Investing in stocks has become more accessible than ever, thanks to platforms like Robinhood. With its user-friendly interface and commission-free trades, Robinhood has attracted a new wave of beginner investors looking to dip their toes into the stock market.

In this article, we will delve into the world of Robinhood stocks under $5 and uncover their appeal for those looking to learn investing.

We will discuss the benefits of investing in low-priced stocks on Robinhood, factors to consider before making investment decisions, how to identify promising stocks under $5, the risks associated with these investments, and strategies for mitigating those risks.

By the end of this article, you’ll have a clearer understanding of the potential that lies within Robinhood stocks under $5 and how to navigate this exciting investment landscape.

Introduction

Robinhood stocks have gained popularity among beginner investors due to their accessibility and no-cost approach. With low-priced stocks available under $5 per share, individuals with limited funds can build a diverse portfolio and potentially achieve significant returns.

This article aims to provide valuable insights on investing in Robinhood stocks under $5, exploring benefits, factors to consider, promising stocks, risks, and strategies for informed decision-making.

Whether you’re a seasoned investor or a beginner, this guide equips you with the knowledge to enhance your investment strategy using Robinhood as your preferred platform. Let’s uncover the untapped potential of affordable stocks on Robinhood together.

The Benefits of Robinhood Stocks

Investing in Robinhood stocks offers significant advantages for investors. One key benefit is the elimination of trading fees, allowing users to buy and sell stocks without incurring additional costs. This makes it an attractive option for those starting with smaller investment amounts.

Additionally, Robinhood provides access to low-priced stocks, typically priced under $5 per share. This affordability allows investors to purchase more shares within their budget, enabling them to build a diversified portfolio across different industries.

For beginner investors, low-priced stocks on Robinhood offer an excellent opportunity to learn about different sectors and gain hands-on experience without risking large sums of money upfront. Overall, Robinhood’s fee-free trades and accessibility to affordable stocks make it a compelling platform for individuals looking to grow their portfolios.

Factors to Consider When Investing in Low-Priced Stocks

Investing in low-priced stocks can be appealing, but thorough research is crucial before making any investment decisions. Consider company fundamentals (revenue growth, profitability), industry trends (emerging sectors, disruptive technologies), and market conditions (economic outlook).

By understanding these aspects, investors can make informed choices and increase their chances of success.

Tips for conducting due diligence include analyzing financial statements, evaluating management teams, studying competitors, and staying updated on news and market trends. Thorough research builds confidence in investment decisions and aligns them with financial goals.

Identifying Promising Stocks Under $5

Investors looking for potential opportunities in low-priced stocks can turn to Robinhood’s selection of stocks under $5. These often overlooked stocks can provide unique prospects for those willing to do their research and take calculated risks.

When identifying promising stocks under $5 on Robinhood, consider factors such as recent positive developments, financial performance, growth strategies, and industry outlooks. For example, Stock X has shown consistent growth with new partnerships and expansions into untapped markets.

Stock Y stands out with its unique market positioning and innovative growth strategies within a rapidly growing industry. Stock Z has enhanced competitive advantages through strategic partnerships or acquisitions, positioning it for potential expansion.

By analyzing these factors and leveraging the resources available on Robinhood’s platform, investors can uncover hidden gems with substantial potential. Thorough research is essential to mitigate risks and maximize returns when investing in low-priced stocks.

Investing in low-priced stocks requires careful consideration and analysis. While they carry higher risks, they also offer potential for significant returns. By utilizing Robinhood’s tools and conducting thorough research, investors can navigate this market segment and identify promising opportunities that align with their investment goals.

