Semiconductor stocks have gained significant traction in the stock market, attracting investors from various backgrounds. These stocks belong to companies that design, manufacture, and distribute semiconductor chips used in a wide range of electronic devices.

From smartphones and computers to cars and medical equipment, semiconductors are essential components of modern technology.

The demand for semiconductor stocks is driven by the ever-growing reliance on electronic devices and advancements in mobile technology. Emerging technologies like AI, IoT, and autonomous vehicles further contribute to the sector’s growth potential.

While investing in individual semiconductor stocks carries risks, diversification or investing in semiconductor ETFs can help mitigate them.

Explanation of the Growing Popularity of Semiconductor Stocks in the Stock Market

Semiconductor stocks are becoming increasingly popular in the stock market for several reasons. Firstly, there is a rising demand for electronic devices across various industries, driving the need for semiconductors.

Additionally, the COVID-19 pandemic has accelerated digital transformation, leading to increased orders and higher revenues for semiconductor companies. Advancements in emerging technologies like AI, IoT, and 5G networks also contribute to the growing popularity of semiconductor stocks.

Moreover, governments are investing in research and development to strengthen domestic chip manufacturing capabilities. Overall, these factors create favorable conditions for semiconductor companies and attract investors looking for long-term growth opportunities.

Brief History of the Semiconductor Industry

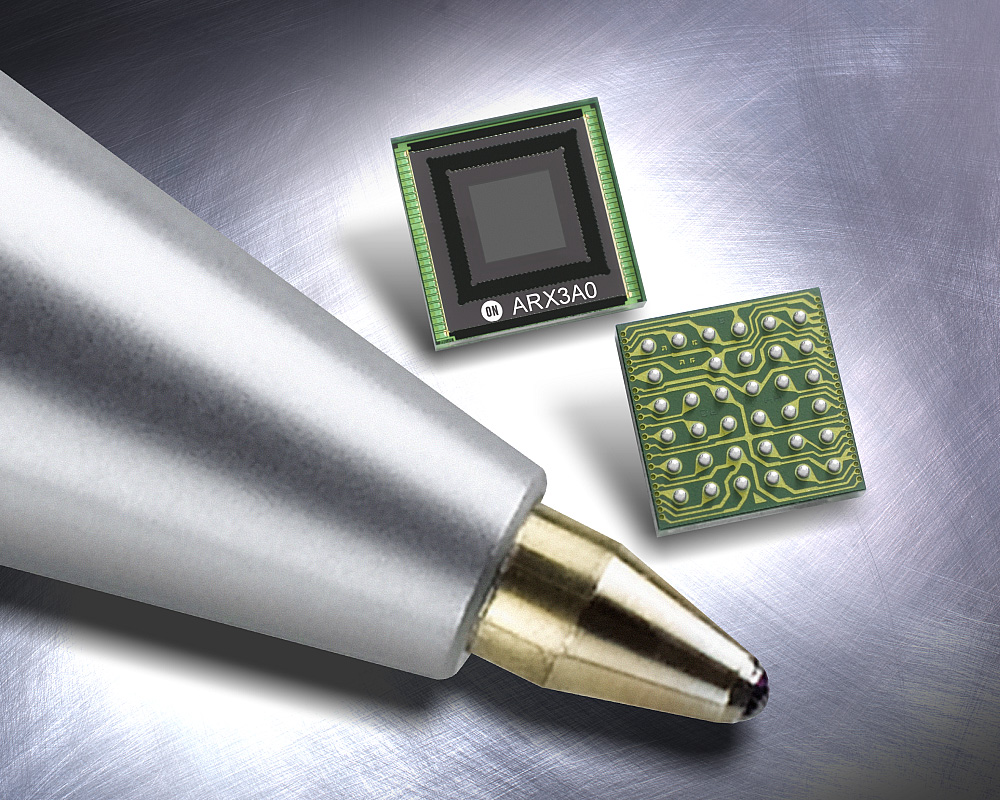

The semiconductor industry has a captivating history that began with the discovery that certain materials could conduct electricity under specific conditions. This breakthrough led to advancements in chip manufacturing processes and technologies, revolutionizing various sectors.

The introduction of microprocessors enabled personal computers, while memory chips facilitated the development of storage devices with increasing capacity. Semiconductors have become essential components in our everyday lives, powering smartphones, tablets, smart home devices, and electric vehicles.

With technology constantly evolving, the demand for semiconductors continues to grow. This industry’s relentless pursuit of innovation drives progress and shapes our future.

