Investing in the right stocks can be a game-changer, and when it comes to electric vehicles (EVs), there’s one sector that’s gaining significant attention: solid state EV battery stocks. These innovative batteries are revolutionizing the automotive industry with their superior performance, longer range, and faster charging capabilities.

In this article, we will explore the rise of solid state EV battery technology, key players in the market, what you need to know before investing, key metrics to consider when evaluating stocks, successful case studies, future outlook, and more. So fasten your seatbelts as we delve into this exciting investment opportunity.

The Rise of Solid State EV Battery Technology

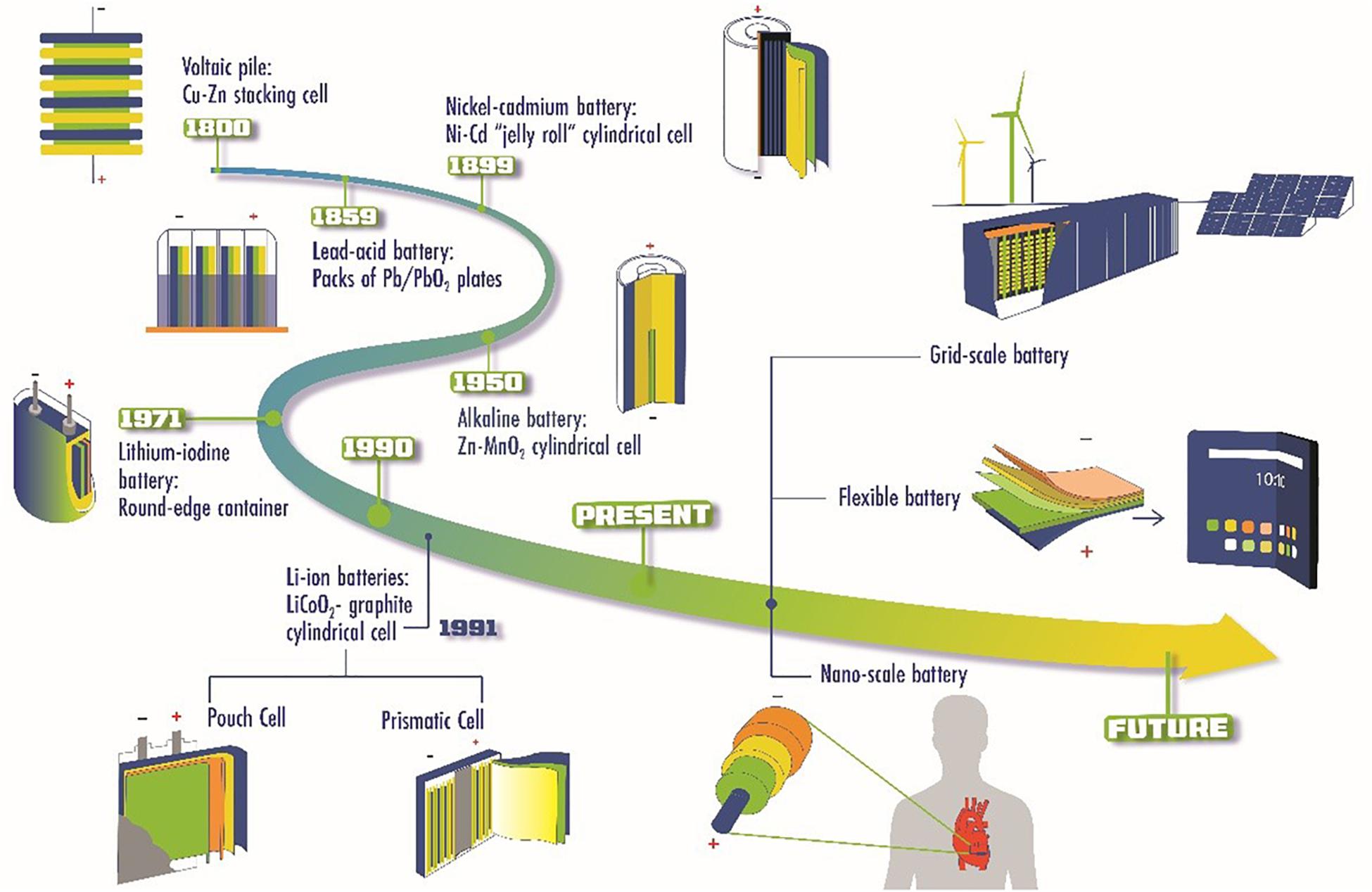

Electric vehicles (EVs) are gaining popularity as consumers prioritize sustainable transportation. Advancements in battery technology and charging infrastructure have propelled EVs from a niche market to potentially dominating the automotive industry.