The Risks Associated with Investing in Low-Priced Stocks on Robinhood

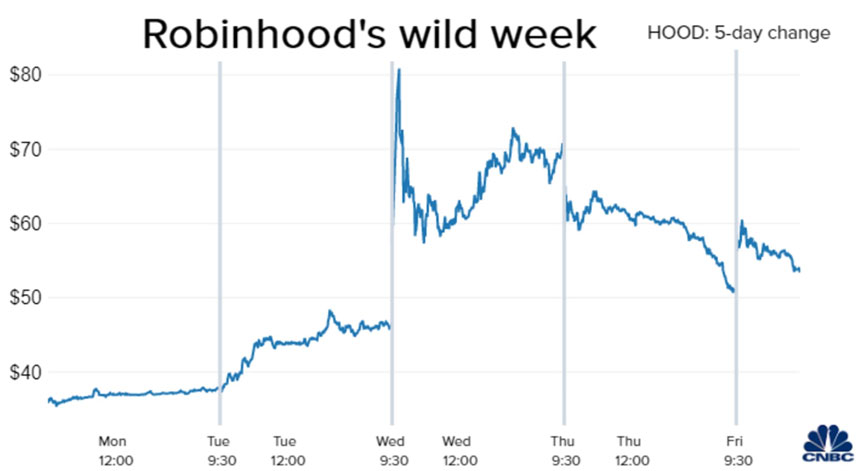

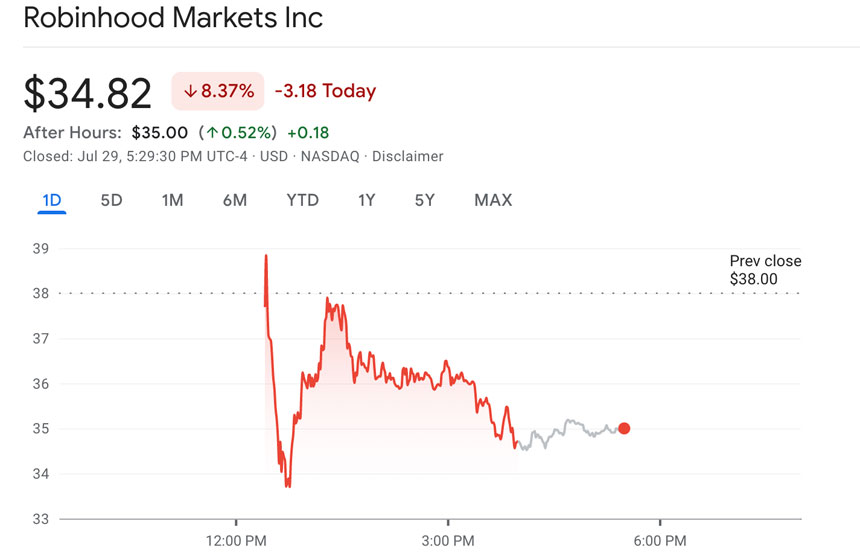

Investing in low-priced stocks on Robinhood carries unique risks that investors should consider. Market volatility can lead to significant fluctuations in stock prices, potentially resulting in losses. Company-specific risks, such as poor management decisions or financial challenges, can also impact the performance of these stocks.

Low-priced stocks often lack information and transparency due to their smaller size or limited coverage by analysts. This makes it challenging for investors to thoroughly assess the potential risks and rewards associated with these stocks.

Furthermore, the lower price of these stocks makes them susceptible to price manipulation or fraudulent activities. Unscrupulous individuals may attempt to artificially inflate or manipulate the stock price, leading unsuspecting investors into significant losses.

To mitigate these risks, investors should exercise caution, conduct thorough research, and stay vigilant when investing in low-priced stocks on platforms like Robinhood.

Strategies for Mitigating Risks

Diversification is crucial when investing in low-priced stocks. Spreading investments across different sectors and asset classes reduces risk exposure. By including a mix of stocks from various industries, investors can avoid relying too heavily on any single sector.

Stop-loss orders are valuable tools for managing risk with low-priced stocks. These orders automatically sell a stock if its price falls below a predetermined level. Implementing stop-loss orders helps limit potential losses and protects investments from drastic declines.

Taking a long-term approach is important when investing in low-priced stocks. Instead of seeking quick profits, focus on the fundamentals and growth prospects of companies. Research financial health, competitive advantage, and future outlook to make informed decisions.

In summary, diversifying investments, using stop-loss orders, and adopting a long-term perspective are effective strategies for mitigating risks with low-priced stocks. Spreading investments, setting stop-loss orders, and focusing on company fundamentals can help reduce risk exposure and increase the potential for favorable returns.

Exploring the Potential of Robinhood Stocks Under $5

Investing in Robinhood stocks under $5 is a cost-effective way for beginner investors to enter the stock market and build a diverse portfolio. However, thorough research and consideration of important factors are crucial before making investment decisions.

While these stocks offer potential for high returns, they also come with risks that need to be managed effectively.

Diversification is essential to mitigate these risks. Spreading investments across different sectors helps minimize losses from any single stock. Utilizing stop-loss orders can further protect investments by automatically selling stocks if their price falls below a predetermined level.

Taking a long-term approach is advisable when investing in low-priced stocks. Patiently riding out market fluctuations allows investors to benefit from growth potential over time. Conducting due diligence, researching company fundamentals, and staying informed about market trends are critical steps to minimize risks.

[lyte id=’WpXw_ejAqsk’]