Investing in the stock market has always been an attractive option for those looking to grow their wealth. Traditionally, individuals would invest their own capital or rely on the expertise of fund managers. However, a new trend is emerging in the world of investing – the rise of stock prop trading firms.

These firms provide a unique opportunity for aspiring traders to leverage significant capital and resources while learning from experienced professionals.

In this article, we will explore the concept of prop trading, its advantages, how to get hired by a prop trading firm, life as a trader in such a firm, risk management strategies, and the future of prop trading.

If you’re interested in investing and want to take your skills to the next level, join us on this journey into the world of stock prop trading.

Understanding the Concept of Prop Trading

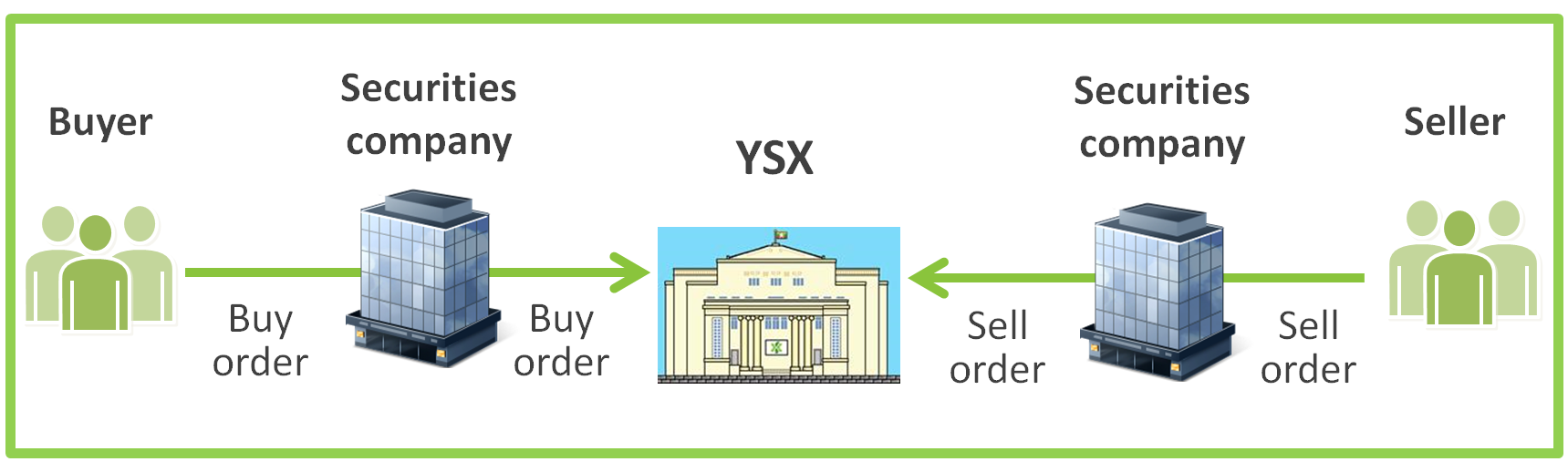

Proprietary trading, or prop trading, refers to financial firms using their own capital for trading purposes instead of relying on client funds. Prop trading firms employ skilled traders who analyze market trends and employ various strategies to generate profits from fluctuations in financial markets.

This approach provides greater flexibility and potential for higher returns compared to traditional investment firms that solely rely on client funds. Prop traders can take advantage of both rising and falling markets, utilizing techniques such as short-selling or options trading.

However, it’s important to note that prop trading comes with its own set of risks, requiring effective risk management measures to mitigate potential losses. Overall, prop trading allows firms to trade with their own capital and potentially achieve higher returns through skilled strategy execution.

How Prop Trading Firms Have Gained Popularity

Prop trading firms have grown in popularity for several reasons. Technological advancements have made it easier for individuals to access financial markets and execute trades efficiently, creating opportunities for talented traders with limited capital.

These firms also offer mentorship from experienced professionals, allowing aspiring traders to gain valuable insights into market dynamics and accelerate their learning curve. Additionally, prop trading firms operate with proprietary funds, enabling them to take calculated risks and attract top-tier traders.

The demand for alternative investment opportunities and the flexibility of regulations in prop trading further contribute to their rise in popularity. Overall, prop trading firms provide a unique avenue for traders looking for growth and success in the financial industry.

The Advantages of Joining a Stock Prop Trading Firm

Trading in the stock market can be an exciting and potentially lucrative endeavor. However, doing so with limited personal funds can often restrict the opportunities available. That’s where joining a stock prop trading firm can provide significant advantages.

One of the key benefits of becoming part of a prop trading firm is gaining access to substantial capital. With a larger capital base at their disposal, traders have the ability to take advantage of market opportunities that may otherwise be out of reach.

This increased buying power not only allows for more substantial trades but also amplifies potential profits.

In addition to access to capital, prop trading firms invest heavily in advanced technology and research tools. These include cutting-edge trading platforms, data analysis software, and real-time market information.

By leveraging these resources, traders are equipped with the necessary tools to make informed decisions and execute trades more effectively.

Prop trading firms offer a unique learning environment for aspiring traders. Many firms provide mentoring programs where seasoned professionals guide and teach new recruits.

This hands-on guidance accelerates skill development by helping traders avoid common pitfalls and learn from experienced individuals who have navigated various market conditions.

