Quantum computing is set to revolutionize the stock market by transforming data analysis, pattern recognition, portfolio optimization, and financial modeling. With its immense processing power, quantum computers can swiftly handle complex calculations that traditional computers struggle with.

This enables investors to gain valuable insights into market trends, make accurate predictions, optimize portfolio allocations, and develop precise models for predicting stock market behavior. As quantum computing continues to evolve, researchers are working towards building scalable systems capable of solving real-world financial problems.

Storytelling Approach: Quantum Computing’s Impact on the Investing Landscape

Quantum computing is transforming the investing landscape, offering investors unimaginable processing power and advanced data analysis capabilities. With quantum computers, algorithms can uncover hidden patterns and predict market trends with unprecedented accuracy.

This technology allows for faster decision-making based on real-time analysis, eliminating the reliance on human intuition alone. Quantum computing’s parallel computation capabilities enable investors to process vast amounts of data simultaneously, optimizing portfolio management strategies and fine-tuning investment decisions.

The potential impact of quantum computing on stock market analysis is immense, revolutionizing how investors navigate and thrive in the ever-evolving financial world.

Brief Explanation of Classical Computing vs. Quantum Computing

Classical computers use bits – binary digits representing either 0 or 1 – as their basic units of information processing. On the other hand, quantum computers leverage qubits – quantum bits – which can exist in multiple states simultaneously thanks to a phenomenon called superposition.

Qubits also exhibit entanglement, allowing them to be interconnected regardless of physical separation. While classical computers excel at sequential tasks, quantum computers offer the potential for parallel computation and solving complex problems more efficiently.

However, practical implementation and stability remain challenges for quantum computing’s widespread adoption.

In summary, classical computing relies on bits, while quantum computing utilizes qubits with superposition and entanglement properties. Quantum computing shows promise for solving complex problems but faces technical hurdles before becoming widely applicable.

