In recent years, the automotive industry has witnessed a revolutionary shift towards electric vehicles (EVs). As concerns over climate change and environmental sustainability grow, more and more people are turning to EVs as a cleaner and greener alternative to traditional combustion engine vehicles.

This global trend has not only transformed the way we think about transportation but has also opened up exciting opportunities for investors.

Introduction to the Electric Vehicle (EV) Market

The electric vehicle market is expanding rapidly, encompassing cars, trucks, buses, and motorcycles powered by electricity. Unlike traditional vehicles that rely on fossil fuels, EVs use electric motors and rechargeable batteries as their primary energy source.

This technology not only reduces greenhouse gas emissions but also brings benefits like lower operating costs and improved energy efficiency.

EVs play a crucial role in reducing carbon dioxide and other pollutants, helping combat climate change and improve air quality. They offer advantages such as lower operating costs due to cheaper electricity compared to gasoline or diesel. Additionally, the simplified design of electric motors leads to reduced maintenance requirements.

Electric vehicles are also more energy-efficient than their combustion engine counterparts, providing longer driving ranges per charge. Advances in battery technology have contributed to increased driving ranges and faster charging times.

As governments prioritize sustainability, incentives and subsidies are being implemented worldwide to encourage the adoption of EVs.

Overall, the electric vehicle market holds significant promise for achieving emission reductions and transitioning towards a sustainable transportation sector. With ongoing technological advancements and improved infrastructure, EVs are gaining popularity among consumers and policymakers alike.

Expect further growth in this market as we work towards an electrified future.

Growing Demand and Popularity of EVs Worldwide

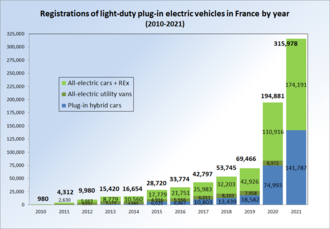

The demand for electric vehicles (EVs) is on the rise globally as awareness about their environmental impact grows. Countries like China, the United States, and European nations are offering incentives such as tax credits, subsidies, and charging infrastructure development to encourage consumers to choose EVs.

Technological advancements have also improved the performance and range capabilities of EVs, addressing concerns about practicality. Rising air pollution concerns and the lower operational costs of EVs are further driving their popularity among individuals and businesses alike.

This global shift towards sustainable transportation is expected to continue growing in the future.

Impact of Government Regulations on EV Adoption

Government regulations play a crucial role in accelerating the adoption of electric vehicles (EVs). Stricter emission standards and zero-emission vehicle mandates incentivize automakers to produce cleaner alternatives, reducing air pollution and mitigating climate change.

Additionally, significant investments in charging infrastructure address range anxiety concerns and make EVs more accessible. These measures, coupled with financial incentives, create an environment that fosters the transition towards a more sustainable transportation future.

Investing in Electric Vehicle Stocks: A Lucrative Opportunity for Investors

The electric vehicle (EV) market is booming, creating exciting investment opportunities. As more consumers embrace EVs, companies involved in their production and development are poised for success. Investing in promising EV stocks early on can lead to significant financial gains.

Factors driving this growth include advancements in battery technology, the expansion of global charging infrastructure, and increasing environmental concerns. By recognizing these trends and making informed investments, investors can capitalize on the lucrative potential of the electric vehicle market.

Key Players in the EV Market: Tesla, NIO, and Beyond

Tesla, a pioneer and leader in the electric vehicle (EV) industry, has revolutionized automotive manufacturing with its innovative and stylish electric vehicles. Under the visionary leadership of CEO Elon Musk, Tesla’s stock has experienced remarkable growth, reflecting its strong market position.

Emerging players like NIO and Rivian are also making their mark in the EV market. NIO, a Chinese manufacturer known for high-quality vehicles and innovative battery-swapping technology, has gained significant traction in China.

Rivian, an American startup backed by major investments from companies like Amazon and Ford, aims to disrupt the truck industry with its all-electric pickup trucks and SUVs. These key players will continue to shape the future of the EV market through their relentless pursuit of innovation and commitment to sustainable transportation solutions.

Evaluating Investment Opportunities: Factors to Consider Before Investing in EV Stocks

Before investing in electric vehicle (EV) stocks, thorough research and consideration of key factors are essential for success. Here are some important points to evaluate:

-

Financial Health: Analyze companies’ financial standing, revenue growth, profitability, and ability to meet increasing demand.

-

Diversification: Spread investments across different segments within the EV industry, such as automakers, battery manufacturers, and charging infrastructure providers.

-

Valuation Analysis: Assess company valuations using key financial ratios like price-to-earnings (P/E) and price-to-sales (P/S) ratios.

By taking these factors into account, investors can make informed decisions that align with their goals and navigate the dynamic landscape of the EV industry effectively.

The Future Outlook for EV Stocks: Potential Risks and Rewards

Investing in electric vehicle (EV) stocks offers exciting prospects but comes with potential risks. The EV market can be volatile, influenced by changing consumer preferences, technological advancements, and regulatory developments. Government policies and legal challenges can significantly impact stock performance.

As the industry grows, competition intensifies with new players entering the market. However, there are significant rewards too. Increasing global demand for EVs driven by environmental awareness and government incentives supports long-term growth prospects.

Governments worldwide are incentivizing consumers through tax credits, subsidies, grants, and investments in charging infrastructure, boosting EV sales.

Despite the risks involved, carefully considering market volatility, monitoring regulations and competition, while recognizing increasing consumer demand and government support is crucial before investing in EV stocks.

| Potential Risks Associated with Investing in EV Stocks | Potential Rewards and Long-Term Growth Prospects |

|---|---|

| Volatility and Market Fluctuations | Increasing Consumer Demand for EVs Globally |

| Legal and Regulatory Challenges | Government Support and Incentives Driving EV Adoption |

| Competitive Landscape and Entry of New Players |

Tips for Successful Investing in EV Stocks: Expert Advice to Maximize Returns

To maximize returns when investing in electric vehicle (EV) stocks, it is important to follow expert advice and employ effective strategies. Here are some tips to consider:

Investors should have a clear understanding of the inherent volatility in the EV market and set realistic expectations. Short-term fluctuations are common, but focusing on long-term growth prospects can lead to more successful outcomes.

In addition to investing in EV stocks, diversifying your investment portfolio by considering other renewable energy sectors such as solar and wind can be beneficial. This approach helps spread risk across multiple emerging industries and allows you to benefit from various sources of potential growth.

Staying updated with industry news, technological advancements, and regulatory changes is crucial for making informed investment decisions in the rapidly evolving electric vehicle sector. By keeping a close eye on these factors, investors can stay ahead of market trends and adjust their strategies accordingly.

Rather than engaging in short-term speculation, it is advisable to adopt a long-term perspective when investing in EV stocks. This approach enables investors to ride out market fluctuations and potentially benefit from substantial growth over time.

By following these tips for successful investing in EV stocks, individuals can position themselves for maximum returns while navigating the ever-changing landscape of the electric vehicle industry.

[lyte id=’oz5mwROO4so’]

.JPG/120px-Metropolitan_Railway_electric_stock_trailer_carriage%2C_1904_(02).JPG)