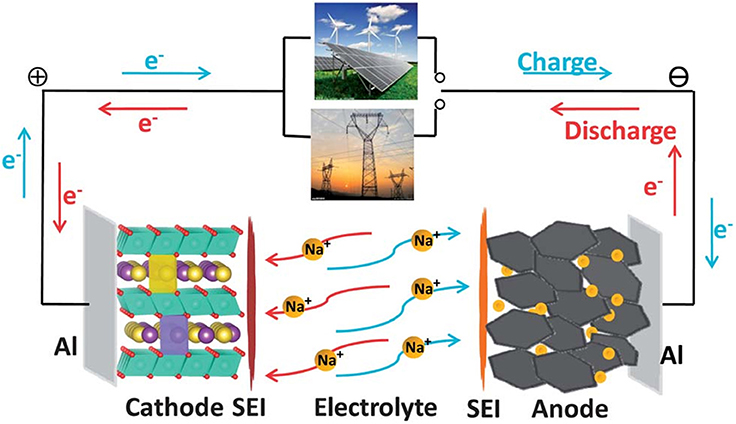

Solid state batteries, the next generation of energy storage for EVs, offer advantages over traditional lithium-ion batteries. With solid electrolytes instead of liquid ones, they provide higher energy density, improved safety, faster charging rates, and longer lifespan.

Major automakers like Toyota, BMW, and Volkswagen are partnering with battery manufacturers to accelerate the development and commercialization of solid state batteries. Venture capitalists are also investing in startups focused on this technology.

As research progresses and costs decrease, solid state EV battery adoption will increase exponentially. This groundbreaking technology has the potential to revolutionize not only transportation but also other industries reliant on energy storage solutions.

Key Players in Solid State EV Battery Stocks

In the solid state EV battery market, three key players are driving innovation and competition.

Company A is a frontrunner with cutting-edge technology and strategic collaborations. Their solid state batteries offer exceptional energy density, enabling longer driving ranges. Partnerships with automakers position them well to capture a significant market share once commercial production begins.

Company B constantly pushes boundaries with breakthroughs in energy efficiency and cost-effectiveness. Their unique approach to solid state battery production fuels their competitiveness. With a strong focus on research and development, they are poised to disrupt the market.

Company C stands out with a novel manufacturing process that allows scalability and cost reduction. Strategic partnerships across the supply chain create a robust ecosystem for future growth opportunities.

These key players – Company A, Company B, and Company C – shape the future of electric vehicles with their groundbreaking advancements in solid state battery technology.

Investing in Solid State EV Battery Stocks: What You Need to Know

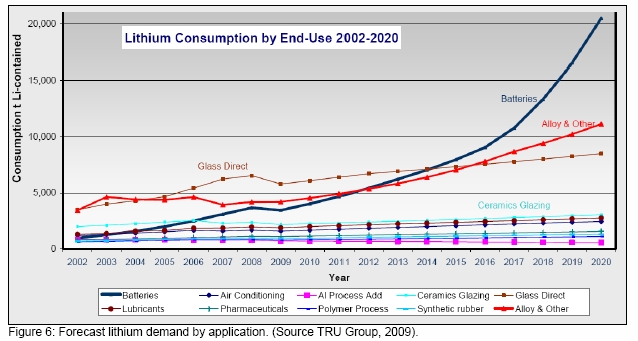

Solid state batteries are in high demand in the automotive industry due to strict environmental regulations, government incentives, and consumer expectations. Governments worldwide are pushing for zero-emission vehicles, creating a favorable environment for solid state EV battery production.

Additionally, consumers want longer range and faster charging capabilities in their electric vehicles. However, investing in this technology comes with risks such as technological hurdles and competition from alternative energy storage solutions like hydrogen fuel cells or improved lithium-ion batteries.

It is crucial for investors to assess these factors before making investment decisions in solid state battery stocks.

Evaluating Solid State EV Battery Stocks: Key Metrics to Consider

When evaluating solid state EV battery stocks, it’s crucial to consider several key metrics that indicate a company’s potential for success in this rapidly evolving industry.

Market capitalization provides insight into a company’s overall value and market perception. Analyzing a company’s financial performance, including revenue growth, profitability, and debt levels, helps gauge its financial stability and growth potential.

