In the ever-evolving landscape of technology, there is one field that has captured the imagination of investors and experts alike – quantum computing. This emerging technology holds immense potential to revolutionize various industries, making it an enticing opportunity for those looking to invest in the future.

In this article, we will delve into the world of quantum computing public companies, exploring their rise, evaluating their investment potential, analyzing their financial performance, and addressing the risks and challenges associated with investing in this nascent field.

So fasten your seatbelts as we embark on a journey through the quantum realm of investing.

The Quantum Computing Revolution: An Opportunity for Investors

Quantum computing is an exciting field that has captured the attention of investors. This revolutionary technology can solve complex problems beyond the capabilities of classical computers. Industries such as finance, healthcare, logistics, and cybersecurity are eagerly awaiting breakthroughs offered by quantum computing.

As an investor, understanding its potential impact on these sectors is crucial for identifying lucrative opportunities.

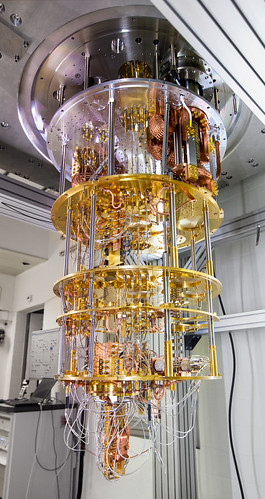

Quantum computing processes information using qubits instead of classical bits. Qubits can exist in multiple states simultaneously, thanks to a phenomenon called superposition. This allows quantum computers to perform computations exponentially faster than classical computers when solving certain types of problems.

In finance, quantum computing can optimize portfolio management and enhance cybersecurity measures within financial systems. In healthcare, it can accelerate drug discovery and development processes.

Logistics can benefit from optimized supply chain networks, while cybersecurity can be strengthened through the development of quantum-resistant cryptography.

The quantum computing revolution presents a unique opportunity for investors to capitalize on this transformative technology. By staying informed and proactive in exploring potential investments, investors can position themselves for long-term growth and success in a rapidly evolving field.

Exploring the Rise of Quantum Computing Public Companies

The rapid advancement in quantum computing research has led to the emergence of public companies dedicated to developing and commercializing this groundbreaking technology. These companies aim to meet the increasing demand for quantum solutions across industries, making them attractive investment options.

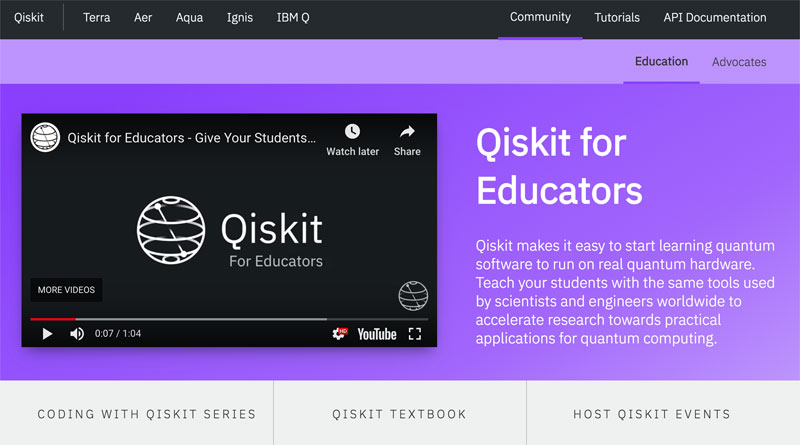

Prominent players like IBM, Google, Microsoft, and D-Wave Systems have made significant contributions to the quantum computing industry. IBM’s IBM Q system offers researchers access to cloud-based quantum computers, while Google focuses on achieving “quantum supremacy” through advanced algorithms.

Microsoft’s Azure Quantum platform provides a comprehensive environment for quantum development, and D-Wave Systems specializes in building commercial-scale adiabatic quantum computers.

