Investing in today’s fast-paced and ever-evolving world can be a daunting task. With countless investment options available, it’s crucial to find the right opportunity that aligns with your goals and interests.

If you’re intrigued by the technology sector and want to explore its potential for growth, the Ultra Semiconductors ETF might just be the perfect fit for you.

In this article, we will delve into the world of Ultra Semiconductors ETFs, providing you with valuable insights and knowledge about this investment option. Whether you’re a seasoned investor or just starting on your investment journey, read on to discover why investing in Ultra Semiconductors ETFs could be a game-changer for your portfolio.

Investment Objective: Ultra Semiconductors ETFs

Exchange-Traded Funds (ETFs) have revolutionized investing by offering individuals a diversified portfolio of assets, similar to mutual funds. Unlike mutual funds, ETFs trade on stock exchanges like individual stocks.

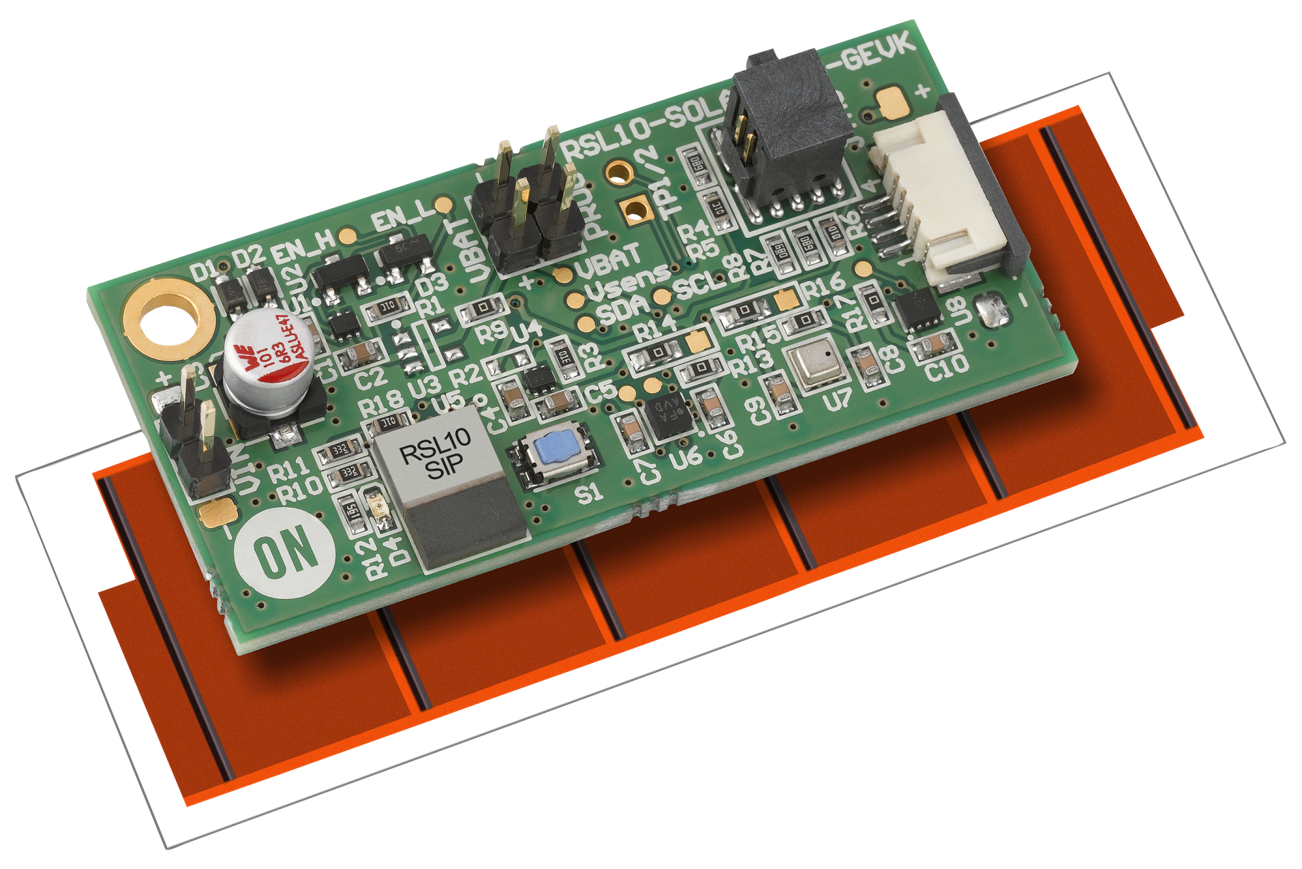

Ultra Semiconductors ETFs aim to provide investors with exposure to the semiconductor industry. By investing in these ETFs, individuals gain access to a basket of stocks from companies involved in manufacturing semiconductors – fundamental components powering various technological devices.

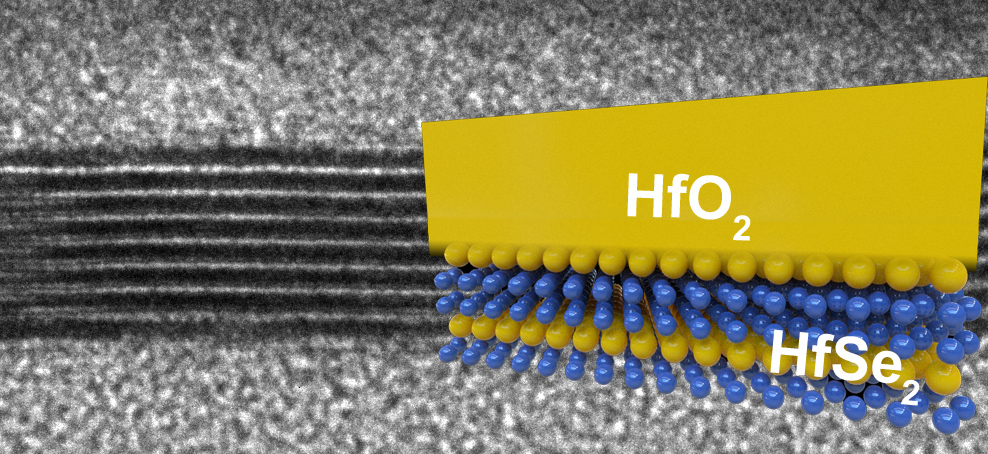

Semiconductors are vital in modern technology, used extensively in smartphones, computers, and automotive systems. They enable control and amplification of electronic signals within these systems.

As technology rapidly advances, semiconductors play an increasingly important role in driving innovation. Investing in Ultra Semiconductors ETFs allows individuals to capitalize on the growth potential of this booming industry.

