Investing in the electric vehicle (EV) sector has become an exciting opportunity that promises significant returns on investment. As the world transitions towards a more sustainable future, EV stocks have gained popularity among investors.

In this article, we will explore the rise of EVs, the promise they hold for investors, and strategies to navigate the evolving landscape of this industry. Additionally, we will provide insights into top picks for up-and-coming EV stocks and discuss how to mitigate risks and challenges in this fast-paced market.

The Rise of Electric Vehicles (EVs)

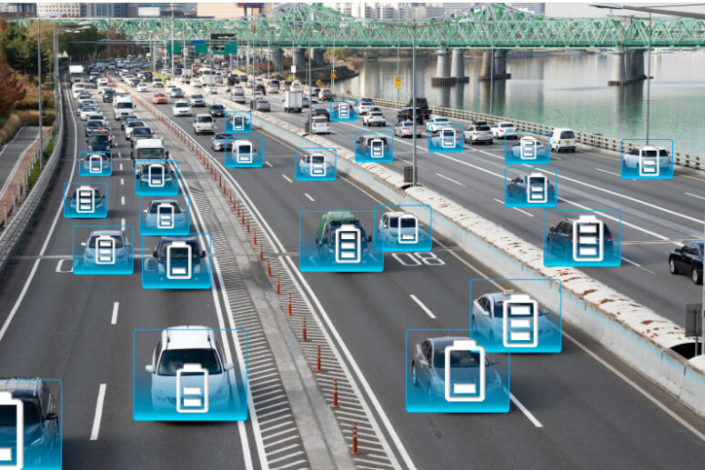

Electric vehicles (EVs) have revolutionized the automotive industry in recent years. With advancements in battery technology and growing environmental concerns, EVs have surged in popularity as efficient and eco-friendly alternatives to traditional combustion engines.

Manufacturers like Tesla and Nissan have pushed boundaries to create groundbreaking electric vehicles such as the Model S and affordable Leaf. These vehicles combine sleek design, high performance, and zero-emission capabilities, appealing to environmentally conscious consumers.

The environmental benefits of EVs are undeniable. By reducing reliance on fossil fuels, these vehicles significantly contribute less to air pollution and greenhouse gas emissions compared to conventional cars.

Governments worldwide are recognizing this potential and implementing initiatives such as tax incentives and infrastructure development plans to promote widespread adoption of EVs.

As we shift towards sustainable mobility, the rise of electric vehicles not only reduces our carbon footprint but also presents opportunities for economic growth and technological advancement. With ongoing advancements in battery technology and continued government support, the popularity of EVs is expected to continue soaring in the years ahead.

The Promise of EV Stocks

Investing in electric vehicle (EV) stocks offers a tempting opportunity for substantial financial gains. With the growing demand for EVs, companies in this sector are experiencing rapid expansion, leading to increased stock prices and potential profits for investors.

Several factors contribute to the growth of EV stocks in today’s market. The global push for sustainability and reduced carbon emissions is driving consumer demand for electric vehicles. Advancements in battery technology are making EVs more affordable and accessible.

Additionally, government policies promoting clean energy solutions provide an extra boost to the industry.

Investing in EV stocks comes with inherent risks, but with careful research and analysis, it can lead to significant returns. As long as there is increasing demand for sustainable transportation and ongoing advancements in battery technology, the promise of EV stocks remains strong.

Navigating the Evolving Landscape of EV Stocks

Investing in electric vehicles (EVs) presents exciting opportunities as the world shifts towards sustainability. Understanding the different types of EV stocks is crucial for making informed investment decisions.

Established automakers are transitioning their production lines to include EVs, leveraging their brand recognition, manufacturing capabilities, and distribution networks. Startups disrupt the industry with unique approaches to electric mobility, focusing on niches like autonomous driving or sustainable materials.

Companies involved in EV infrastructure and charging networks play a vital role in supporting widespread adoption.

By exploring these categories, investors can strategically position themselves within the evolving landscape of EV stocks and contribute to a sustainable future.

