Investing in small stocks can be an exciting and potentially lucrative endeavor. These lesser-known companies have the potential for significant growth, making them an attractive option for investors looking to diversify their portfolios and maximize returns.

In this article, we will explore the appeal of small stocks, understand their unique characteristics, analyze two top small stocks worth considering, discuss tips for investing wisely, address the associated risks, and highlight the importance of diversification.

So if you’re ready to learn more about the world of small stocks and how they can benefit your investment strategy, read on!

The Appeal of Small Stocks

Small stocks, or small-cap stocks, offer significant growth potential compared to large-cap stocks. These companies are often overlooked by investors but possess the agility to capitalize on emerging trends and niche markets.

Investing in small stocks provides several advantages, including greater room for expansion and the potential to discover undervalued gems. Individual investors can compete with institutional investors on an equal footing, free from strict mandates or size limitations.

However, thorough research is essential before investing in small stocks to assess financial health, management team, and industry outlook. Overall, small stocks present a compelling opportunity for growth and individual investor success.

Understanding Small Stocks

Small stocks, or small-cap stocks, refer to companies with a market capitalization between $300 million and $2 billion. These companies are often found in high-growth industries like technology, healthcare, and renewable energy. They have the ability to adapt quickly to market changes and capitalize on emerging trends.

When evaluating small stocks, consider factors such as market capitalization, revenue growth potential, industry trends, competitive landscape, management team expertise, and financial health. Look for companies operating in expanding markets or with innovative products/services that can capture a larger share of their target market.

Assess how the company stands out from competitors and whether it has a sustainable competitive advantage. Evaluate the management team’s track record and strategic vision, as well as key financial metrics like profitability and cash flow stability.

Investing in small stocks offers growth opportunities but also comes with risks. Conduct thorough research before making investment decisions. By considering these factors, investors can gain insight into the potential growth and risks associated with investing in small-cap companies.

Top Small Stocks to Consider Now: ABC Pharmaceuticals

ABC Pharmaceuticals is a standout small stock investment option in the pharmaceutical industry. With a focus on developing innovative drugs for rare diseases, the company has positioned itself as a leading player.

Despite its smaller size, ABC Pharmaceuticals has demonstrated consistent revenue growth and boasts a robust pipeline of potential blockbuster drugs. This unique niche, coupled with its competitive advantages over larger pharmaceutical companies, makes ABC Pharmaceuticals an attractive choice for investors seeking long-term growth potential.

Top Small Stocks to Consider Now: XYZ Technology Solutions

XYZ Technology Solutions stands out as a disruptive player in the tech industry, offering cloud-based software solutions designed specifically for businesses. With its innovative products and services, XYZ has swiftly gained market share, challenging even the most established players in the industry.

When analyzing XYZ’s recent financial performance, one can see a remarkable track record of strong revenue growth and an expanding market share. This solidifies their position as a promising investment option among small stocks.

Furthermore, the company’s aggressive expansion plans on both domestic and international fronts demonstrate their commitment to sustained success.

In addition to their ambitious growth strategy, XYZ Technology Solutions focuses on product diversification. This approach ensures that they remain at the forefront of an ever-evolving industry. By continuously adapting and introducing new solutions, XYZ stays ahead of the curve and maintains its competitive edge.

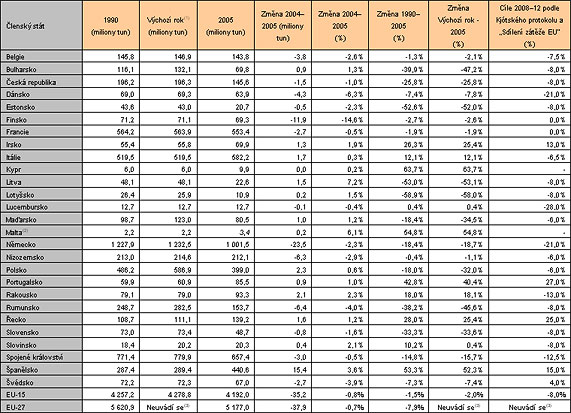

Table: Financial Highlights

| Metric | Value |

|---|---|

| Revenue Growth | Strong |

| Market Share | Increasing |

| Expansion Plans | Aggressive |

| Product Diversification | Emphasized |

With strong financial performance, increasing market share, ambitious expansion plans, and a dedication to product diversification, XYZ Technology Solutions presents itself as an exciting opportunity for investors seeking small stocks with potential for significant returns.

