Investing in dividend-paying stocks is an excellent strategy for investors seeking a stable income stream and the potential for capital appreciation. One such company that offers attractive dividends is Public Storage.

With a strong brand presence, extensive property portfolio, and affordable pricing strategy, Public Storage has become a leader in the self-storage industry.

In this article, we will delve into the story of Public Storage, understand the concept of dividend yield, explore the company’s dividend history, analyze factors impacting its dividend yield, evaluate its sustainability, and discuss strategies to maximize returns from its dividends.

The Story of Public Storage

Public Storage, a renowned real estate investment trust (REIT), has grown from its humble beginnings in Southern California to become a market leader in the self-storage industry.

Founded in 1972 by B. Wayne Hughes Sr., the company has expanded through strategic acquisitions and organic growth, establishing thousands of locations across the United States.

As a customer-centric business, Public Storage leases storage units on short-term or long-term bases, providing convenient solutions for individuals and businesses. With its extensive property portfolio and commitment to accessibility and convenience, Public Storage ensures customer satisfaction.

With a strong focus on service excellence, Public Storage has earned the trust and loyalty of its customers. Beyond business operations, the company actively contributes to communities through philanthropic initiatives.

Overall, Public Storage’s success is attributed to its adaptability and commitment to quality service. As a leader in the self-storage industry, Public Storage continues to redefine standards with its innovative approach and dedication to meeting customer needs.

Understanding Dividend Yield

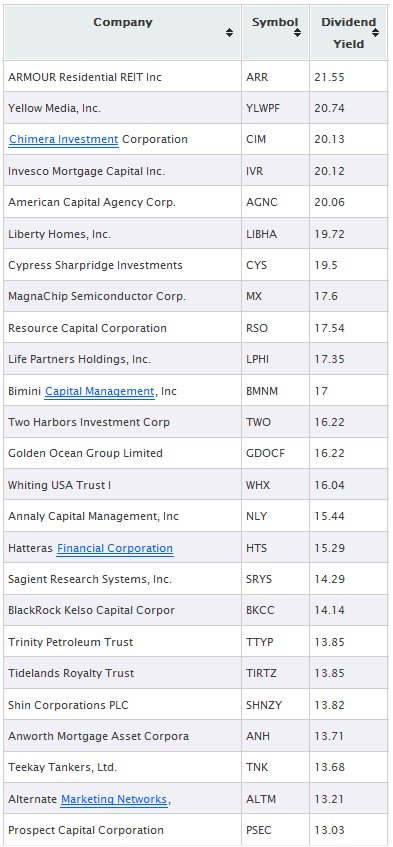

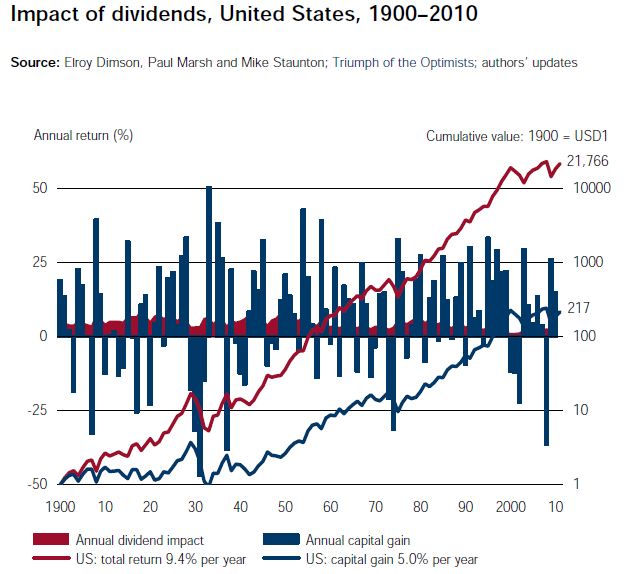

Dividend yield is a key metric for investors to assess the income potential of a stock investment. It represents the percentage return on investment generated by dividends relative to the stock’s price.

To calculate dividend yield, divide the annual dividend per share by the stock’s current price and multiply by 100. Factors influencing dividend yield include financial performance, cash flow generation, payout ratios, and industry dynamics.

Analyzing these factors helps investors evaluate the sustainability and potential growth of a company’s dividends. By considering financial performance, cash flow, payout ratios, and industry norms, investors can make informed decisions about stocks with attractive dividend yields.

Public Storage’s Dividend History

Public Storage has a strong track record of consistently paying dividends to its shareholders. This regular income distribution makes it an attractive option for investors seeking stable returns. Over the years, Public Storage has demonstrated its commitment to rewarding its shareholders by increasing its dividend payments.

Analyzing Public Storage’s dividend growth reveals a positive trend, showcasing the company’s dedication to providing value to its investors. By consistently increasing its dividends, Public Storage not only offers a reliable source of income but also demonstrates its financial stability and long-term growth potential.

