In the fast-paced world of technology, one company has been making waves in the restaurant industry – Toast Inc. As a leading provider of restaurant technology solutions, Toast is revolutionizing the way businesses operate and thrive.

This article will provide an in-depth analysis of Toast’s stock performance, recent upgrades by prominent analysts, market outlook, growth potential, as well as risks and challenges associated with investing in Toast stock.

Introduction to Toast Inc.

Toast Inc. is a leading software company specializing in cloud-based solutions for the restaurant industry. Their comprehensive suite of tools, including point-of-sale systems, online ordering platforms, and inventory management tools, helps restaurants streamline operations and enhance the dining experience for customers.

With over 48,000 customers ranging from small cafes to large-scale chains, Toast has established itself as a dominant player in the industry due to its innovative offerings and commitment to customer success.

Analysis of Toast’s Stock Performance

Toast’s stock performance has witnessed remarkable growth in recent years, despite temporary setbacks during the COVID-19 pandemic. The company’s resilience and ability to bounce back stronger than ever have contributed to its success.

Several key factors have influenced Toast’s impressive stock performance. Continuous product innovation, a strong customer base, and strategic partnerships with industry leaders have played a crucial role in driving its growth.

Additionally, Toast’s ability to adapt to changing market demands and provide tailored solutions has further cemented its position as a leader in the restaurant technology sector.

When compared to its industry peers, Toast has outperformed many competitors, demonstrating its competitive advantage and consistent growth trajectory. This solidifies its market standing and showcases the company’s ability to capture a larger share of the market.

Overall, analysis of Toast’s stock performance reveals a story of resilience, innovation, and strategic positioning within the restaurant technology sector. Despite challenges faced during the pandemic, Toast has emerged stronger by continuously innovating its products, maintaining strong customer relationships, and forming strategic partnerships.

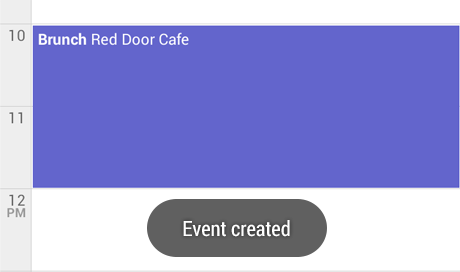

Needham Increases Toast Price Target to $32

Financial services firm Needham recently raised its price target for Toast stock from $25 to $32, signaling their confidence in the company’s future prospects.

This upward revision was influenced by factors such as Toast’s strong financial performance, expanding customer base, and positive industry trends as the restaurant sector recovers from the pandemic.

Needham’s increased price target serves as a promising signal for investors considering investing in Toast stock, indicating continued success and potential for favorable returns.

Mizuho Upgrades Toast Stock to Buy

Global investment bank Mizuho has upgraded their rating on Toast stock from neutral to buy. This upgrade reflects their confidence in Toast’s ability to outperform market expectations and deliver value to shareholders.

Mizuho’s decision is based on several factors, including optimism about the restaurant industry’s recovery, Toast’s strong competitive position, and its track record of driving growth through technological innovation. They believe Toast has the potential to generate significant returns for investors.

The upgrade is likely to boost investor sentiment and increase demand for Toast stock. As more investors recognize the company’s growth potential, it could lead to an upward trajectory in the stock price.

Mizuho’s upgrade signifies their belief in Toast as a promising investment opportunity with strong prospects for success.

UBS Initiates Coverage on Toast with Neutral Rating and $22 Price Target

UBS, a prominent player in the financial sector, has recently started covering Toast, a leading restaurant technology company. In their analysis, UBS has assigned Toast a neutral rating, indicating that they expect the stock to perform in line with market expectations. Alongside this rating, UBS has set a price target of $22 for Toast shares.

UBS’ decision to give Toast a neutral rating reflects their cautious stance on the challenges that the restaurant technology sector might face in the future. While there is potential for growth in this industry, UBS acknowledges that there could be hurdles impacting Toast’s performance.

