Investing in the stock market can be a daunting task, especially when it comes to emerging industries. One such field that has been gaining significant attention is synthetic biology. This cutting-edge discipline combines biology, engineering, and computer science to design and create new biological systems and organisms with improved functions.

In this article, we will explore the world of synthetic biology ETFs (Exchange-Traded Funds) and how they offer investors an opportunity to participate in this exciting sector. Whether you are a seasoned investor or just starting out, understanding the potential of synthetic biology ETFs can help you make informed investment decisions.

What is Synthetic Biology?

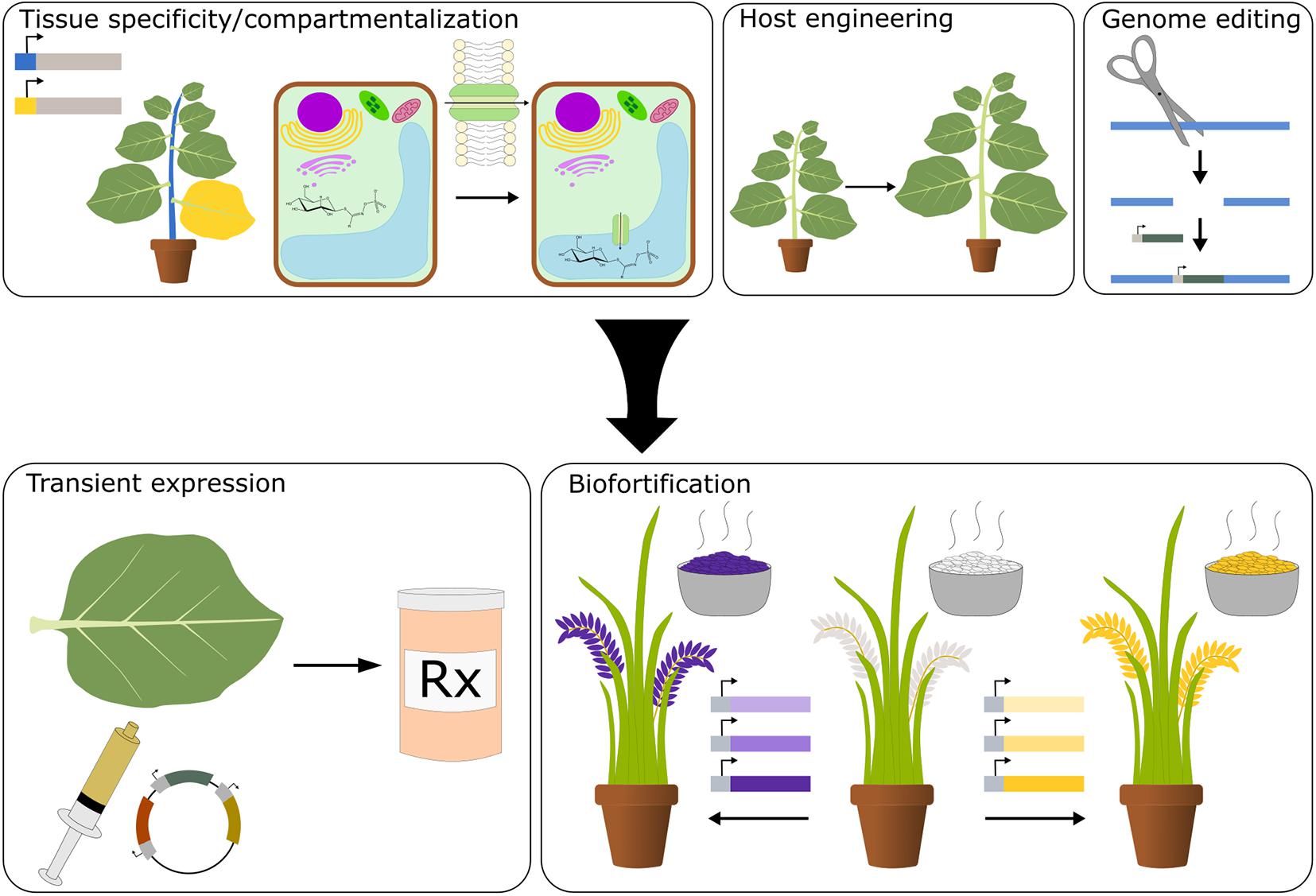

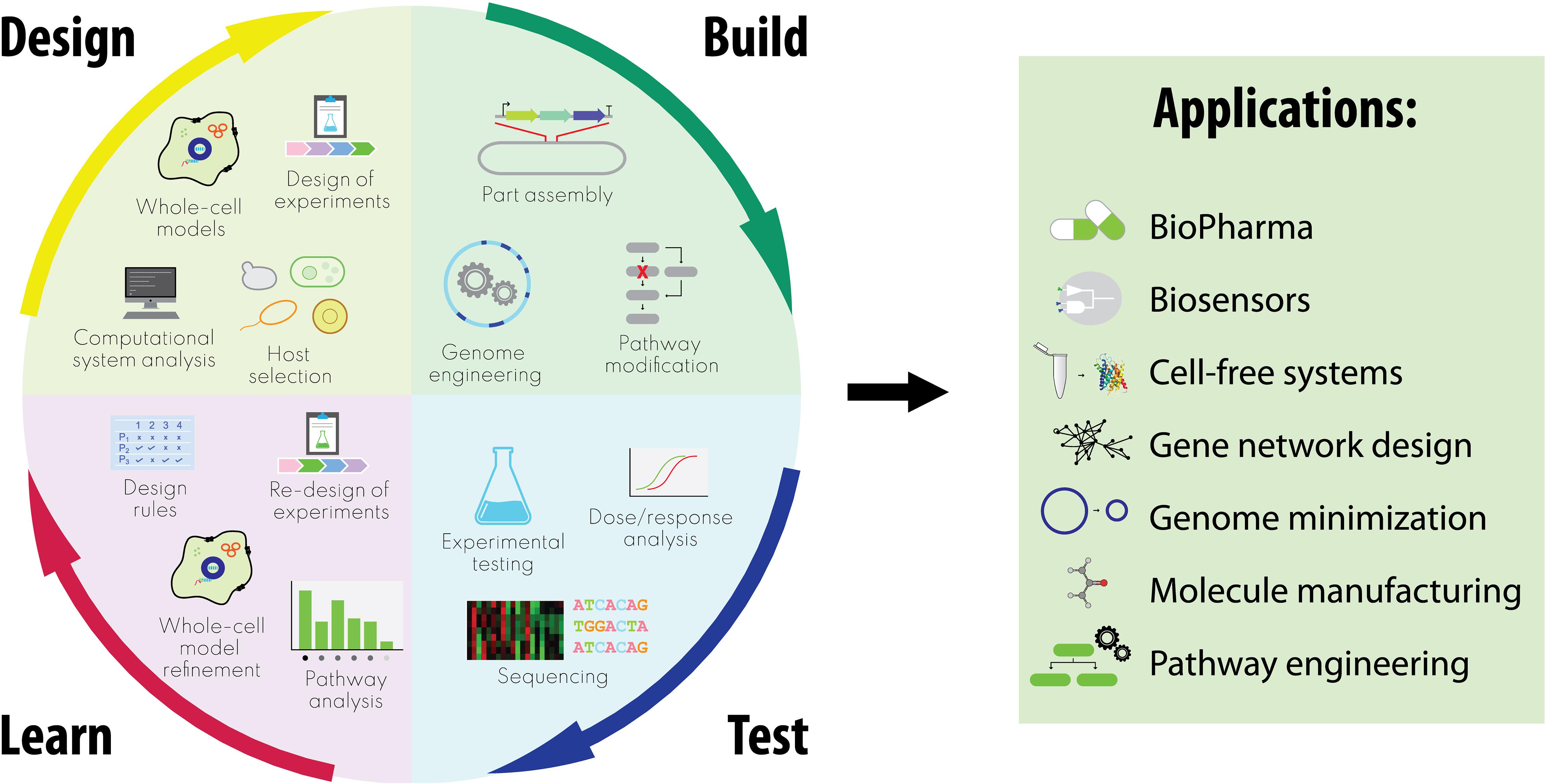

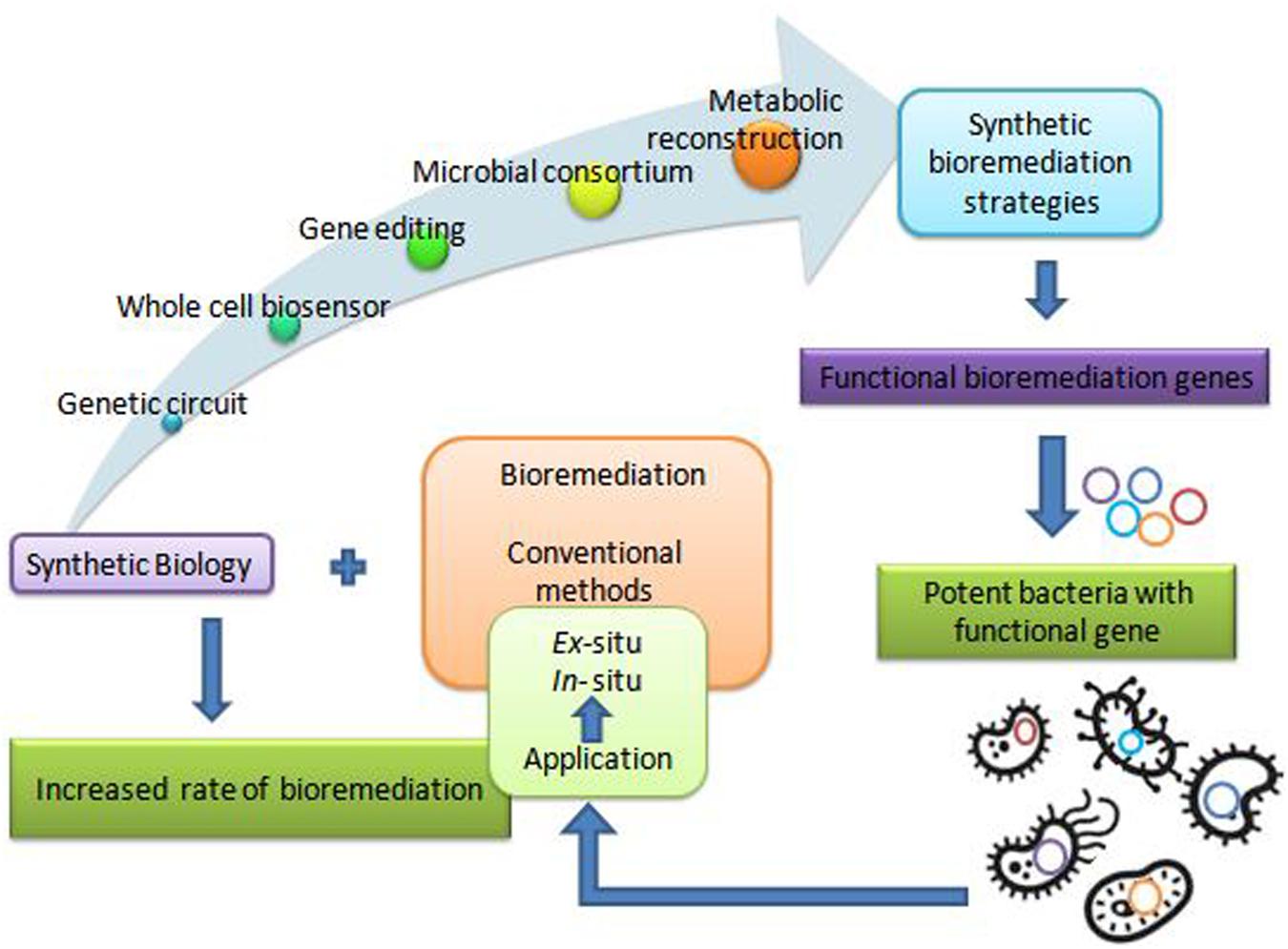

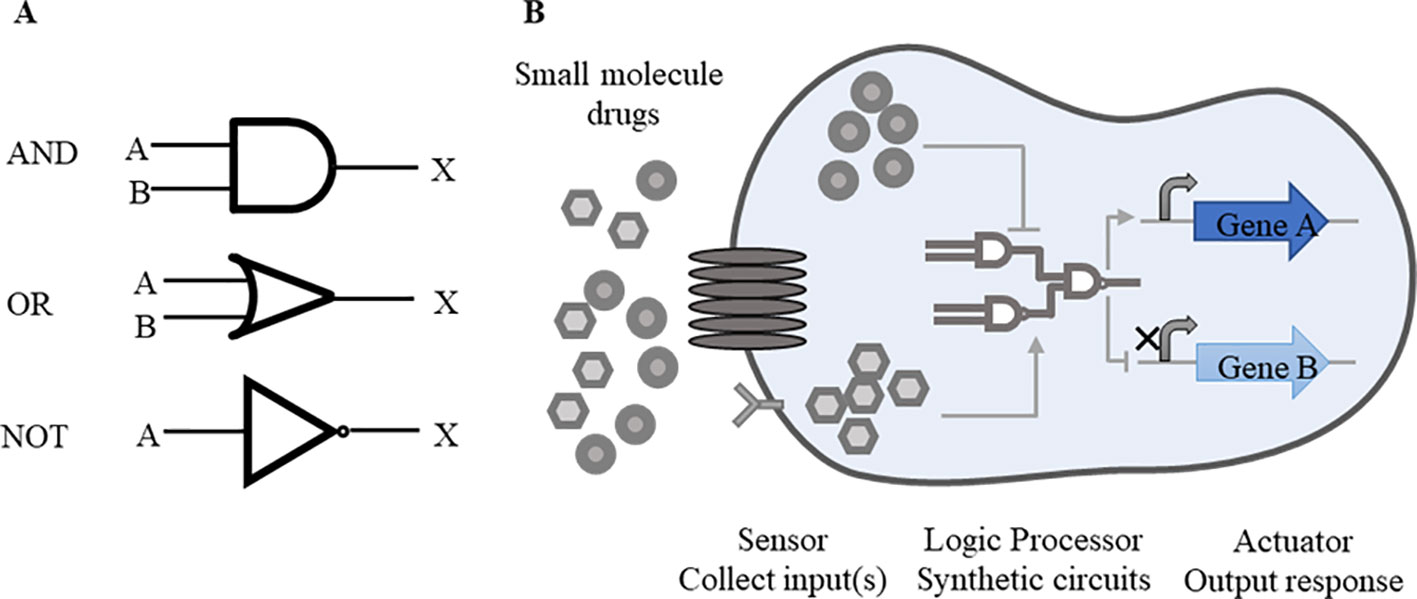

Synthetic biology is an interdisciplinary field that involves designing and constructing biological systems not found in nature. It aims to revolutionize industries like healthcare, agriculture, and energy by solving complex problems through innovative solutions.

One application of synthetic biology is the creation of genetically modified organisms (GMOs). These organisms have been genetically altered to possess desired traits, offering benefits such as increased crop yield and disease resistance.

Another application involves engineering bacteria to produce valuable pharmaceutical compounds, making drug manufacturing more efficient.

Synthetic biology also offers sustainable solutions like biofuels made from algae, reducing reliance on fossil fuels. Additionally, lab-grown meat production utilizes tissue engineering techniques to create meat products without raising or slaughtering animals, addressing food security concerns and environmental impact.

In summary, synthetic biology combines biology and engineering to design new biological systems with unique functionalities. With applications ranging from GMOs to engineered bacteria for drug production, this field has the potential to transform traditional industries and create exciting investment opportunities.

The Growing Field of Synthetic Biology

The field of synthetic biology has seen significant growth in recent years, driven by the demand for sustainable solutions. Market Research Future predicts that the global synthetic biology market will reach $27 billion by 2025.

Leading the way in this industry are companies like Intellia Therapeutics, Zymergen Inc., Twist Bioscience Corporation, and Ginkgo Bioworks. These companies are known for their groundbreaking work and innovative approaches to gene editing therapies, sustainable material production, and organism engineering.

