Investing in stocks can be an exciting endeavor, especially with the rise of commission-free trading platforms like Robinhood. With its user-friendly interface and accessibility, Robinhood has become a popular choice for both beginner and experienced investors.

However, before you dive into the world of investing on Robinhood, it’s crucial to understand the risks, challenges, and strategies for success. In this article, we will explore these aspects and more to help you maximize your investments on Robinhood.

Analyzing the Risks and Challenges of Investing on Robinhood

Investing through online platforms like Robinhood has gained popularity due to its commission-free trading feature. However, it’s crucial for investors to understand and evaluate the potential risks and challenges associated with this form of investing.

One important consideration is the potential downsides of commission-free trading platforms. While the absence of trading fees may seem attractive, it’s essential to recognize that there are still costs involved. These costs can manifest in the form of bid-ask spreads or hidden fees when executing trades.

It is imperative for investors to educate themselves about these expenses in order to make informed investment decisions.

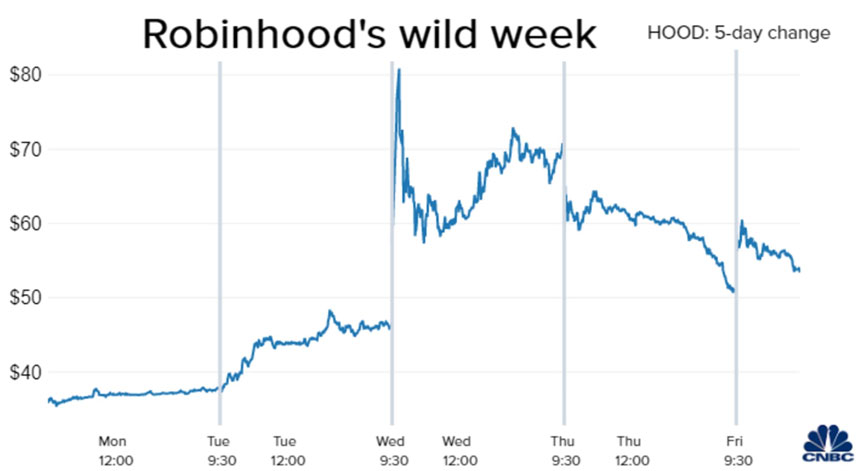

Another factor to examine is the impact of market volatility on Robinhood investments. Market volatility is an inherent aspect of investing, affecting all types of investments, including those made on Robinhood.

Understanding how market volatility can influence stock prices and navigating through turbulent times is vital for long-term success as an investor.

Moreover, it’s necessary to consider the risks associated with investing solely in individual stocks instead of diversified funds. While individual stocks may offer attractive returns, they also carry a higher chance of significant losses.

By diversifying one’s portfolio through funds or exchange-traded funds (ETFs), investors can balance risk effectively and manage their portfolio more efficiently.

In summary, analyzing the risks and challenges of investing on Robinhood involves understanding the costs associated with commission-free trading platforms, examining the impact of market volatility on investments, and considering the risks related to investing solely in individual stocks rather than diversified funds.

By evaluating these factors carefully, investors can make informed decisions that align with their financial goals and risk tolerance levels.

Strategies for Success: Tips and Tricks for Maximizing Your Investments on Robinhood

To maximize your investments on Robinhood, follow these tips and tricks:

-

Set realistic investment goals and time horizons: Define your objectives clearly, whether it’s saving for retirement or a short-term goal. This will guide your investment choices.

-

Implement a disciplined approach to buying and selling stocks: Avoid impulsive decisions by setting target prices, establishing stop-loss orders, and sticking to your strategy.

-

Utilize research tools and resources on Robinhood: Leverage company profiles, financial statements, analyst ratings, and news updates to make informed investment decisions.

By following these strategies, you can navigate Robinhood with confidence and increase your chances of success.

Navigating Market Turbulence: How to Respond to Economic Downturns on Robinhood

During economic downturns, understanding the impact on stock prices is crucial for strategic investing on Robinhood. Different sectors and industries are affected, presenting both risks and opportunities.

To protect your investments during turbulent times, develop a risk management strategy. Diversify your portfolio further and consider hedging strategies like options trading or stop-loss orders.

Despite concerns, economic downturns also offer unique growth opportunities. Analyze undervalued stocks or sectors poised for recovery to identify potential investments with significant returns when the market rebounds.

Stay informed and adapt your investment strategy as needed. Monitor market trends, use analytical tools, and make data-driven decisions to position yourself for success on Robinhood.

Robinhood vs Traditional Brokerages: Pros and Cons for Investors

When deciding between Robinhood and traditional brokerages, it’s essential to weigh the pros and cons. Robinhood offers commission-free trading and a user-friendly interface, but traditional brokerages may provide more advanced trading features and research tools. Understanding your priorities as an investor will help you make an informed choice.

Fees, account options, and customer support vary across different investment platforms. Assessing these factors is crucial to ensure that the platform you choose aligns with your investment goals and preferences.

Advanced trading features can be beneficial for experienced investors looking for more sophisticated strategies. However, for beginners or those seeking simplicity and accessibility, Robinhood’s straightforward approach may be more appealing. Carefully consider your needs and preferences when deciding on a platform.

The Future of Investing: Emerging Trends and Technologies on Robinhood

The world of investing is constantly evolving, and it’s important to stay informed about emerging trends and technologies that can shape the future of investment strategies. Artificial intelligence (AI) and machine learning are revolutionizing investments by providing valuable insights and analysis.

Cryptocurrency investments have also gained popularity, offering new avenues for portfolio diversification. Robo-advisors use algorithms to provide automated investment advice, while social investing networks connect investors with like-minded individuals for idea sharing.

Understanding these trends can help you stay ahead in the ever-changing landscape of investing. Evaluate the risks and opportunities associated with platforms like Robinhood versus traditional brokerages to make informed decisions.

Embrace advancements in AI, machine learning, cryptocurrencies, robo-advisors, and social investing networks to position yourself for success in this dynamic field. The future of investing on Robinhood holds exciting possibilities – seize them by staying informed and adaptable.

[lyte id=’GSZ2cPPrFr4′]