Key Principles of Quantum Mechanics for Faster Complex Calculations

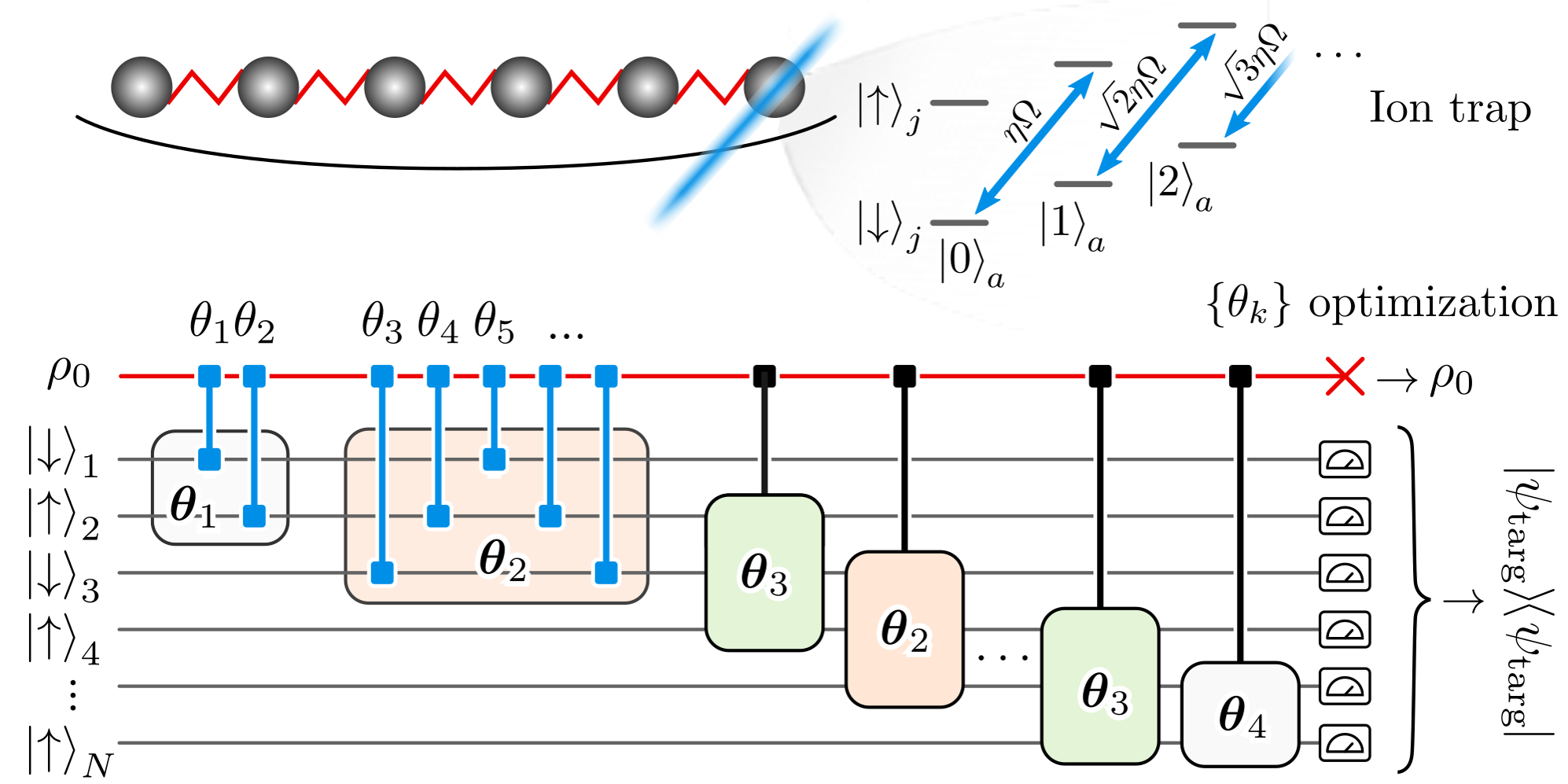

Quantum mechanics provides the basis for quantum computers to perform complex calculations at incredible speeds. Two crucial principles, superposition and entanglement, drive this computational power.

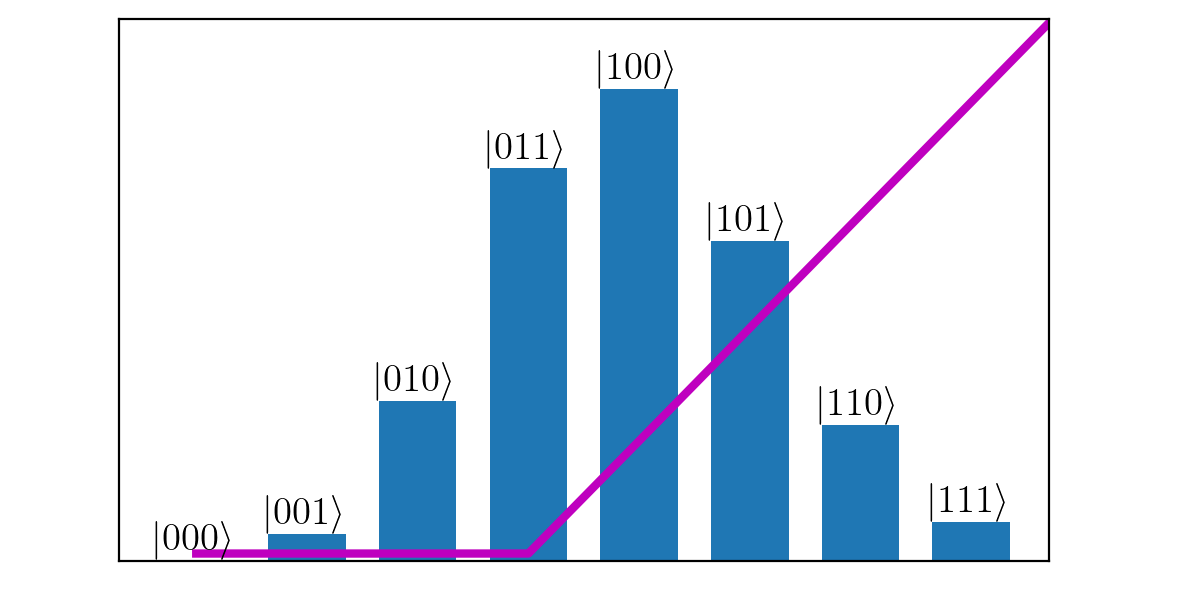

Superposition allows qubits to exist in multiple states simultaneously. Unlike classical bits that can only represent 0 or 1, qubits can be both at once. This exponentially expands the possibilities and enables parallel processing, accelerating complex calculations.