With its potential to address global challenges and revolutionize various industries, synthetic biology is shaping the future of science and technology. As the market continues to evolve, we can expect more exciting discoveries and applications from this field.

| Key Players |

|---|

| Intellia Therapeutics |

| Zymergen Inc. |

| Twist Bioscience Corporation |

| Ginkgo Bioworks |

Investing in Synthetic Biology ETFs: An Introduction

Investing in synthetic biology ETFs allows investors to gain exposure to a basket of companies involved in this rapidly evolving field. ETFs, or Exchange-Traded Funds, are investment funds that trade on stock exchanges like individual stocks. These funds provide diversification, reducing the risk associated with investing in individual stocks.

Additionally, synthetic biology ETFs offer liquidity, flexibility, and lower expense ratios compared to actively managed funds. With the potential to revolutionize industries like healthcare and energy, synthetic biology offers exciting growth opportunities for investors.

Understanding Synthetic Biology ETFs

Synthetic biology ETFs offer investors a way to access the growing field of synthetic biology. These funds hold a diversified portfolio of companies involved in research, development, and commercialization within this industry. Some ETFs track specific synthetic biology indexes or sectors, providing targeted exposure.

For beginners, these ETFs provide an easy entry into investing with instant diversification and the potential for industry-wide growth. By investing in synthetic biology ETFs, investors can benefit from the advancements and opportunities within this exciting field.

Top Synthetic Biology ETFs to Consider Investing In

Synthetic biology, a rapidly growing field that combines biology and engineering principles to create new biological systems and products, presents exciting investment opportunities. One avenue for investors to participate in this emerging industry is through synthetic biology exchange-traded funds (ETFs).

These funds offer diversified exposure to companies involved in genomics research, biotechnology, and pharmaceuticals. Here are some top synthetic biology ETFs worth considering:

The iShares Genomics & Biotechnology ETF (IBB) aims to track an index comprised of U.S.-listed biotech and pharmaceutical companies.

This fund holds a diverse range of firms engaged in genomics research and development, including notable players like Amgen Inc., Gilead Sciences Inc., and Moderna Inc. By investing in IBB, investors gain exposure to established companies at the forefront of the synthetic biology industry.

To assess the performance history of IBB, it’s important to note that past performance does not guarantee future results. However, this ETF has exhibited strong performance over the years, reflecting the promising growth potential of synthetic biology.

Investors can also rely on financial research firms such as Morningstar for ratings and expert analysis on synthetic biology ETFs, aiding them in making informed investment decisions.

In conclusion, exploring the world of synthetic biology offers unique investment prospects. Synthetic biology ETFs like IBB provide a convenient way for individuals seeking exposure to this innovative industry.

With their diversified portfolios consisting of leading biotech and pharmaceutical companies, these ETFs offer potential for long-term growth and participation in groundbreaking advancements within the field of synthetic biology.

| Fund | Ticker | Description |

|---|---|---|

Factors to Consider Before Investing in Synthetic Biology ETFs

Investing in synthetic biology exchange-traded funds (ETFs) requires careful consideration. Key factors include assessing profitability potential versus risk exposure, understanding regulatory challenges, aligning investment timeframe with goals, evaluating risk tolerance, comparing expense ratios, and assessing liquidity options.

By thoroughly analyzing these factors, investors can make informed decisions that maximize potential returns and effectively manage their portfolios.

How to Start Investing in Synthetic Biology ETFs?

To invest in synthetic biology ETFs, follow these steps:

- Open a brokerage account with a reputable financial institution.

- Educate yourself about the investment process, including buy/sell orders and stop-loss orders.

- Place buy or sell orders based on your investment strategy and goals.

- Regularly monitor the performance of your synthetic biology ETF holdings.

- Rebalance your portfolio periodically to align with changing financial goals and risk tolerance.

By following these steps, you can begin investing in synthetic biology ETFs and potentially benefit from the growth and innovation in this field.

The Future Outlook for Synthetic Biology ETFs

The future of synthetic biology ETFs looks promising, driven by emerging trends and advancements in the field. Breakthroughs and discoveries continue to create new growth opportunities. However, investors must also consider regulatory hurdles, ethical concerns, and technological limitations.

Despite these challenges, the increasing demand for sustainable solutions across industries provides a favorable long-term outlook for synthetic biology ETFs. Thorough research is essential to identify funds that align with investment goals and risk tolerance.

By navigating these factors, investors can position themselves to benefit from the expanding world of synthetic biology.

[lyte id=’7Urjh4QiAyY’]