Definition and Explanation of Dividend Stocks

Dividend stocks, in essence, are shares of companies that distribute a portion of their profits as dividends to shareholders. Unlike growth stocks that reinvest all their earnings back into the business, dividend stocks provide investors with regular income in the form of cash payments.

These types of stocks are favored by investors seeking a combination of potential capital appreciation and a steady stream of passive income. By owning dividend stocks, individuals can benefit from both the growth potential of the company’s stock value and consistent cash flow from dividend payments.

Dividends are typically paid on a quarterly or annual basis, depending on the company’s policy. This schedule allows investors to anticipate and plan for these income streams accordingly. The frequency and amount of dividend payments can vary based on factors such as company profitability, financial stability, and overall market conditions.

Investing in dividend stocks can be particularly appealing for those looking to supplement their regular income or build long-term wealth through compounding returns. By reinvesting dividends received, investors can potentially increase their holdings over time, leading to higher future payouts.

Additionally, dividend stocks often belong to well-established companies with a track record of generating consistent profits. These companies tend to operate in stable industries and have proven business models that allow them to sustain regular dividend payments even during economic downturns.

One key advantage of investing in dividend stocks is the ability to diversify one’s portfolio across various sectors and industries. This diversification helps mitigate risk by spreading investments across different types of businesses.

In summary, dividend stocks offer investors the opportunity for both capital appreciation and recurring passive income through regular cash dividends. These investments can provide stability and potential long-term growth while allowing individuals to benefit from reliable income streams.

Benefits of Investing in Dividend Stocks

Investing in dividend stocks offers multiple advantages for investors. Firstly, it provides a predictable and stable source of income, making it particularly appealing to retirees or those seeking consistent cash flow.

Additionally, dividend stocks tend to be less volatile than growth stocks, providing stability during market downturns and a sense of security. Moreover, through dividend reinvestment plans (DRIPs), investors can compound their returns over time without additional capital investment.

This allows for potential wealth accumulation and accelerated growth. Lastly, certain jurisdictions offer tax advantages for dividends, further enhancing investment returns. In summary, investing in dividend stocks presents benefits such as reliable income, reduced volatility, compounding returns through DRIPs, and potential tax advantages.

Importance of Dividends for Long-Term Investors

Dividends hold significant importance for long-term investors as they provide a dual benefit of generating income while preserving capital.

When planning for retirement or financial independence, considering dividend stocks is essential, as they offer a reliable source of passive income that complements other sources like pensions or social security.

Furthermore, historical data shows that dividend-paying companies have consistently outperformed non-dividend-paying ones over the long run. Reinvested dividends have proven to be a significant contributor to overall returns in successful portfolios.

Therefore, incorporating dividend investing into one’s strategy can steadily build wealth over time.

Dividends serve as an indicator of a company’s financial health and stability. Companies that regularly pay dividends are often well-established and possess solid cash flows. By investing in these companies, long-term investors can benefit from both the potential growth of the underlying stock and the consistent income stream provided by dividends.

Moreover, dividends provide a cushion during market downturns. When stock prices decline, dividend payments remain relatively stable, offering some degree of protection to investors’ portfolios.

This stability not only provides peace of mind but also allows investors to reinvest their dividends at lower stock prices, potentially increasing their future returns when markets recover.

Another advantage of dividend stocks for long-term investors is the power of compounding. Reinvesting dividends allows shareholders to purchase additional shares, leading to an exponential growth effect over time. This compounding effect can significantly enhance investment returns and accelerate wealth accumulation.

In summary, dividends play a crucial role in the investment journey of long-term investors. They offer a reliable source of passive income, contribute to overall portfolio returns, indicate financial stability in companies, provide stability during market downturns, and enable the power of compounding.

By incorporating dividend stocks into their investment strategy, long-term investors can generate sustainable income and steadily build wealth over time.

Overview of the semiconductor industry’s growth potential

The semiconductor industry is set for significant growth due to its crucial role in technology, healthcare, automotive, and renewable energy sectors. As emerging technologies like AI, 5G, and IoT gain traction, the demand for semiconductors is expected to surge.

Investing in dividend stocks within the semiconductor sector allows investors to benefit from this growth potential while receiving regular income. By choosing companies with a strong track record and solid dividends, investors can enjoy capital appreciation and consistent returns.