These companies are driving progress in solving complex problems that were previously unsolvable using classical computers alone. With continued advancements and collaborations, the future of quantum computing looks promising as it revolutionizes various industries and fuels global innovation.

Evaluating Quantum Computing Stocks as an Investment Opportunity

Investing in quantum computing stocks offers a chance to participate in a rapidly growing market with immense potential for future profitability. However, before committing capital, it is crucial to evaluate factors such as the competitive landscape, market demand for quantum solutions, and the company’s long-term viability.

Additionally, consider technological barriers, intellectual property protection, research partnerships, and the ability to attract top talent. Thorough evaluation of these factors will help determine the investment potential of quantum computing stocks.

Analyzing the Financial Performance of Quantum Computing Public Companies

Examining the financial performance of quantum computing public companies is crucial for assessing their position as investment opportunities. Metrics such as revenue growth, profitability margins, and market share provide valuable insights into a company’s ability to generate returns for shareholders.

To evaluate these companies effectively, key metrics come into play. These include research and development expenses as a percentage of revenue, cash burn rate, customer acquisition costs, and the ability to secure government grants or contracts.

Understanding these metrics can help investors make informed decisions about their investment portfolio.

By analyzing the financial performance of quantum computing public companies using these metrics, investors gain a deeper understanding of their potential for growth and overall financial health. This assessment enables more informed decision-making regarding investment opportunities in this evolving field.

Risks and Challenges in Investing in Quantum Computing Stocks

Investing in quantum computing stocks comes with risks and challenges. The technology is still in its early stages, raising uncertainties about commercial viability and adoption timelines. Competition from other emerging technologies, regulatory hurdles, and technical limitations are factors that investors must consider.

Staying updated on legal developments and monitoring research advancements becomes crucial for informed investment decisions.

Strategies for Successful Investing in Quantum Computing Stocks

When investing in quantum computing stocks, thorough research is crucial. Consider a company’s fundamentals, management teams, partnerships, and technological advancements. Diversify your investments to mitigate risk and maximize potential returns.

Choose between a long-term approach, capitalizing on technological advancements over time, or a short-term strategy that takes advantage of market fluctuations or industry events. Successful investing in quantum computing stocks requires careful evaluation and strategic decision-making.

Success Stories from Investing in Quantum Computing Public Companies

Investors who recognize emerging technologies have reaped substantial rewards by investing in quantum computing. Analyzing success stories of those who invested in public companies specializing in this field provides valuable insights into strategies and foresight for remarkable returns.

These case studies reveal how investors capitalized on the growth of quantum computing stocks through informed decision-making, offering lessons for future investments. Applying these lessons increases the likelihood of making informed choices and achieving favorable outcomes.

These success stories inspire and guide investors looking to enter the exciting field of quantum computing. Studying them enhances understanding and improves decision-making in this rapidly evolving market, leading to remarkable returns.

| Heading | Content |

|---|---|

| Field | Quantum Computing |

| Focus | Success stories from investing in quantum computing companies |

| Purpose | Provide insights and guidance for future investment decisions |

| Approach | Analyze case studies of successful investors |

| Lessons Learned | Factors contributing to success, key indicators, strategies |

| Benefits | Inspiration, motivation, informed decision-making |

Note: The table above provides a summary of the content discussed in the paragraph.

The Future Outlook for Quantum Computing Public Companies

The quantum computing industry is set to experience exponential growth in the coming years, with advancements pushing boundaries and revolutionizing sectors like drug discovery, optimization, encryption, and artificial intelligence. Investors who position themselves early in this field can benefit from its future expansion.

Emerging trends and innovations within the sector present opportunities for potential investments or strategic partnerships that could generate significant returns.

Quantum computing has the potential to transform industries by speeding up drug discovery processes, solving complex optimization problems, enhancing data encryption, and advancing artificial intelligence models. With its promising outlook, quantum computing is an exciting area for investors to explore.

[lyte id=’sNn39TkbV9M’]