With an Ultra Semiconductors ETF, investors can tap into the returns offered by a diverse range of semiconductor-related companies without needing to select individual stocks themselves. This type of investment provides convenience and risk mitigation through diversification.

Moreover, Ultra Semiconductors ETFs offer flexibility and liquidity as they trade on stock exchanges throughout the trading day at market prices. Investors can buy or sell shares whenever the markets are open.

It’s important for investors considering an Ultra Semiconductors ETF to conduct research and assess their risk tolerance before making investment decisions. Understanding the fund’s objectives and composition allows alignment with investment goals and risks associated with the semiconductor industry.

In summary, Ultra Semiconductors ETFs allow investors to participate in the growth of the semiconductor industry conveniently and with diversification. As technology continues advancing, investing in these ETFs can be a strategic move to capitalize on the increasing importance of semiconductors in our interconnected world.

About the Fund: Snapshot and Price Performance

The global semiconductor market is booming, driven by the increasing demand for electronic devices and advancements in emerging technologies. It is projected to reach $1 trillion by 2022, highlighting its immense growth potential.

Electronic devices like smartphones and wearables have become integral to our lives, fueling the semiconductor industry’s success. Additionally, AI and automation technologies rely heavily on semiconductors, further driving demand.

In Part II of this series, we will explore the performance of Ultra Semiconductors ETFs during Q3 2023. We will analyze their total return, daily return, specific holdings, and benchmark index.

Stay tuned for an in-depth look at Ultra Semiconductors ETFs’ performance and insights into this exciting sector.

(Word count: 109 words)

[lyte id=’QhvaqVeNgec’]