Moreover, being part of a prop trading firm exposes traders to real-life experiences in different market conditions. This exposure enables them to fine-tune their strategies and adapt to changing dynamics swiftly. The ability to learn from both successes and failures is invaluable in building a successful trading career.

By joining a stock prop trading firm, traders gain access to significant capital resources that enhance their trading abilities. Additionally, they have the opportunity to learn from experienced professionals who can guide them towards success in navigating the complexities of the stock market.

Getting Hired by a Stock Prop Trading Firm

Joining a stock prop trading firm can be competitive, but there are key factors that can increase your chances:

Demonstrate consistent profitability in personal trading accounts and highlight successful strategies. Showcase risk management skills to impress potential employers.

Be well-prepared to showcase knowledge of financial markets, trading strategies, and risk management. Emphasize passion for trading and dedication to continuous learning. Practice articulating thoughts confidently and effectively communicate industry understanding.

By building an impressive track record and excelling in the interview process, you can increase your chances of getting hired by a stock prop trading firm.

Life as a Trader in a Stock Prop Trading Firm: Challenges and Rewards

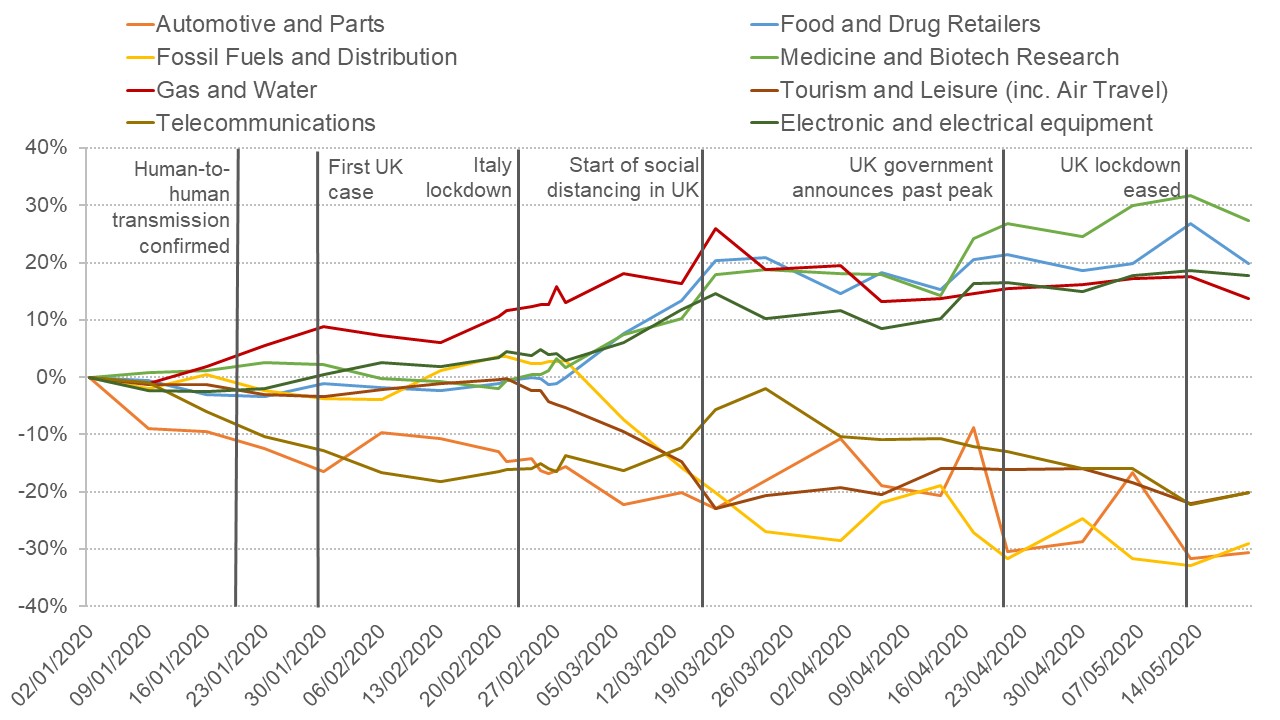

Being a trader in a stock prop trading firm involves navigating high-pressure situations and celebrating the rewards of successful trades. Traders must manage emotions during volatile market conditions, develop discipline, and make effective decisions under pressure.

Successful trades bring lucrative profits and serve as motivation for future successes. Continuous learning, adaptation to changing market conditions, and networking opportunities within the collaborative trading environment are also integral to this profession.

Embracing these challenges and reaping the rewards allows traders to thrive in the dynamic world of stock trading.

Risk Management: Mitigating Losses in Stock Prop Trading

Effective risk management is crucial in stock prop trading. Traders must prioritize protecting their capital and avoiding significant losses. A robust risk management plan includes setting stop-loss orders to limit potential downsides.

By diversifying investments, monitoring market conditions, and making informed decisions based on analysis, traders can mitigate risks and maximize profitability. Prioritizing risk management is key to long-term success in stock prop trading.

The Future of Stock Prop Trading Firms: Adapting to Changing Markets

Stock prop trading firms must adapt to evolving markets to remain competitive. Utilizing artificial intelligence (AI) and machine learning algorithms allows for data analysis and identifying profitable opportunities. Automation in trading processes enables faster execution and reduces human error.

Embracing emerging trends and diversifying portfolios are key strategies for navigating changing markets. Continuous learning and fostering a collaborative environment are essential for future success.

Conclusion: Taking the Leap into Stock Prop Trading

[lyte id=’2Y_22c-XLHI’]