Investing in disruptive technology companies like XYZ allows individuals to take advantage of innovative advancements shaping various industries. As XYZ continues to challenge traditional players in the tech sector, their unique offerings place them in a favorable position for future growth.

By considering XYZ Technology Solutions as a small stock investment option now, investors have the opportunity to potentially capitalize on its promising trajectory within the technology industry.

Tips for Investing in Small Stocks Wisely

When it comes to investing in small stocks, there are several key tips that can help you make informed decisions and minimize risks. One crucial aspect is utilizing fundamental analysis techniques for effective evaluation.

This involves thoroughly analyzing financial statements, assessing important metrics such as the price-to-earnings ratio and return on equity, and evaluating the company’s competitive position within its respective industry.

By conducting thorough fundamental analysis, you can gain valuable insights into the financial health and potential growth of a small stock. It allows you to understand the company’s profitability, debt levels, and overall stability. This information is essential in determining whether a small stock is a wise investment choice or not.

Another valuable tip is seeking insights from investment newsletters or expert opinions. Staying informed through reliable sources can provide additional perspectives and help you identify potential small stock investments.

However, it is crucial to consider multiple sources of information and conduct independent research before making any investment decisions.

Investment newsletters often provide analysis, recommendations, and market trends that can be useful in identifying promising small stocks. Additionally, seeking advice from experts who have a deep understanding of the market can offer valuable insights into emerging opportunities.

However, it’s important to remember that relying solely on investment newsletters or expert opinions may not always be sufficient. It’s advisable to use them as part of your overall research process while also considering other factors such as market conditions, company news, and your own risk tolerance.

Risks Associated with Investing in Small Stocks

Investing in small stocks can offer significant opportunities for growth, but it is important to be aware of the potential risks involved. One major concern is the volatility and liquidity associated with these stocks.

Due to their lower trading volumes and susceptibility to market fluctuations, small stocks tend to be more volatile than larger companies. This means that investors should be prepared for short-term price swings while keeping their focus on long-term growth prospects.

Another risk to consider is the potential impact of economic downturns on smaller companies. During times of economic hardship or recessions, smaller companies may face greater challenges compared to their larger counterparts.

It is crucial for investors to carefully assess a company’s financial stability and its ability to weather economic storms before deciding to invest in small stocks.

In order to mitigate these risks, thorough research and analysis are necessary. Investors should evaluate a company’s financial statements, management team, competitive position, and growth potential. Additionally, diversification can play a key role in managing risk when investing in small stocks.

By spreading investments across different sectors or industries, investors can minimize the impact of any one company’s performance on their overall portfolio.

It is also important for investors to stay informed about market trends and changes that could affect small stocks. Keeping up with news and developments in the industry can provide valuable insights into potential risks or opportunities.

Diversifying Your Portfolio with Small Stock Investments

Diversification is crucial for a successful investment strategy. Including small stocks in your portfolio helps mitigate risk and potentially boost returns. Small stocks have different performance patterns than large-cap stocks, offering enhanced diversification benefits.

Small stocks add value to a diversified portfolio by providing potential for high growth and acting as a source of alpha. Their ability to outperform during specific market conditions or industry trends can significantly enhance overall portfolio performance.

Investing in small stocks offers several advantages. They have room for expansion and innovation, operating in niche markets with unique products or services. By including them in your portfolio, you expose yourself to the potential upside of investing in promising ventures.

Moreover, including small stocks reduces concentration risk and allows you to diversify across sectors and industries. These stocks often go unnoticed by institutional investors, providing an opportunity to identify undervalued gems early on.

Small stocks can also offer uncorrelated performance compared to larger counterparts during certain market conditions or economic cycles. This resilience stabilizes your portfolio and cushions against potential downturns.

In summary, diversifying with small stock investments optimizes returns while minimizing risk exposure. Their potential for high growth, alpha generation, reduced concentration risk, and uncorrelated performance make them attractive additions to any well-diversified investment strategy.

Seizing the Opportunity with Small Stocks

Investing in small stocks offers individual investors a chance to capitalize on significant growth potential and discover undervalued gems. These companies operate in high-growth industries and possess unique competitive advantages, making them attractive investments.

Before diving in, conducting thorough research, analyzing financials, evaluating industry trends, and assessing management teams is crucial for informed decision-making. While small stocks carry inherent risks, they present exciting opportunities for long-term growth.

By diversifying your portfolio and carefully selecting promising companies, you can seize the potential offered by these lesser-known gems and achieve substantial returns over time.

Start exploring now and unlock the hidden potential of small stocks!

[lyte id=’5hhyZtBRwNQ’]