Welcome to the world of investing, where opportunities abound and financial success awaits those who are willing to take the plunge. If you have a basic understanding of investing and are ready to take your portfolio to new heights, then this article is for you.

In this article, we will explore the concept of a power portfolio and how it can lead you on a path to financial success in 2023. We will delve into key principles that should be considered when building your power portfolio, including risk assessment, diversification, and stock selection.

Additionally, we will unveil some of the top stocks for 2023 across various sectors such as technology, healthcare, and renewable energy.

But don’t worry if you’re feeling overwhelmed – we’ve got you covered! We’ll provide real-life case studies of successful power portfolios from previous years so you can learn from the strategies employed by these investors.

And of course, we’ll share tips for perfecting your own power portfolio strategy and navigating potential risks along the way.

So get ready to embark on an exciting journey towards financial success through investing. Whether you’re a seasoned investor or just starting out, this article will equip you with the knowledge and resources necessary to make informed investment decisions.

Let’s dive in!

The Power Portfolio 2023: A Path to Financial Success

A power portfolio is a well-diversified collection of carefully selected investments with long-term growth in mind. Unlike portfolios focused on short-term gains, a power portfolio aims to build wealth over time through compounding returns.

By investing in stocks with strong growth potential and holding them for the long term, investors can tap into the success of thriving companies and potentially enjoy substantial returns in the years to come. Stocks have historically outperformed other investment options, making them a key component of any well-rounded investment portfolio.

With proper research, diversification, and monitoring, a power portfolio can pave the way for financial prosperity in 2023 and beyond.

Building Your Power Portfolio: Key Principles to Consider

When building a power portfolio, there are key principles to keep in mind. Assess your risk tolerance and investment goals to determine suitable investments. Diversify your portfolio across asset classes, industries, and regions to minimize risks. Thoroughly research stocks with strong growth potential and stay informed about market trends.

Lastly, emphasize patience and a long-term mindset to resist impulsive reactions and allow investments time to grow. By following these principles, you can create a powerful portfolio aligned with your goals and increase your chances of success in the market.

Unveiling the Top Stocks for 2023: Promising Opportunities Await

In 2023, there are promising growth opportunities in various sectors that investors should consider when building their portfolios. The tech sector continues to drive digital transformation, presenting high-growth potential through innovative companies.