Table: Types of EV Stocks

| Category | Description |

|---|---|

| Established Automakers | Traditional automakers transitioning production lines to include electric vehicles. Benefit from brand recognition, manufacturing capabilities, and distribution networks. |

| Startups Disrupting the Industry | Innovative companies entering the market with unique approaches to electric mobility. Focus on specific niches like autonomous driving or sustainable materials. Offer investors a chance to be part of groundbreaking innovations. |

| Companies Involved in EV Infrastructure | Specialize in charging stations, battery technology, and network management to support the growth of electric mobility. Play a crucial role in developing robust charging infrastructure as EV adoption increases. |

Before investing in the EV sector, consider your risk tolerance and investment objectives. Consulting with a financial advisor or conducting thorough research is recommended for informed decision-making.

Riding the Wave: Strategies for Successful EV Investing

Investing in electric vehicles (EVs) requires a well-thought-out strategy to maximize returns. Here are key strategies to navigate the EV market successfully:

Diversify your portfolio by investing in established automakers, startups, and infrastructure-related companies within the EV sector. This mitigates risks associated with individual companies and market fluctuations while capitalizing on overall sector growth.

Adopt a patient, long-term perspective as the transition to EVs is a gradual trend shaping future transportation systems. By riding out short-term volatility, you can benefit from the anticipated long-term growth of this sector.

Stay updated on industry trends, news updates, and expert opinions to make well-informed decisions. Research technological advancements, policy changes, and market dynamics within the EV industry to identify potential opportunities and effectively navigate market fluctuations.

Successful EV investing requires diversification, a long-term approach, and staying informed about industry developments. By implementing these strategies, you can increase your chances of success in this dynamic sector.

Top Picks for Up-and-Coming EV Stocks

In this section, we will explore a carefully selected range of up-and-coming EV stocks that meet our high-growth potential criteria. By analyzing their financial stability, technological advancements, market demand, and scalability, investors can gain valuable insights into companies poised for success in the evolving EV industry.

Firstly, evaluating a company’s financial stability and track record is crucial. Look for companies with solid financials and a proven track record of profitability or strong growth potential.

Secondly, consider a company’s technological innovations and competitive edge. Assess their patents and unique selling propositions that give them an advantage in the market.

Lastly, examine the market demand for their products or services and evaluate their ability to scale operations to meet growing demands.

We will provide an in-depth analysis of select up-and-coming EV stocks that meet our criteria. By examining their financial performance, technological advancements, market positioning, and growth prospects, readers will gain valuable insights into potential high-growth investments.

Investing in the EV industry offers exciting opportunities for growth and sustainability. Stay informed about these top picks to position yourself for success in the anticipated surge of electric vehicles’ demand.

Mitigating Risks and Challenges in EV Investing

Investing in electric vehicles (EVs) carries risks, including volatility in stock prices. To mitigate this risk, investors should understand market dynamics through thorough research and diversify their portfolios. Additionally, staying updated on regulatory changes allows investors to adapt effectively.

Technological advancements can disrupt the EV market, so staying ahead of trends by researching and monitoring innovations is crucial for identifying investment opportunities. By employing these strategies, investors can navigate risks and capitalize on the growth potential of the EV industry.

Seizing the Opportunity

The rise of electric vehicles presents an exciting opportunity for investors to capitalize on a rapidly growing industry. With increasing consumer demand, government support, and advancements in technology, up-and-coming EV stocks hold significant growth prospects.

Investors who are interested in seizing this opportunity can venture into the electric vehicle sector, which offers a promising avenue for sustainable investments with long-term potential.

By following industry trends, conducting thorough research, and diversifying their portfolios, investors can position themselves to benefit from the anticipated growth of up-and-coming EV stocks.

It is crucial to understand that investing in electric vehicle stocks not only promises financial gains but also contributes to a sustainable future. By supporting companies at the forefront of clean energy solutions, investors play a vital role in driving positive change and shaping a greener tomorrow.

To navigate this evolving market successfully, investors should grasp the dynamics of the electric vehicle sector. This understanding will enable them to employ effective investment strategies and stay informed about industry trends.

Being aware of key factors such as technological advancements, government policies, and consumer preferences will help investors make well-informed decisions and maximize their returns.

Additionally, staying connected with reputable sources of information within the industry can provide valuable insights for making informed investment choices.

Monitoring news updates related to new product launches, partnerships between companies, regulatory developments, and shifts in consumer behavior will allow investors to stay ahead of market trends.

[lyte id=’0XaEUyY_RhA’]