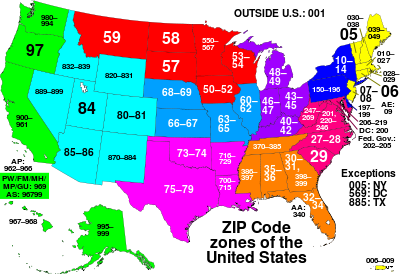

In today’s digital age, sending money has become easier and more convenient than ever before. However, one common requirement that often poses a challenge is the need to provide a zip code when making payments.

Whether you’re investing or learning about investing, it’s essential to understand how to navigate this hurdle and explore alternative payment options. In this article, we’ll delve into the world of sending money without a zip code, discussing its implications and providing you with valuable insights.

What is a Credit Card Zip Code?

A credit card zip code refers to the billing address associated with your credit card account. It serves as an extra layer of security for online transactions by confirming that the person making the payment is the authorized cardholder.

By requiring this information, online merchants can reduce the risk of fraud and ensure that only the rightful owner of the credit card can complete the transaction.

While it’s not foolproof, combining the credit card zip code with other security measures enhances overall transaction security and protects against unauthorized use of stolen or lost cards.

Can You Transfer Money From a Card Without a Zip Code?

Yes, it is possible to transfer money from a card without providing a zip code. However, most platforms require this information for verification purposes during online purchases or traditional methods like bank transfers or wire transfers.

Not having access to or knowledge of the specific zip code associated with your credit card billing address can pose challenges. While some alternative methods may not require a zip code, they may have their own requirements or limitations. It’s important to ensure accurate information when conducting financial transactions to avoid complications.

How to Make Payment Without ZIP Codes?

Making payments without the need for ZIP codes is now possible through innovative methods. Online services offer virtual addresses, allowing you to make payments and receive packages without sharing your personal address or ZIP code.

Cryptocurrencies like Bitcoin provide a decentralized solution, enabling you to send money securely without traditional payment systems or ZIP codes. Mobile payment apps such as PayPal and Venmo offer alternative ways to transfer funds with minimal information required, eliminating the need for a ZIP code during transactions.

Embrace these alternatives to overcome the hurdle of providing a ZIP code when making payments and enjoy secure and convenient transactions.

