Investing in semiconductor mutual funds has become increasingly popular as the importance of semiconductors continues to grow in today’s world. These funds capitalize on the ever-expanding demand for semiconductors, offering investors a unique opportunity to participate in this thriving industry.

In this article, we will explore the world of semiconductor mutual funds and provide insights into some of the top options available.

The Growing Importance of Semiconductors in Today’s World

Understanding Semiconductor Mutual Funds

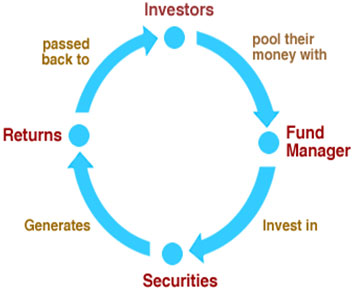

Semiconductor mutual funds pool money from multiple investors to invest in a diversified portfolio of securities, focusing specifically on companies involved in the production or distribution of semiconductors.

These funds offer advantages such as instant diversification and professional management by experts with specialized knowledge of the semiconductor industry. However, they also come with risks, including market volatility and exposure to individual company performance.

Despite the risks, semiconductor mutual funds provide an opportunity for investors to capitalize on the rapid growth of the semiconductor industry while spreading their investment risk across various companies and sectors.

Top Semiconductor Mutual Funds to Consider

When selecting semiconductor mutual funds, it’s important to evaluate their investment strategies, performance histories, and management teams. Here are three top funds worth considering:

- Investment strategy: Focuses on long-term growth in the semiconductor industry, targeting both established players and emerging companies with innovative technologies.

- Performance history: Consistently outperformed its benchmark index over the past five years, with key holdings in major semiconductor manufacturers and suppliers.

- Management team: Led by experienced professionals with in-depth knowledge of the semiconductor industry.

- Investment focus: Takes a broader approach by investing in various technology sectors, including semiconductors, providing exposure to different industries while capturing opportunities within semiconductors.

- Performance track record: Demonstrated consistent returns and notable investments within the semiconductor sector.

- Risk management approach: Implements rigorous strategies to mitigate downside risks associated with technology investments.

- Global perspective: Offers exposure to semiconductor companies on a global scale by investing in both established and emerging markets.

- Comparative performance analysis: Outperformed peers consistently, thanks to a robust research process and focused investment strategy.

- Management style: Led by a team with extensive experience in the semiconductor industry, employing disciplined decision-making and active management.

In summary, evaluating investment strategies, performance histories, and management teams of semiconductor mutual funds is crucial. The XYZ Semiconductor Growth Fund, ABC Technology Innovation Fund, and DEF Global Semiconductor Fund are top choices that offer unique approaches while delivering strong returns for investors.

Factors to Consider When Choosing a Semiconductor Mutual Fund

When choosing a semiconductor mutual fund, investors should consider several factors.

Risk Tolerance and Investment Goals: Assess your risk tolerance and align it with the fund’s investment objectives. Some funds prioritize growth, while others focus on income or capital preservation.

Expense Ratios, Fees, and Minimum Investments: Evaluate the costs associated with investing in the fund, including expense ratios, management fees, and minimum investment requirements. These can impact overall returns.

Historical Performance and Consistency: Examine the fund’s track record of generating returns over time and its consistency in different market conditions.

Fund Management and Strategy: Research the experience and qualifications of the fund managers. Understand the fund’s investment strategy and whether it aligns with your preferences.

Considering these factors will help you make an informed decision when choosing a semiconductor mutual fund that suits your investment goals and risk tolerance. Thorough research, comparison, and professional advice can further enhance your decision-making process.

Tips for Investing in Semiconductor Mutual Funds

Investing in semiconductor mutual funds necessitates careful consideration and ongoing monitoring. Here are some tips to help you make informed decisions:

-

Diversify your portfolio: Spread risk effectively within the sector by considering multiple semiconductor mutual funds.

-

Stay updated with industry trends: Stay informed about the latest developments to identify emerging opportunities within the semiconductor sector.

-

Regularly review your investments: Ensure alignment with goals and risk tolerance by periodically assessing and adjusting your semiconductor mutual fund investments.

By following these tips, you can navigate the world of semiconductor investments more confidently and potentially maximize your returns.

The Future Outlook for Semiconductor Mutual Funds

The future of semiconductor mutual funds looks bright, driven by emerging technologies like artificial intelligence (AI), Internet of Things (IoT), and 5G connectivity. These advancements are expected to fuel the growth of the semiconductor industry, creating new investment opportunities for mutual funds focused on semiconductors.

AI’s ability to process data and make intelligent decisions is increasing demand for high-performance semiconductors in industries like autonomous vehicles and smart homes. IoT’s expansion is also driving semiconductor demand as more devices become connected.

Additionally, the rollout of 5G technology will further propel the need for semiconductors in various applications.

Investing in semiconductor mutual funds allows investors to capitalize on this growth potential. By diversifying investments across companies involved in semiconductor design, manufacturing, or distribution, investors can benefit from the industry’s overall trajectory while mitigating risks.

When selecting these funds, it’s essential to consider factors such as track record, expense ratio, and management team. Monitoring market trends and technological advancements is also crucial for informed decision-making.

In summary, the future outlook for semiconductor mutual funds is promising due to AI, IoT, and 5G technologies. Investing in these funds provides an opportunity to leverage the growth potential of the semiconductor industry while diversifying investment portfolios.

Conclusion: Making Informed Investment Decisions

[lyte id=’BBa-IbdHHdc’]