Investing in precious metals has long been a popular strategy for diversifying investment portfolios and hedging against inflation. One of the most well-known financial gurus, Dave Ramsey, has garnered a massive following with his practical advice on personal finance.

However, when it comes to investing in silver, Ramsey’s perspective may surprise you.

Introduction to Dave Ramsey’s Background and Expertise in Personal Finance

With over three decades of experience, Dave Ramsey has become a renowned financial guru in the realm of personal finance. He rose to fame by providing sound advice that resonates with individuals from all walks of life.

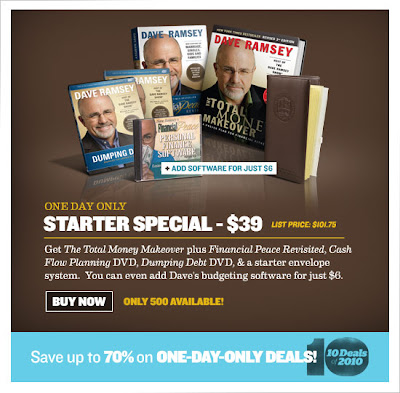

Ramsey’s expertise lies in empowering individuals to take control of their money through principles such as budgeting, debt elimination, emergency savings, and wise investing. His relatable approach and unwavering commitment have transformed the lives of millions, guiding them towards financial freedom and a brighter future.

Investing in Precious Metals: An Overview of Silver as an Investment Option

Investing in silver is a strategy that involves diversifying your portfolio by allocating a portion towards tangible assets. Throughout history, silver has been valued for its rarity, durability, and industrial applications. Its role as both a currency and a store of value makes it an attractive investment option.

Analyzing market trends and indicators is crucial to assess potential risks and rewards associated with silver investments. With its ability to act as a hedge against economic uncertainties and currency depreciation, silver offers stability and long-term growth potential.

Consider investing in silver to diversify your portfolio beyond traditional assets like stocks and bonds.

The Pros and Cons of Investing in Silver According to Experts

Investing in silver has its advantages and drawbacks, according to financial experts. One benefit is its potential as a hedge against inflation, offering protection during times of rising prices. It also allows for portfolio diversification, spreading risk across different asset classes.

However, there are risks to consider, such as price volatility and storage costs for physical silver. Liquidity issues may arise with certain forms of silver investments, and counterparty risks could be a concern for certain financial instruments.

As with any investment, it’s crucial to weigh these factors before making decisions about investing in silver.

Dave Ramsey’s Perspective on Investing in Silver: Is It Worth It?

Dave Ramsey does not advocate for heavy investments in silver. While some exposure to precious metals is beneficial for diversification, putting a significant portion of wealth into silver may not yield substantial long-term returns.

Ramsey suggests exploring alternative options like low-cost index funds, REITs, or dividend-paying stocks that offer better growth potential and income generation. Silver’s historical volatility and the additional costs and risks associated with physical possession make it less favorable compared to these alternatives.

Conducting thorough research and considering financial goals are crucial before making investment decisions.

Real-Life Stories: Individuals Who Invested in Silver Following Dave Ramsey’s Advice

Despite Dave Ramsey’s reservations about investing in silver, some individuals have chosen to follow his guidance and venture into this precious metal. These real-life stories provide valuable insights into the challenges and successes encountered during their investment journey.

From remarkable returns to market fluctuations, these narratives shed light on the potential outcomes of investing in silver and how it aligns with different financial goals. However, it’s important to remember that these stories are not guarantees for success or indicators of future performance.

Each individual’s experience is unique, influenced by various factors such as timing and personal circumstances. Exploring these real-life stories offers a comprehensive perspective on the alternative investment strategy of silver.

Alternatives to Investing in Physical Silver Recommended by Dave Ramsey

While Dave Ramsey may not advocate for heavy investment in physical silver, he does offer alternative options for those seeking similar benefits. One such option is low-cost index funds or exchange-traded funds (ETFs), which provide diversification across a range of sectors and asset classes.

These investment vehicles allow investors to spread their risk and potentially benefit from the overall growth of the market.

Another alternative suggested by Ramsey is real estate investment trusts (REITs) or dividend-paying stocks. REITs are companies that own, operate, or finance income-generating real estate properties. Investing in REITs can provide individuals with exposure to the real estate market without the need for direct property ownership.

This option offers the potential for both income generation through dividends and long-term capital appreciation.

Dividend-paying stocks are another avenue worth considering. These stocks belong to companies that distribute a portion of their profits back to shareholders in the form of dividends.

By investing in dividend-paying stocks, individuals have the opportunity to earn regular income while also participating in potential capital gains as the stock price appreciates over time.

Both REITs and dividend-paying stocks provide alternatives to physical silver investments that can deliver financial benefits over the long term. While these options require careful research and consideration, they offer individuals an opportunity to diversify their portfolios and potentially achieve their financial goals.

In summary, Dave Ramsey suggests exploring alternative investment options that can provide similar benefits as physical silver investments. These include low-cost index funds or ETFs, which offer diversification across various sectors and asset classes.

Additionally, considering investments in REITs or dividend-paying stocks can provide individuals with potential income generation and long-term capital appreciation opportunities.

By exploring these alternatives, investors can tailor their portfolios to align with their financial objectives while reducing reliance on physical silver as a sole investment strategy.

Tips for Wise Silver Investments

Investing in silver requires caution and informed decision-making. Follow these tips to make wise silver investments:

-

Research: Thoroughly research market trends and factors influencing silver prices.

-

Set Realistic Goals: Determine your investment horizon and desired rate of return based on your financial objectives and risk tolerance.

-

Dollar-Cost Averaging (DCA): Invest a fixed amount regularly to minimize the impact of short-term market volatility.

-

Diversify Your Portfolio: Spread risks by investing in different asset classes, not just silver.

-

Stay Informed: Subscribe to reliable financial publications and follow expert analysts for valuable insights.

By implementing these strategies, you can navigate the silver market more effectively and potentially achieve your investment goals.

Conclusion: Navigating Your Path in Investing

Investing is a complex endeavor that requires careful consideration and strategic decision-making. While silver investments may not be suitable for everyone, it is important to approach the topic with an open mind and explore alternative options.

Dave Ramsey’s perspective on investing in silver offers a unique viewpoint, but readers should conduct thorough research and understand their financial goals before making any investment decisions.

Diversifying your portfolio beyond silver investments is crucial to mitigate risks and maximize returns. Exploring other investment options recommended by experts like Dave Ramsey can provide valuable insights. Seeking professional advice tailored to your specific financial goals can further enhance your investment journey.

Remember that investing is not one-size-fits-all. Each individual has unique circumstances and aspirations for their financial future. By combining research, exploration of various options, and seeking professional guidance, investors can confidently navigate their path in investing.

[lyte id=’vfU5CwdkSUk’]