However, they also recognize that opportunities exist for success within the sector.

With a price target of $22, UBS expects moderate growth from Toast but does not anticipate significant outperformance compared to other stocks in the same sector. This evaluation provides valuable information for investors considering investing in Toast stock.

It suggests that while there is potential for growth and success, it may be more aligned with market trends rather than outperforming them.

Overall, UBS’ coverage initiation on Toast with a neutral rating and $22 price target highlights their analysis of the company’s potential performance within the restaurant technology sector.

Their cautious stance acknowledges both challenges and opportunities while providing investors with valuable insights to consider when making investment decisions related to Toast stock.

Market Outlook and Growth Potential for Toast Inc.

As the restaurant industry continues to evolve, driven by changing consumer preferences and technological advancements, Toast Inc. finds itself operating in a market with immense potential for growth. With its innovative approach to restaurant technology, Toast is well-positioned to capitalize on the opportunities that lie ahead.

One of the key factors contributing to Toast’s growth potential is its ability to identify market opportunities and expand its customer base. By staying ahead of evolving trends such as online ordering, delivery services, and contactless payments, Toast can provide cutting-edge solutions that meet the changing needs of the industry.

This adaptability positions them well for sustained growth in the future.

To further fuel their expansion, Toast has actively pursued strategic partnerships and acquisitions. By aligning with other industry leaders, they can enhance their product offering, tap into new markets, and strengthen their position as an innovative leader in the restaurant technology sector.

These strategic moves not only increase Toast’s revenue streams but also solidify their presence in the market.

In addition to technological advancements and strategic partnerships, there are other factors that contribute to Toast’s growth potential. The rising demand for efficient restaurant management systems and the increasing adoption of cloud-based solutions create a favorable environment for Toast’s products and services.

Moreover, as more restaurants recognize the importance of streamlined operations and improved customer experiences, there is a growing market for Toast’s comprehensive platform.

Risks and Challenges in Investing in Toast Stock

Investing in the restaurant technology sector, including Toast stock, entails inherent risks. Factors such as changing consumer preferences, intense competition, economic downturns, and technological disruptions can impact its performance.

Increasing competition poses a risk of losing market share to competitors offering similar solutions or catering to evolving customer preferences. Additionally, regulatory challenges related to labor laws, food safety regulations, and data privacy requirements may affect Toast’s operations and profitability.

Investors should carefully consider these risks when evaluating their investment options in Toast stock.

VIII: Conclusion

Toast Inc. has firmly established itself as a leader in the competitive restaurant technology sector, offering innovative solutions that empower businesses to thrive in today’s challenging market landscape.

Despite facing temporary setbacks, Toast has consistently demonstrated resilience and delivered impressive stock performance over the past few years.

Analysts from reputable firms like Needham and Mizuho have expressed unwavering confidence in Toast’s growth potential, as evidenced by their increased price targets and upgraded ratings. While UBS remains cautiously neutral, these positive sentiments from industry experts indicate that investing in Toast stock could offer promising returns.

With its strong market position, continuous focus on innovation, and optimistic outlook from analysts, Toast presents an exciting investment opportunity for those looking to venture into the thriving restaurant technology sector.

However, it is essential for prospective investors to carefully consider the associated risks and conduct thorough research before making any investment decisions.

In summary, Toast Inc.’s consistent growth and success in the restaurant technology sector make it a compelling choice for investors seeking opportunities with high potential returns. The company’s ability to adapt to market challenges and deliver innovative solutions positions it well for future success.

However, prudent decision-making requires a comprehensive understanding of both the opportunities and risks involved in investing in Toast stock. By carefully weighing these factors, investors can make informed choices that align with their financial goals and risk tolerance levels.

Please note that this information should not be considered financial advice but rather serves as an exploration of the potential investment opportunity presented by Toast Inc. It is always recommended to consult with a qualified financial advisor before making any investment decisions.

[lyte id=’u6h4orsFz0Y’]