Bob is deeply fascinated by the world of investing. He spends hours researching strategies, reading financial news, and analyzing market trends. However, he struggles to generate consistent returns on his investments. Despite setbacks, Bob remains committed to improving his investment skills and finding success in the dynamic field of finance.

In the following sections, we will explore Bob’s journey as an investor, including the strategies he has explored and the lessons he has learned along the way.

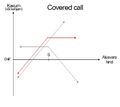

Explanation of Covered Call Recommendations

Covered call recommendations involve selling call options on stocks that an investor already owns. This strategy allows investors to generate additional income from their stock holdings by collecting premium payments from the buyers of these call options.

By selling covered call options, investors can potentially earn income even if their stocks remain stagnant or experience minor fluctuations in price. However, it’s important to note that there are risks involved, such as missing out on potential gains if the stock price rises significantly above the strike price.

Overall, covered call recommendations offer a way for investors to enhance their returns and reduce their average cost basis for owning stocks. It’s crucial for investors to carefully consider market conditions and choose appropriate strike prices when implementing this strategy.

| Pros of Covered Call Recommendations | Cons of Covered Call Recommendations |

|---|---|

| Additional income from stock holdings | Potential missed gains if stock price rises significantly |

| Enhanced overall returns | Obligation to sell shares at a lower price if the stock price surpasses the strike price |

| Reduction in average cost basis | Market conditions and strike price selection require careful consideration |

How covered call recommendations boosted Bob’s investment returns

Bob discovered the potential of covered call strategies to increase his investment returns. By selling call options, he not only earned income from premium payments but also cushioned against losses and optimized his portfolio’s performance.

With tailored recommendations and expert analysis, Bob incorporated these strategies into his investments, resulting in significant improvements. The additional income generated from selling call options allowed him to compound gains over time and gain valuable insights into market dynamics.

Bob’s investment journey was transformed, thanks to the power of covered call recommendations in maximizing returns while managing risk effectively.

What is a Covered Call?

A covered call is an investment strategy where an investor who owns a particular stock also sells call options on that same stock. By selling these call options, the investor collects premiums from buyers in exchange for the potential obligation to sell their shares at a predetermined price before a specific date.

This strategy provides additional income on top of any dividends received from the underlying stock and can act as downside protection or enhance overall returns. However, it’s important to carefully manage the risks associated with covered calls, such as missing out on potential gains if the stock price rises significantly above the strike price.

By selecting stocks and strike prices wisely, investors can maximize their chances of achieving favorable outcomes.

Developing an Effective Covered Call Strategy

A successful covered call strategy involves selecting the right stocks with stable or slightly bullish outlooks. Determining the optimal strike price and expiration date is crucial for balancing premium income and potential capital appreciation. Risk management through diversification helps avoid overexposure to any single stock or sector.

By considering these key components, investors can develop a well-rounded covered call strategy that aligns with their goals and risk tolerance. It’s important to be aware of the risks involved and ensure that the strategy suits individual investment objectives.

[lyte id=’8ypiul9X39Q’]