Exploring the Stability and Reliability of Semiconductor Companies

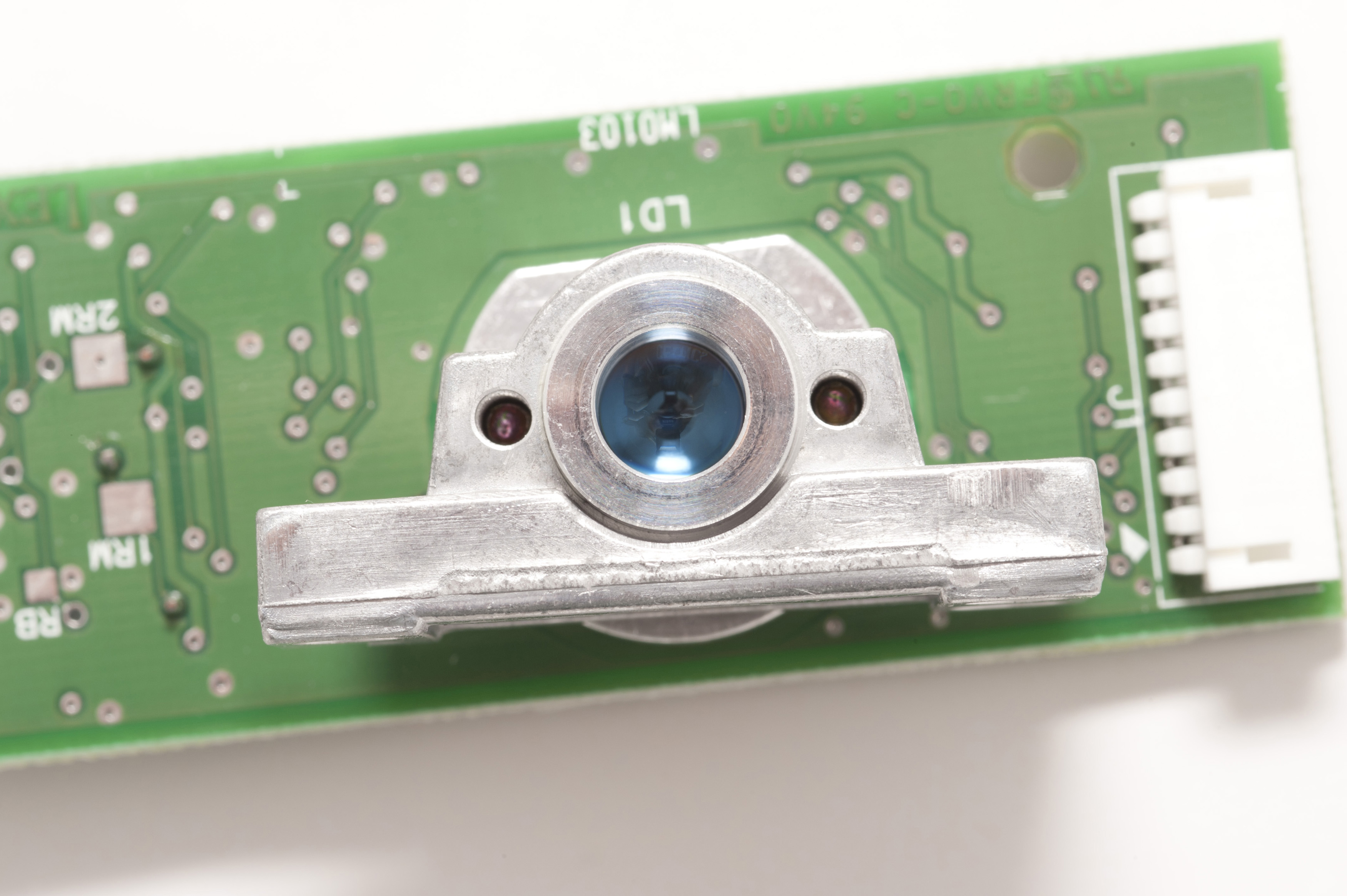

Semiconductor companies are known for their resilience and stability. They operate in an industry with high barriers to entry, requiring significant investments in research and development as well as advanced manufacturing facilities.

Furthermore, many semiconductor companies have established long-standing relationships with key customers, which leads to consistent orders and revenue streams. This stability makes them attractive investments for income-focused investors looking for reliable dividend payments.

Semiconductor companies also demonstrate adaptability, responding to changing market conditions and technological advancements. Their ability to navigate economic downturns is supported by a diverse customer base and a global presence, reducing dependency on specific regions or industries.

Overall, the stability and reliability of semiconductor companies position them favorably in the market, making them a compelling choice for investors seeking consistent returns.

[lyte id=’1_-iB3ZvQiQ’]

.jpg)