldwide. Governments are prioritizing sustainability and reducing carbon emissions, leading to incentives, tax breaks, and infrastructure development for EVs.

This shift has not only revolutionized the automotive industry but also created lucrative opportunities for investors.

Batteries play a crucial role in this transformation. Unlike traditional internal combustion engines, EVs rely on efficient and reliable battery technology. As a result, batteries have become an integral part of the success of the EV market.

With the rising demand for electric vehicles comes a significant opportunity for investors to capitalize on this trend by investing in EV battery stocks. These companies are at the forefront of developing cutting-edge battery technologies that power these vehicles.

By investing early in this sector, investors can potentially reap substantial rewards as the EV market continues to grow.

The increasing adoption of electric vehicles extends beyond individual consumers to commercial fleets and public transportation. Major automakers are shifting their focus towards electric vehicle production, with plans to phase out internal combustion engine models entirely.

This transition is driven by advancements in battery technology and stricter emission regulations implemented by governments worldwide.

Investing in EV battery stocks offers exposure to an industry poised for significant growth as more countries commit to phasing out gasoline-powered cars. The demand for cleaner transportation options creates a promising future for EV battery stocks.

Understanding the Basics of EV Batteries: Types and Technologies

Lithium-ion (Li-ion) batteries dominate the electric vehicle (EV) market. They offer high energy density, longer lifespan, and faster charging. Advantages include lightweight construction, energy efficiency, and low self-discharge rates. Major players like Panasonic and LG Chem lead in Li-ion battery production.

Emerging technologies to watch out for are solid-state batteries with higher energy density and improved safety features, and lithium-sulfur batteries with potential for lower costs. Despite challenges, these advancements could shape the future of EVs. Stay informed to make informed decisions in this evolving industry.

Key Factors Influencing the Performance of EV Battery Stocks

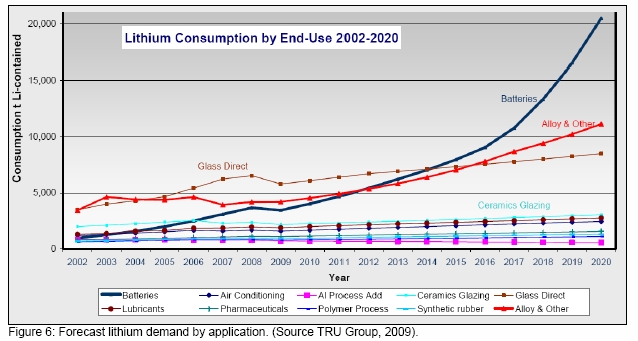

Government policies, technological advancements, and supply chain dynamics are crucial factors impacting the performance of EV battery stocks. Government initiatives promoting clean transportation solutions can influence market demand for electric vehicles (EVs) and subsequently impact battery stock performance.

Technological advancements in battery efficiency and charging capabilities play a significant role in determining which companies are well-positioned for growth. Additionally, disruptions or shortages in the supply chain for raw materials such as lithium, cobalt, and nickel can affect production capacity and impact stock performance.

Understanding these key factors is essential for investors looking to capitalize on the growing EV market.

Top Players in the EV Battery Market: A Comprehensive Analysis

The EV battery market is rapidly expanding, driven by the global demand for electric vehicles. Two key players in this industry are Tesla Inc. and Panasonic Corporation.

Led by Elon Musk, Tesla has revolutionized the electric vehicle industry with its high-performance cars and focus on long-range capabilities. The company not only manufactures its vehicles but also produces batteries through its Gigafactories.

Their innovative battery technology, including the “4680” cells, aims to enhance energy density and reduce costs significantly.

Panasonic, on the other hand, collaborates with Tesla to advance lithium-ion battery technology. With extensive experience in manufacturing batteries for various industries, including automotive applications, Panasonic holds a dominant position in the market. Their expertise gives them significant influence over EV battery stocks.

Emerging Players with Promising Potential in the EV Battery Market

LG Chem Ltd. and CATL (Contemporary Amperex Technology Co., Limited) are two emerging players in the EV battery market with promising potential.

LG Chem Ltd. is a global leader in lithium-ion battery production, supplying batteries to various industries, including electric vehicles. Their established presence and partnerships with major automakers make them an attractive investment opportunity.

Additionally, LG Chem Ltd. is actively investing in R&D to enhance battery performance and explore emerging technologies like solid-state batteries, positioning themselves for long-term growth.

CATL, China’s largest producer of lithium-ion batteries, holds a strong market position and has rapidly expanded its production capacity globally. Recognizing the increasing global demand for EVs, CATL has been strategically expanding its production capacity worldwide to cater to growing markets and potentially boost their stock performance.

These companies’ strong market positions, investments in R&D, and strategic expansions make them key players in the EV battery market. As the demand for EVs continues to rise, LG Chem Ltd. and CATL are well-positioned to shape the future of electric mobility.

Strategies for Investing in EV Battery Stocks

Investing in EV battery stocks requires careful consideration and planning. Two common strategies include a long-term investment approach and short-term trading. Long-term investors focus on strong fundamentals, sustainable business models, and promising growth prospects.

They analyze financial performance, competitive positioning, and technological advancements. Government policies can also influence stock performance. Major players like LG Chem Ltd., a leading manufacturer of lithium-ion batteries, are worth considering. Overall, comprehensive analysis is crucial for successful investment in this promising sector.

Risks and Challenges in Investing in EV Battery Stocks

Investing in EV battery stocks comes with risks and challenges. The volatile nature of the electric vehicle market, competition from emerging battery technologies, and geopolitical factors affecting supply chains are some key considerations.

The EV market is still young and subject to fluctuations in consumer demand, regulatory changes, and shifts in technology. This volatility can significantly impact the performance of EV battery stocks.

Emerging battery technologies like solid-state batteries or hydrogen fuel cells pose potential competition to lithium-ion batteries, which currently dominate the market. Investors need to be aware of these disruptive technologies and their potential impact on EV battery stocks.

Geopolitical factors such as political instability or trade disputes can disrupt the supply chain dynamics of EV batteries. This disruption may affect the availability of raw materials required for battery production, impacting stock performance.

To navigate these risks, investors must stay informed about industry trends, technological advancements, and geopolitical events. Being prepared for potential disruptions will help mitigate risks and make informed investment decisions in this dynamic industry.

Market Outlook and Future Trends for EV Battery Stocks

The future of EV battery stocks looks promising as the global electric vehicle market continues to grow. Factors such as environmental concerns, government support, and technological advancements are driving this expansion.

The development of solid-state batteries and improvements in energy density, charging speed, and battery lifespan are shaping the future trends of EV battery stocks. Companies like LG Chem Ltd., Panasonic Corporation, and CATL are investing in research and development to stay ahead in this competitive market.

Investing in these evolving technologies can offer long-term growth opportunities for investors.

[lyte id=’fddC65Bo7uw’]