Entanglement links qubits together so that manipulating one affects its entangled counterparts instantly. This facilitates faster communication between qubits, enhancing computational efficiency.

These principles have significant implications for stock market analysis. Quantum computing’s ability to explore multiple possibilities simultaneously through superposition accelerates financial modeling and prediction accuracy.

Entanglement enables real-time understanding of interdependencies among variables, leading to better-informed investment decisions.

In summary, superposition and entanglement are key principles in quantum mechanics that empower quantum computers with unparalleled computational speed. Applying these principles to stock market analysis promises transformative advancements in finance and beyond.

How Quantum Computing Enhances Data Analysis for Investors

Quantum computing revolutionizes data analysis for investors by offering unprecedented speed and accuracy. With its ability to process vast amounts of financial data quickly, quantum computers enable investors to identify trends and make informed decisions with greater precision.

Additionally, quantum computing excels at pattern recognition, unlocking hidden patterns within complex financial data that traditional methods may miss. This advanced capability allows investors to predict market trends and uncover profitable investment opportunities.

Furthermore, the integration of quantum computing enables efficient portfolio optimization through real-time data processing and advanced analytical tools. As this technology continues to advance, it holds the promise of transforming investment strategies and improving outcomes for investors.

Exploring Quantum Computing’s Efficiency in Portfolio Optimization

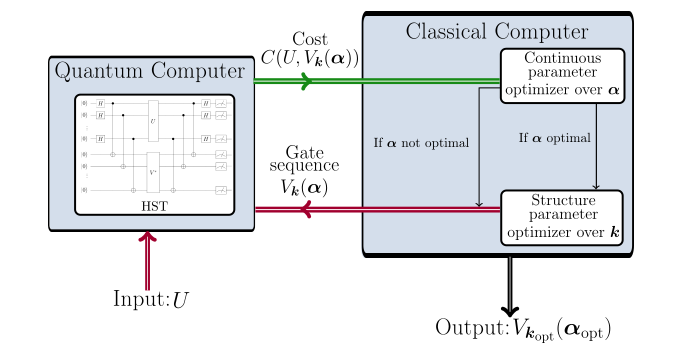

Traditional portfolio optimization involves complex calculations based on risk tolerance, return objectives, and correlation analysis. However, quantum computing offers a more efficient alternative.

By harnessing the power of superposition and entanglement, quantum computers can rapidly explore countless asset allocation combinations. This enables investors to achieve better risk reduction, increased diversification, and improved returns compared to classical methods.

Quantum computing’s ability to handle vast amounts of data simultaneously allows for swift fine-tuning of portfolios. It also uncovers hidden patterns or correlations that may be missed by traditional approaches.

Update on Quantum Computing Stocks in 2023

In 2023, quantum computing stocks are thriving as companies like IonQ, Microsoft, Alphabet (Google’s parent company), and Nvidia lead the way in developing technologies for stock market analysis. IonQ is attracting attention with their scalable and stable quantum computers.

Microsoft is investing heavily to make quantum computing accessible to a wider audience. Google’s Sycamore achieved “quantum supremacy,” while Nvidia accelerates quantum computing simulations. Despite challenges like scalability and error correction, these advancements offer promising solutions for optimized portfolio management.

Investors should watch these companies closely as they continue to innovate in this transformative field.

Addressing Existing Obstacles in Adopting Quantum Computing Technology for Investment Purposes

Quantum computing has immense potential for investment, but there are obstacles to overcome before widespread adoption. Current limitations in hardware, such as stability and scalability issues, need to be addressed for reliable financial performance. Data security concerns arise due to the potential vulnerability of encryption algorithms.

Additionally, practical applications are still limited, requiring further development. A robust regulatory framework and education programs for professionals are necessary to ensure successful integration into the investment world.

[lyte id=’62UGZkkPs3E’]