Investing in the futures market has always been an enticing prospect for individuals looking to diversify their portfolios and potentially earn significant returns. However, diving into this complex and dynamic market can be daunting, especially without the right guidance and resources. This is where futures prop firms come into play.

Exploring the World of Futures Trading

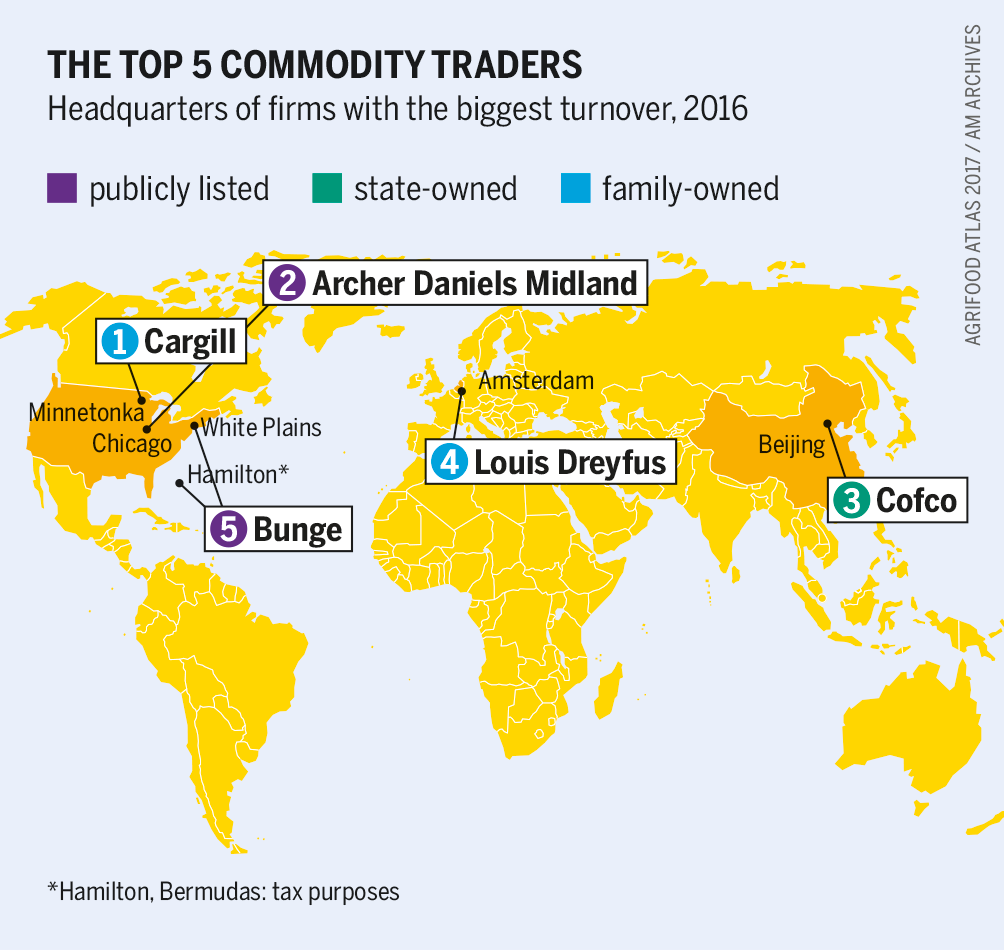

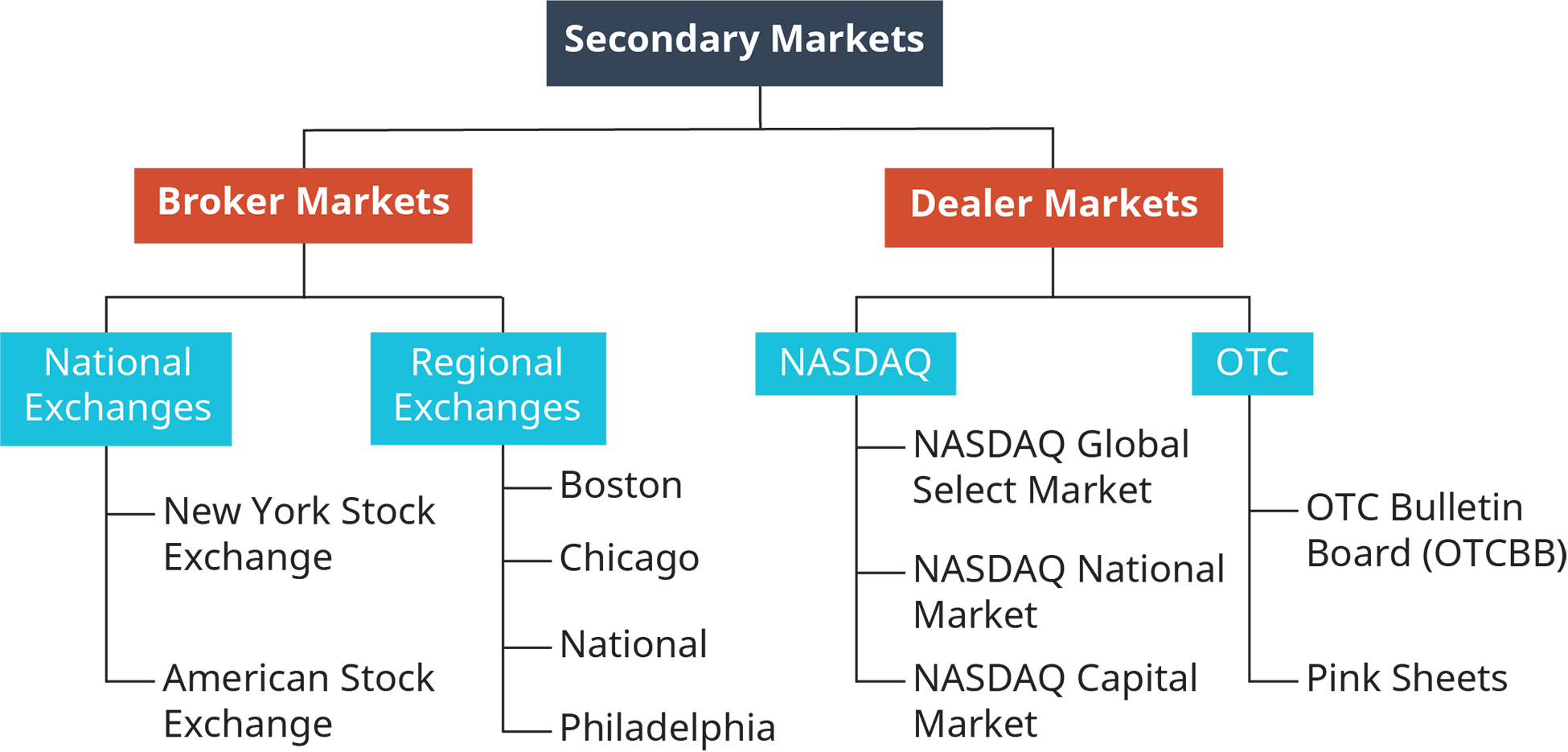

Futures trading allows traders to speculate on the future price movements of assets like commodities, currencies, and stock indexes. By entering into contracts, traders can buy or sell specific assets at predetermined prices and dates. This versatility enables them to diversify their portfolios and potentially maximize returns.

For example, a trader could enter into a futures contract for crude oil if they believe its price will rise due to geopolitical tensions. They can profit if their prediction is correct, but also face potential losses if the price decreases. Nevertheless, risk management strategies can help mitigate downside risks in futures trading.

Overall, futures trading offers an exciting opportunity for traders to navigate diverse markets and achieve their financial goals.

The Growing Popularity of Prop Firms

In recent years, futures prop firms have witnessed a remarkable surge in popularity. These firms offer aspiring traders access to capital, leverage, and valuable resources that are typically hard to obtain independently. By joining a prop firm, individuals can enhance their chances of success in the highly competitive world of futures trading.

Prop firms, also known as proprietary trading firms, provide traders with significant advantages. Firstly, they offer access to substantial funds for trading purposes, allowing traders to seize larger market opportunities and potentially earn higher returns.

Additionally, prop firms often provide leverage, enabling traders to control larger positions with a smaller initial investment.

Another key benefit is the access to valuable resources and support systems. Traders at prop firms gain access to advanced trading platforms, real-time market data, research reports, and educational materials.