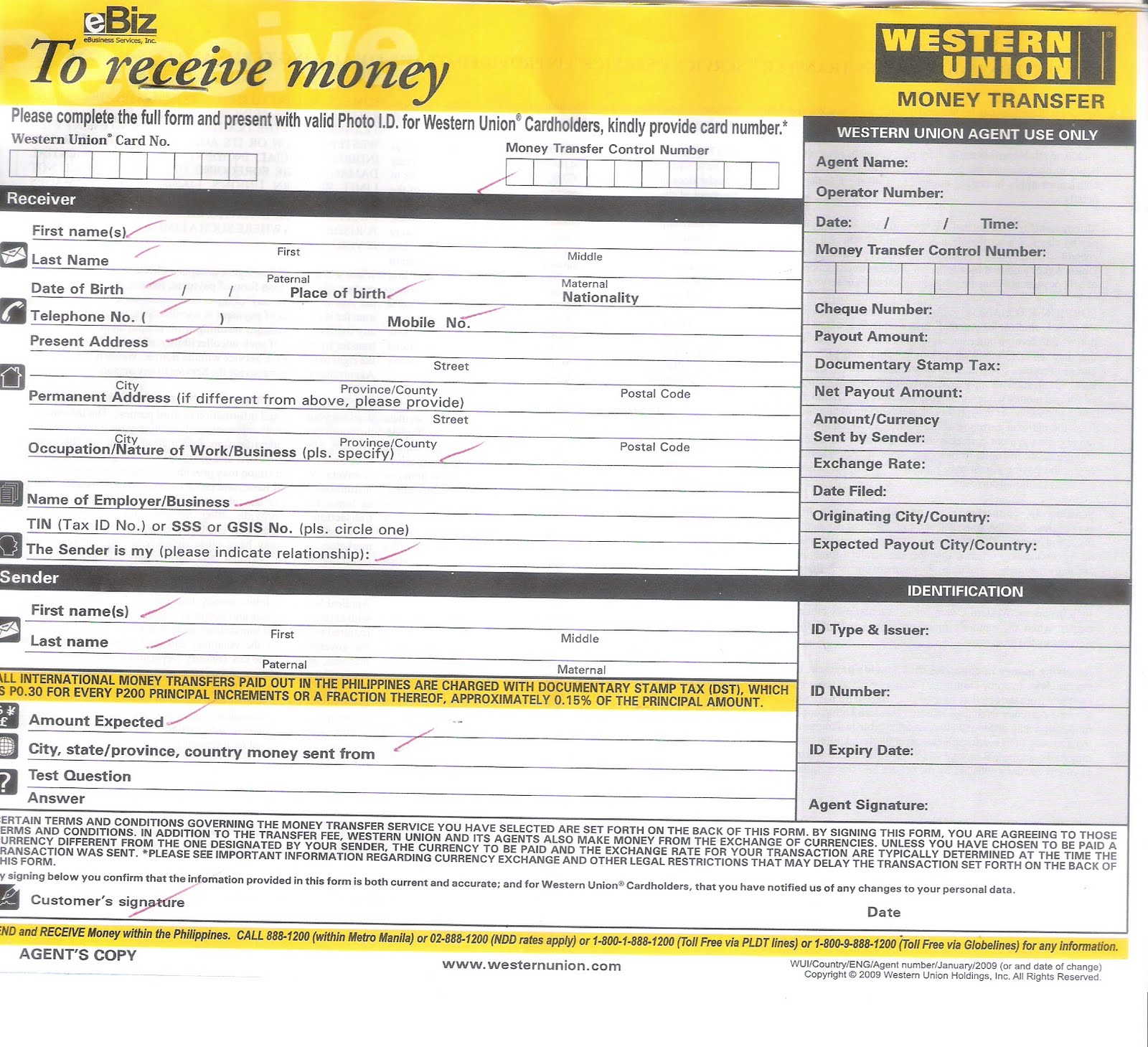

Money Transfer Services

In this section, we will explore popular money transfer services that allow you to make payments without a zip code. These services provide convenient options for sending money domestically and internationally. Let’s take a closer look at three of them:

- Features: Competitive exchange rates and fast transaction processing times.

- Benefits: Conveniently send money internationally without the need for a zip code.

- Limitations: Restrictions on maximum amounts per transaction or within a specific time frame.

- Features: User-friendly interface and wide network coverage.

- Benefits: Easily send money domestically and internationally without a zip code.

- Limitations: Fees associated with specific transaction types or currency conversions.

- Features: Extensive range of payment options and additional security measures.

- Benefits: Choose from various payment methods and enjoy enhanced security features.

- Limitations: Limited usability in certain countries or regions.

These money transfer services offer flexibility and ease when making payments without the hassle of a zip code requirement. Whether you’re sending money nearby or across borders, these options cater to your needs.

Conclusion

Exploring alternative payment options and money transfer services allows for the possibility of sending money without a zip code. By recognizing the limitations of traditional methods and embracing innovative solutions, individuals can navigate the challenges associated with zip code requirements.

Whether you are an investor seeking global financial opportunities or simply someone interested in learning about investing, staying informed about these alternative methods is crucial. Not only do these new technologies and payment systems provide convenience, but they also open doors to a world of financial possibilities.

Why confine yourself to conventional payment methods when there are alternative options available? By venturing into the realm of sending money without a zip code, you can experience the convenience and ease that these innovative solutions offer.

Embracing this change not only simplifies transactions but also broadens your horizons in today’s interconnected world.

Consider exploring various alternative payment platforms that operate beyond traditional zip code constraints. These platforms leverage cutting-edge technology to streamline global transactions, enabling seamless transfers regardless of geographical boundaries or postal codes.

By capitalizing on these advancements, you can participate in international commerce effortlessly and take advantage of emerging investment opportunities.

In conclusion, don’t limit yourself to outdated approaches when it comes to transferring funds. Instead, embrace the evolving landscape of financial technology and discover how sending money without a zip code can revolutionize your cross-border transactions.

The convenience and flexibility offered by these alternative options are well worth exploring for anyone seeking simplicity and efficiency in their financial endeavors.

[lyte id=’xro_ZrRRrPw’]