In the world of investing, data is king. The ability to gather, analyze, and interpret vast amounts of information can mean the difference between success and failure in the financial markets. With the ever-increasing complexity of these markets, investors need powerful tools to help them navigate through the chaos and make informed decisions.

One such tool that has revolutionized the way investors approach data analysis is Splunk. This game-changing data analytics platform has quickly gained popularity for its ability to turn raw data into valuable insights.

In this article, we will explore how tools like Splunk are transforming the world of investing and how they can enhance your investment strategies.

Unleashing the Potential: How Tools like Splunk Revolutionize Investing

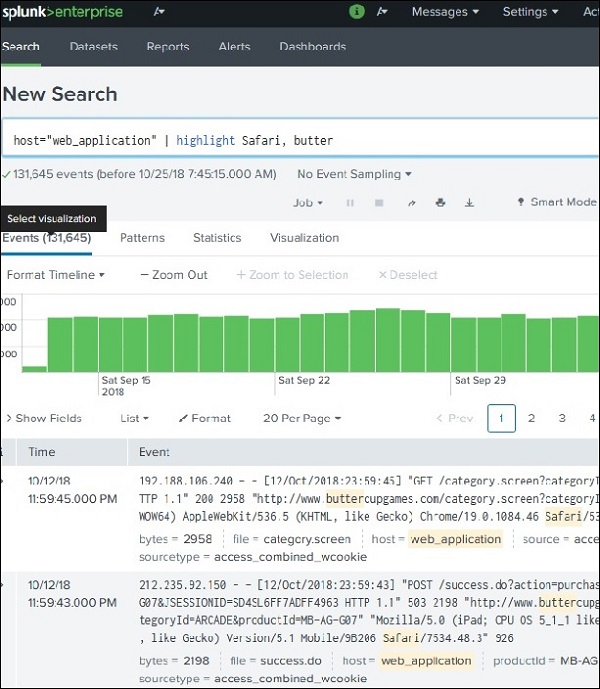

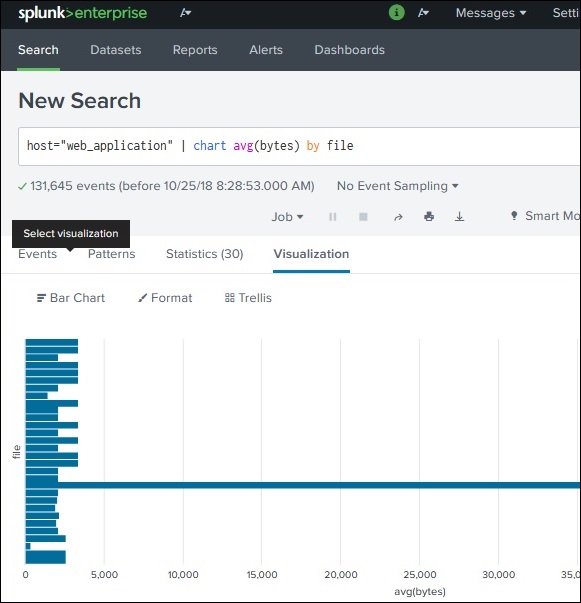

Investing in today’s complex financial markets requires timely and accurate information. That’s where tools like Splunk come in. Splunk is a powerful data analytics platform that allows investors to collect, search, monitor, analyze, and visualize large volumes of machine-generated data from various sources.

With its efficient search functionality, real-time monitoring capabilities, advanced reporting features, and integration with machine learning models, Splunk revolutionizes investing by providing investors with valuable insights and a competitive edge in decision-making.

It enables them to identify trends, assess risks, seize opportunities, and make informed investment strategies for success in a dynamic market environment.

Navigating the Financial Maze: How Splunk Simplifies Investing

Splunk simplifies investing by providing real-time monitoring and alerts, as well as advanced search and reporting capabilities. With Splunk, investors can track the performance of their investments, monitor market conditions, and receive automated alerts when specific events occur.