Moreover, these firms foster a collaborative environment where traders can learn from experienced professionals and develop their skills faster.

The growing popularity of futures prop firms can be attributed to the immense benefits they offer aspiring traders. With access to capital, leverage opportunities, and invaluable resources, joining a reputable prop firm provides individuals with a competitive edge in the challenging world of futures trading.

Definition and Purpose

Futures prop firms act as intermediaries between traders and the financial markets, providing tools, capital, and support for active futures trading. These firms empower traders by minimizing risks and maximizing profit potential. They offer comprehensive services such as advanced trading platforms, market analysis tools, and expert guidance.

Additionally, futures prop firms provide access to substantial capital, implement risk management strategies, and offer ongoing education opportunities to enhance traders’ skills. Their purpose is to equip traders with the necessary resources to navigate the complex world of futures trading successfully.

How Prop Firms Operate in the Futures Market

Proprietary trading firms, or prop firms, operate uniquely within the futures market. They recruit skilled traders who use their own funds or pooled capital from multiple traders. These traders receive training, mentoring, and access to advanced technology platforms for efficient execution and analysis of trades.

Joining a prop firm offers aspiring traders several advantages. Firstly, they gain access to capital that may be otherwise difficult to secure independently. This allows them to take larger positions and potentially earn higher profits.

Additionally, prop firms provide ongoing training and mentorship from experienced professionals, helping traders enhance their skills and stay updated on market trends.

Collaboration is another key aspect of prop firms. Traders work together as a team rather than competing against each other. This fosters knowledge sharing and collaboration, resulting in better decision-making and improved trading performance.

In summary, prop firms offer aspiring traders the benefits of capital access, comprehensive training programs, advanced technology platforms, and a collaborative environment for success in the futures market.

Access to Capital and Leverage

Proprietary trading firms provide traders with access to substantial capital and leverage, offering several significant advantages. Traders can execute larger trades and take advantage of market opportunities that may not be feasible individually. This access to capital enables traders to amplify potential profits while effectively managing risks.

By accessing financial resources from prop firms, traders can enter into positions with more significant contract sizes, participate in markets with high entry barriers, capitalize on short-term opportunities, and maintain financial stability through strict risk controls.

Overall, prop firms empower traders to expand their trading capabilities and enhance their potential for profit.

Learning Opportunities and Mentorship Programs

Proprietary trading firms offer comprehensive training programs and mentorship opportunities for new traders. These initiatives equip individuals with the knowledge, skills, and strategies required to navigate the complexities of futures trading successfully.

By learning from experienced professionals, traders can accelerate their learning curve and increase their chances of success.

These programs cover a wide range of topics, including technical analysis, risk management, trade execution strategies, and market psychology. Traders gain practical experience and access to advanced trading platforms, enhancing their capabilities. Simulated trading environments allow for risk-free practice, building confidence for live trading.

Overall, the availability of such learning opportunities within proprietary trading firms provides aspiring traders with a competitive advantage. Immersing themselves in these educational initiatives enables individuals to acquire the necessary skills needed for successful futures trading.

Technology and Infrastructure Support

Futures prop firms prioritize technology and infrastructure to give traders a competitive edge. They invest in state-of-the-art platforms for analyzing market data, executing trades swiftly, and monitoring positions in real-time. These advanced tools enhance traders’ capabilities and provide access to cutting-edge resources.

Prop firms also ensure speedy trade execution, real-time monitoring, and reliable infrastructure for uninterrupted operations. Overall, technology and infrastructure support are crucial for prop firms in empowering traders with the necessary tools to succeed in futures trading.

XYZ Trading: Empowering Traders for Success

XYZ Trading is committed to empowering traders through expertise, innovative technology, and a supportive community. We offer a range of educational resources, including webinars, seminars, and personalized coaching sessions.

Our approach focuses on developing individualized trading strategies tailored to each trader’s strengths and goals while emphasizing risk management and continuous growth. Many successful traders have emerged from XYZ Trading, consistently outperforming market benchmarks by applying our disciplined methodologies.

| Notable Achievements | Success Stories |

|---|---|

| Consistently outperforming | Individuals who have consistently outperformed market benchmarks |

| market benchmarks | by applying disciplined trading methodologies |

| taught within the firm |

[lyte id=’dAe4RWZ_if8′]