As investing becomes more accessible and popular among a new generation of investors, online brokerage platforms like Robinhood have emerged as game-changers in the industry. One particular trend that has gained significant momentum is Over-The-Counter (OTC) trading on Robinhood.

In this article, we will explore what OTC trading is, how it works, and why it has become increasingly popular on the Robinhood platform. Whether you’re a seasoned investor or just starting out, this guide will provide you with valuable insights into trading OTC stocks on Robinhood.

What is OTC Trading?

OTC trading refers to the direct buying and selling of stocks between two parties without a centralized exchange. Unlike traditional exchanges, OTC markets allow investors to trade securities that are not listed on major exchanges, including small companies, foreign stocks, and penny stocks.

Transactions in OTC markets are facilitated by market makers who act as intermediaries. Compared to stock exchange trading, OTC markets have less regulation and transparency, with prices determined through negotiations between buyers and sellers.

While OTC trading offers flexibility and liquidity, it also comes with risks due to reduced oversight and potentially wider bid-ask spreads.

In summary, OTC trading enables direct stock transactions outside of centralized exchanges. It provides access to non-listed securities but carries risks due to limited regulation and negotiation-based pricing in OTC markets.

Introducing Robinhood

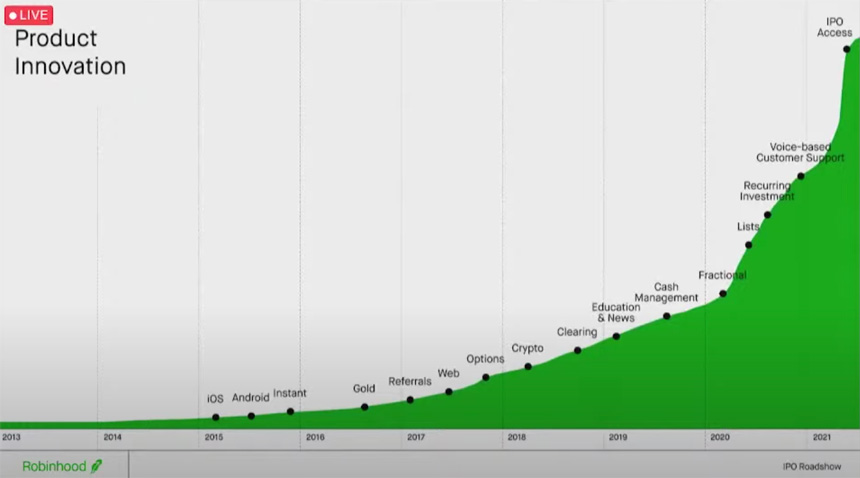

Robinhood is a commission-free online brokerage platform that has revolutionized investing. Launched in 2013, it aims to democratize the stock market by making it accessible to everyday investors. With its user-friendly interface and intuitive mobile app, Robinhood quickly gained popularity, especially among young investors.

By eliminating trading fees and offering fractional shares, Robinhood has lowered barriers and provided a simple and affordable way for people to start investing.

The Rise of OTC Trading on Robinhood

OTC trading has gained significant popularity on the Robinhood platform in recent years. This can be attributed to increased interest in speculative investments, access to emerging companies not listed on major exchanges, and the influence of social media-driven investment communities like Reddit’s WallStreetBets.

Robinhood’s accessibility and ease of use have allowed retail investors to quickly trade OTC stocks, fueling this trend. However, it is important for traders to be aware of the risks associated with OTC trading, such as volatility and limited liquidity.

Exploring the Pros and Cons of OTC Trading on Robinhood

OTC trading on Robinhood offers advantages and disadvantages for investors. One advantage is cost savings through commission-free trades. Investors can buy and sell OTC stocks without incurring additional costs. Another benefit is access to up-and-coming companies not listed on major exchanges, providing opportunities for early-stage investments.

However, there are risks associated with OTC trading. Compared to major exchanges, OTC stocks have less regulatory oversight, leading to increased volatility and potential market manipulation. Limited information and transparency about OTC stocks make it challenging for investors to conduct thorough research or obtain accurate financial data.

To navigate this unique market effectively, investors must weigh the benefits of cost savings and access to emerging companies against the risks of reduced oversight and limited information.

| Advantages | Disadvantages |

|---|---|

| Cost savings through commission-free trades | Lack of regulatory oversight compared to major exchanges |

| Access to up-and-coming companies | Limited information and transparency about OTC stocks |

How to Trade OTC Stocks on Robinhood

Trading OTC stocks on Robinhood is a great way for beginners to expand their investment portfolio. Here’s a step-by-step guide:

-

Account setup and funding: Download the Robinhood app, create an account, and deposit funds into your brokerage account.

-

Navigating the search function: Use Robinhood’s search function to find specific OTC stocks by company name or ticker symbol.

-

Placing orders: Choose between market orders (buy/sell at current price), limit orders (set a specific price), or stop orders (trigger action at a certain price). Specify the number of shares and review before confirming.

By following these steps, beginners can confidently trade OTC stocks on Robinhood and explore exciting investment opportunities. Remember to conduct thorough research and exercise caution when trading OTC stocks.

Tips for Successful OTC Trading on Robinhood

When engaging in over-the-counter (OTC) trading on Robinhood, it’s crucial to conduct thorough research and due diligence. Look into a company’s financials, management team, industry trends, and potential risks. Seek advice from financial professionals or reliable sources of information.

Understand that OTC trading carries inherent risks due to limited regulatory oversight and transparency. OTC stocks can be highly volatile, illiquid, and prone to manipulation. Assess your risk tolerance and investment goals before engaging in OTC trading.

Develop a well-defined trading strategy based on your goals, time horizon, and risk tolerance. Diversify your portfolio across different sectors within the OTC market to mitigate risk.

Regularly monitor your investments and stay informed about news and developments that may impact the companies you have invested in. Review and reassess your positions regularly to ensure they align with your strategy.

Practice patience and discipline by avoiding impulsive decisions based on short-term market fluctuations. Stick to your strategy and remember that successful OTC trading takes time.

By following these tips, you can navigate the world of OTC trading on Robinhood with greater confidence. Stay informed, adapt strategies as needed, and remain disciplined throughout your trading journey.

Stories of Success and Cautionary Tales

Trading OTC stocks on Robinhood presents a range of experiences, from remarkable success stories to cautionary tales. Some investors have achieved significant profits by identifying early opportunities and capitalizing on companies that later experienced substantial growth or breakthroughs.

These success stories serve as inspiration for diligent research and strategic decision-making.

However, it’s crucial to acknowledge the risks involved in OTC trading. Some investors have faced losses or fallen victim to scams, highlighting the importance of careful decision-making and thorough research. By learning from these cautionary tales, investors can navigate the OTC market with greater awareness and minimize potential pitfalls.

In summary, stories of success and cautionary tales surrounding OTC trading on Robinhood offer valuable insights into this dynamic market. They emphasize the need for informed decision-making and highlight both the rewards and risks associated with trading OTC stocks.

The Future of OTC Trading on Robinhood

The rising popularity of over-the-counter (OTC) trading on Robinhood indicates that this trend will continue to grow. As more investors seek opportunities beyond traditional exchanges, Robinhood is likely to expand its offerings and provide enhanced tools for OTC traders.

However, as Robinhood expands its OTC offerings, it may face regulatory challenges related to investor protection, market manipulation, and transparency. Striking a balance between access to OTC markets and proper oversight will be crucial for the platform’s success.

[lyte id=’hGayuBDXVMQ’]