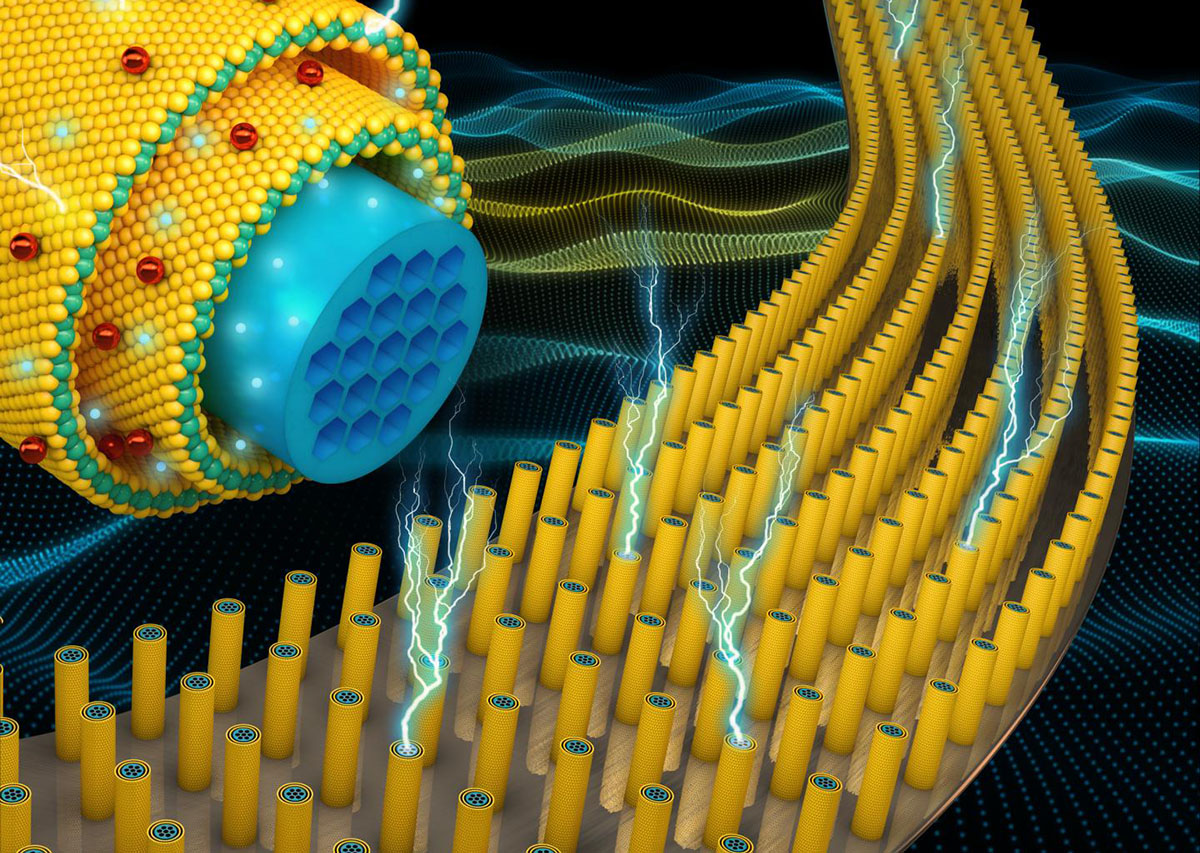

Companies with strong research and development capabilities along with a robust patent portfolio have a competitive advantage. Intellectual property protection ensures exclusivity over breakthrough technologies, providing long-term value for investors.

Strong partnerships with automakers demonstrate market validation for a company’s technology. Supply chain integration ensures efficient production processes while global reach indicates the potential for widespread adoption of solid state EV batteries.

Case Study: Successful Investments in Solid State EV Battery Stocks

Investors have profited from early adoption of solid state EV battery stocks, showcasing the importance of thorough research and analysis before making investment decisions. These success stories highlight the value of identifying companies with technological advancements, strong market positioning, and strategic partnerships.

By learning from both successful investments and missed opportunities, investors can gain valuable insights for future ventures.

Future Outlook for Solid State EV Battery Stocks

The future outlook for solid state EV battery stocks is highly promising. Industry projections indicate a significant increase in demand, fueled by government support, technological advancements, and rising consumer preference for electric vehicles.

Advancements in technology, such as high-density cathode materials and improved cell designs, contribute to longer battery life and faster charging times. The intense competition among manufacturers fosters constant innovation, making it crucial to stay informed about potential disruptors or game-changers that could revolutionize the industry.

Overall, solid state EV battery stocks offer lucrative investment opportunities as the market continues to grow and evolve.

Conclusion:

[lyte id=’JH-8Tm2QCTo’]