The advanced search functionality allows users to analyze historical stock prices alongside news articles related to a particular company, gaining valuable insights into how external factors impact stock performance. Additionally, Splunk offers comprehensive reporting tools that highlight key performance indicators, trends, and anomalies.

By leveraging these features, investors can make data-driven investment strategies with ease.

The Magic of Machine Learning: Enhancing Investment Decisions with Splunk

Splunk, a powerful data analysis platform, is revolutionizing investment decisions through machine learning. By integrating predictive analytics into its framework, investors can leverage historical data to accurately forecast market behavior and make smarter choices.

Splunk’s real-time monitoring capabilities enable proactive risk assessment, empowering investors to identify potential risks before they escalate. Additionally, its anomaly detection techniques help detect fraudulent activities within financial systems.

With Splunk, investors can simplify investing by gaining valuable insights and maximizing returns in today’s dynamic financial landscape.

From Chaos to Clarity: How Splunk Streamlines Investment Operations

In today’s fast-paced investment landscape, Splunk offers a powerful solution to streamline operations and bring clarity amidst chaos. By automating data collection and integration processes, Splunk simplifies the gathering of relevant financial data from multiple sources.

With seamless integration with existing systems, it eliminates manual data transfer and reduces errors. Moreover, Splunk facilitates cross-team collaboration by providing a centralized platform for real-time data access and analysis. This leads to faster decision-making and better communication among team members.

With its robust reporting capabilities, Splunk enhances overall efficiency in investment operations.

In summary, Splunk transforms the investment process by simplifying data collection, improving collaboration, and enhancing decision-making efficiencies.

Success Stories: Real-World Examples of Splunk in the Financial Industry

Splunk has revolutionized operations in the financial industry, providing valuable insights and boosting performance. Let’s explore two examples:

Hedge Fund X faced challenges in analyzing vast amounts of data. By implementing Splunk, they streamlined their processes, staying ahead of market trends and identifying new investment opportunities. Splunk helped optimize their strategies and boost returns.

Bank Y utilized Splunk’s AI-powered anomaly detection to detect and prevent fraudulent transactions. By leveraging historical data and machine learning models, they significantly mitigated the risk of financial losses.

These success stories demonstrate how Splunk empowers financial institutions to make informed decisions, enhance fraud detection, and achieve success in a competitive industry.

The Future is Bright: What Lies Ahead for Tools like Splunk in Investing

Advancements in data analytics and artificial intelligence are propelling the potential applications of tools like Splunk in investing. With the ability to analyze vast amounts of data in real-time and utilize machine learning models, these tools will shape the future of investment strategies.

Investors can anticipate enhancements in predictive analytics, risk assessment, fraud detection, and seamless integration with existing systems. By leveraging Splunk’s capabilities, investors will be better equipped to navigate financial markets and make well-informed decisions based on data-driven insights.

The future holds great promise for tools like Splunk as they revolutionize the way we invest.

Conclusion: Embracing the Data Revolution in Investing with Tools like Splunk

In today’s fast-paced investment landscape, embracing the data revolution is crucial for staying competitive. Splunk, a powerful software platform, has revolutionized the way investors approach data analysis.

With real-time insights, advanced search capabilities, machine learning integration, and streamlined operations, Splunk simplifies investing and enhances decision-making processes.

Splunk provides real-time insights that allow investors to monitor market trends as they happen, enabling swift and informed decision-making. Its advanced search capabilities extract valuable information from large datasets quickly and efficiently, uncovering hidden patterns or anomalies that impact investment decisions.

By integrating machine learning technologies, Splunk offers predictive insights that inform investment strategies.

The user-friendly interface of Splunk streamlines complex data analysis tasks, ensuring accessibility for all users. Embracing this data revolution gives investors a significant edge in their investment strategies by unlocking the power of real-time insights and informed decision-making.

[lyte id=’ZlKPqjuM0wo’]