When comparing Public Storage’s dividend yield with that of its industry peers, valuable insights can be gained into how the company fares in terms of income generation for investors. This comparison allows investors to gauge whether Public Storage is performing above or below average within the industry.

It provides a benchmark against which the company’s dividend-paying abilities can be evaluated.

By maintaining a strong dividend payment track record and showcasing consistent growth over the years, Public Storage distinguishes itself as a reliable investment option in the real estate sector.

Its ability to generate stable returns through dividends offers peace of mind for shareholders and attracts new investors looking for dependable income sources.

Overall, Public Storage’s dividend history highlights its commitment to rewarding shareholders and positions it favorably among industry peers. By delivering consistent dividends and demonstrating growth over time, Public Storage provides investors with an appealing opportunity for stable income generation within the real estate sector.

Factors Impacting Public Storage’s Dividend Yield

Public Storage’s dividend yield, a key metric for investors, is influenced by various factors that reflect the financial performance and stability of the company. These factors play a crucial role in determining the sustainability and potential growth of its dividend payments.

Earnings growth and stability are paramount considerations when evaluating Public Storage’s ability to generate consistent returns for shareholders. A company with a track record of steady earnings growth instills confidence in investors, as it indicates the potential for stable and possibly increasing dividend payments over time.

Another important factor to assess is Public Storage’s debt levels and interest coverage ratio. Monitoring these metrics provides insight into the company’s financial stability and its ability to meet its dividend obligations. Excessive debt can strain cash flow, making it challenging for a company to sustain or increase dividend payments.

On the other hand, a healthy interest coverage ratio demonstrates that Public Storage has sufficient earnings to cover interest expenses, enhancing its capacity to distribute dividends.

By scrutinizing these financial indicators, investors can gain valuable insights into the factors impacting Public Storage’s dividend yield. This analysis helps them make informed investment decisions based on the company’s performance and its potential to provide consistent returns through dividends.

Table: Factors Impacting Public Storage’s Dividend Yield

| Factors | Influence on Dividend Yield |

|---|---|

| Earnings growth and stability | Potential for sustained or increased dividend payments |

| Debt levels and interest coverage ratio | Financial stability and ability to meet dividend obligations |

Evaluating Public Storage’s Dividend Sustainability

When evaluating the sustainability of Public Storage’s dividends, we analyze its cash flows, payout ratios, and ability to generate surplus funds. This assessment helps us determine if the company can consistently support dividend payments in different market conditions.

By examining Public Storage’s cash flows, we assess its ability to generate sufficient funds for dividend payments over time.

Analyzing payout ratios, such as the dividend payout ratio and free cash flow payout ratio, provides insights into the proportion of earnings or cash flow allocated towards dividends.

Reviewing Public Storage’s cash flow from operations and free cash flow gives us a deeper understanding of its ability to generate surplus funds for dividends and future growth initiatives.

In summary, evaluating Public Storage’s dividend sustainability involves analyzing its cash flows, payout ratios, and ability to generate surplus funds for consistent dividend payments.

Public Storage’s Competitive Advantage in the Industry

Public Storage excels in the self-storage industry thanks to its strong brand presence and market leadership, extensive property portfolio, and affordable pricing strategy.

With a trusted reputation and years of experience, Public Storage has become a recognized leader in the industry. Its robust brand recognition attracts customers and sets the company apart from competitors.

Public Storage’s vast property portfolio spans various locations, reducing dependency on specific markets and ensuring revenue stability. This geographic diversification allows the company to adapt swiftly to changing market conditions.

By adopting an affordable pricing strategy, Public Storage appeals to a wide customer base. This customer-centric approach drives rental occupancy rates and strengthens the company’s financial position.

In summary, Public Storage’s competitive advantage lies in its strong brand presence, extensive property portfolio, and affordable pricing strategy. These factors contribute to its industry leadership and ongoing success.

Investing in Public Storage for Dividend Income & Maximizing Returns

Investing in dividend-paying stocks like Public Storage can provide a stable income stream and potential capital appreciation. These stocks offer reliable dividends, even during market volatility, making them attractive to investors seeking consistent cash flow.

Dividends also act as a hedge against inflation, historically outpacing rising living costs. To maximize returns from Public Storage’s dividends, consider reinvesting through DRIPs, timing purchases strategically, and diversifying your portfolio with other dividend-paying stocks.

By implementing these strategies, you can optimize your investment returns while managing risk.

Analysis of Risks Associated with Investing in Public Storage

Investing in Public Storage comes with certain risks, particularly those associated with the self-storage industry’s market dynamics. Economic downturns can lead to decreased demand for storage facilities, impacting Public Storage’s revenue and dividends.

Additionally, competition from new entrants or existing players poses a threat to the company’s market share and profitability. It is important for investors to carefully evaluate these risks when considering an investment in Public Storage, taking into account both macroeconomic factors and industry-specific competition.

Consulting with a financial advisor is advised before making any investment decisions.

[lyte id=’50b5lR0TTlU’]