In today’s fast-paced and data-driven world, information is power. For investors, having access to accurate and timely data can mean the difference between making profitable decisions and missing out on opportunities. That’s where software tools like Splunk come in.

These powerful platforms unlock the value of data, providing investors with actionable insights that revolutionize their decision-making process.

What is Splunk and How Does it Work?

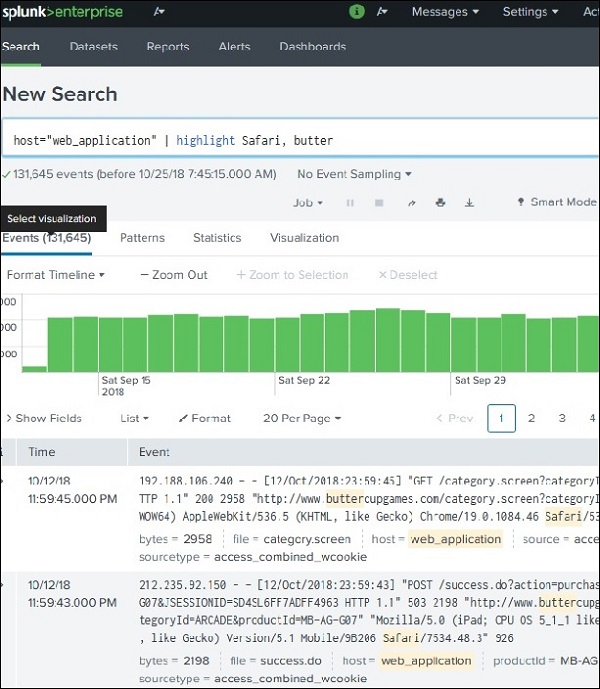

Splunk, founded in 2003, is a leading software application for analyzing and visualizing machine-generated data. It collects data from various sources, such as servers and applications, and indexes it for easy searching and analysis. With its user-friendly interface and advanced algorithms, Splunk quickly processes large volumes of real-time data.

It offers powerful visualization capabilities and automation features that help organizations gain valuable insights and identify potential issues proactively. Overall, Splunk is a versatile tool that enables businesses to effectively manage big data and make informed decisions.

Investing in Insights: How Splunk Revolutionizes Decision-Making

In today’s investment world, data-driven decision-making is crucial. Splunk revolutionizes this process by providing investors with actionable insights for shaping their strategies. With real-time monitoring of market trends and sentiment analysis, investors can gauge public opinion accurately.

Splunk’s powerful search capabilities analyze financial data in real-time, identifying patterns and anomalies that traditional methods miss. Additionally, its machine learning algorithms detect potential risks and fraudulent activities, protecting investments.

Splunk equips investors with the tools to make well-informed choices and stay ahead in the competitive investment landscape.

Learning to Invest Smarter with Splunk’s Features

Splunk’s features empower investors to make better decisions by harnessing the power of real-time data. By integrating real-time market data feeds into Splunk, investors can monitor stock prices, news updates, and other critical information instantly. This allows them to react quickly to market changes and adjust their strategies accordingly.

Splunk also enables investors to track the performance of their portfolios in real-time. By visualizing key metrics and trends, they can identify areas of strength and weakness within their investments. This information is invaluable for effective risk management and optimizing portfolio performance.

Investing wisely is no longer a guessing game. With Splunk’s features, you can gain the insights needed to invest with confidence and maximize your returns.

Case Studies: Success Stories from Investors Leveraging Splunk

Investors have found success by leveraging Splunk, a powerful data analytics platform. One hedge fund manager used Splunk to analyze trading patterns across markets, refining investment strategies and increasing returns.

A multinational bank implemented Splunk in its fraud detection system, identifying unusual spending patterns and preventing major financial scams. These real-life examples demonstrate how Splunk empowers investors to gain a competitive edge through data-driven insights.

Splunk Alternatives: Exploring Other Software Tools

While Splunk is a leading player in data analysis and management, there are alternative software tools investors can consider.

Signoz offers monitoring and troubleshooting for applications, Logstash provides centralized logging and log processing, Fluentd enables real-time data streaming and analytics, and Datadog combines infrastructure monitoring with application performance monitoring (APM).

Each tool has its unique features that cater to specific investment needs, empowering investors to make informed decisions based on comprehensive data analysis.

| Software Tool | Key Features |

|---|---|

| Signoz | Monitoring & troubleshooting applications |

| Logstash | Centralized logging & log processing |

| Fluentd | Real-time data streaming & analytics |

| Datadog | Infrastructure monitoring & APM |

Investors can explore these alternatives to find the software tool that best aligns with their goals and enhances their investment process.

Getting Started with Splunk: Tips for New Investors

Investing in Splunk? Here are some essential tips to maximize its value for your investment goals:

-

Define your objective: Clearly articulate what you want to achieve with Splunk and tailor your data analysis accordingly.

-

Familiarize yourself with the platform: Take advantage of online tutorials and documentation provided by Splunk to understand its functionalities thoroughly.

-

Join the user community: Connect with experienced users through the Splunk community to learn from their insights and best practices.

-

Embrace experimentation: Explore different approaches within Splunk, continuously iterating to uncover new insights and refine your investment strategies.

By following these tips, you’ll be well-equipped to leverage Splunk’s capabilities effectively, making informed investment decisions and achieving better outcomes.

Conclusion: Unleash Your Investing Potential with Software like Splunk

[lyte id=’ZlKPqjuM0wo’]