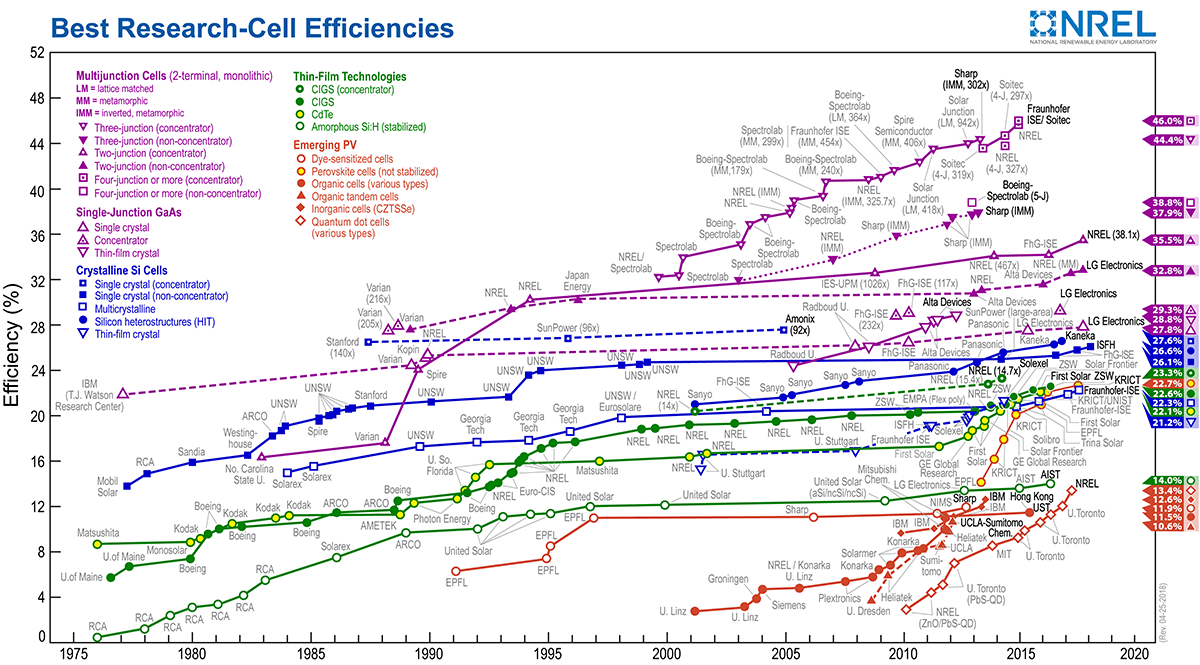

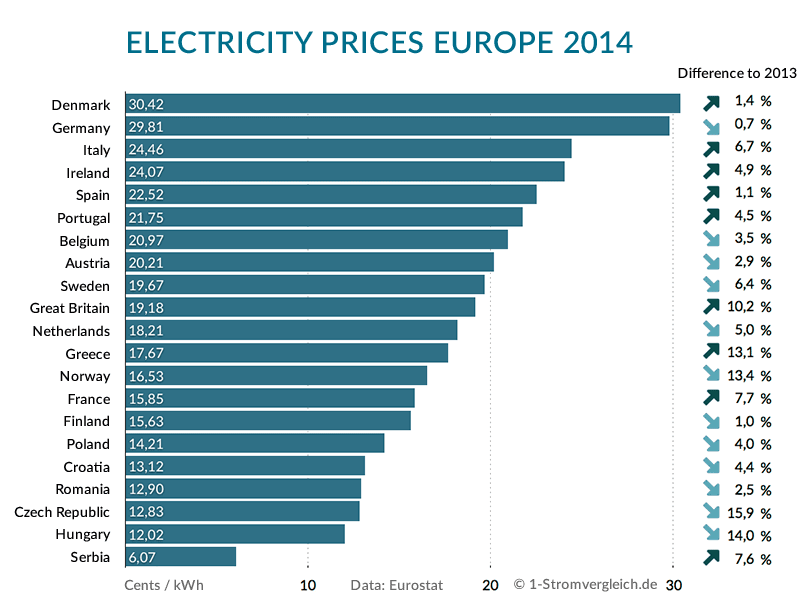

The healthcare sector, driven by an aging population and increasing demand for healthcare services, offers opportunities in pharmaceuticals, biotech, and healthcare services. With the world shifting towards sustainable energy solutions, companies involved in renewable energy production are poised for significant growth.

By exploring specific stocks within these sectors that have shown strong performance and growth prospects, investors can uncover attractive investment opportunities. However, thorough research is essential before making any investment decisions to ensure informed choices align with individual goals and risk tolerance.

Case Studies of Successful Power Portfolios from Previous Years

Let’s explore real-life case studies of individuals who achieved substantial returns through their power portfolios. These examples provide valuable insights for building successful portfolios.

- Case Study 1: Sarah’s Technology Power Portfolio

Sarah invested heavily in technology stocks, focusing on innovative companies in 2017. Despite short-term volatility, she remained committed to her long-term strategy. By 2020, her power portfolio had grown significantly as the tech sector boomed, resulting in substantial returns.

- Case Study 2: John’s Diversified Power Portfolio

John took a diversified approach by investing across various sectors and asset classes. He spread his investments across technology, healthcare, renewable energy, and other industries while considering bonds and real estate investment trusts (REITs). Maintaining a balanced portfolio and regular review led to consistent growth over time.

Analyzing these strategies reveals key insights:

-

Patience: Both Sarah and John showed commitment amid market fluctuations, understanding that investing is a marathon.

-

Diversification: John’s diversified power portfolio mitigated risks and capitalized on opportunities in different sectors for consistent growth.

-

Research and Analysis: Thorough research empowered Sarah and John to identify attractive investment opportunities by staying informed about market trends and emerging industries.

These case studies emphasize the importance of patience, diversification, and diligent research in building successful power portfolios. Learning from others’ experiences can enhance our own investment strategies for long-term success.

Tips for Perfecting Your Power Portfolio Strategy

Building a strong power portfolio is an ongoing process that requires continuous learning and adaptation. Here are some tips to help you perfect your strategy:

-

Stay informed: Keep up with market trends, economic indicators, and company news to make informed investment decisions. Subscribe to financial news platforms and follow industry-specific publications.

-

Regularly review and rebalance: Markets evolve, so regularly review your portfolio and adjust it based on changing conditions or financial goals. Reallocate investments that no longer align with your strategy.

-

Seek professional advice: Consider consulting with financial advisors for personalized recommendations and expertise on complex investment products or strategies.

By following these tips, you can enhance the effectiveness of your power portfolio and increase your chances of long-term success.

Navigating Risks in Power Portfolio Investing

Investing in the stock market comes with risks, but there are steps to minimize potential losses. Address concerns about stock market volatility by staying focused on your investment strategy and avoiding emotional reactions. Set stop-loss orders to protect against significant losses by selling stocks at a predetermined price.

Practice disciplined investing by conducting thorough research and making informed decisions based on long-term goals rather than short-term trends. By implementing these strategies, you can navigate risks and build a strong power portfolio.

Learn Investing: Empowering Yourself Through Education and Resources

Continuous learning is crucial for becoming a successful investor. Staying up-to-date with the latest market trends, strategies, and financial concepts is essential for making informed decisions. Fortunately, there are numerous educational resources available to help enhance your investment knowledge.

Expanding your knowledge through reading books, attending seminars or webinars, taking online courses, or joining investment clubs can empower you with the tools necessary for success. Reputable resources like “The Intelligent Investor” by Benjamin Graham or “A Random Walk Down Wall Street” by Burton Malkiel provide valuable insights.

Financial websites such as Investopedia, Morningstar, and Seeking Alpha offer comprehensive information on investing topics. Online platforms like Coursera and Udemy provide expert-led courses covering various aspects of investing.

By embracing continuous learning and utilizing these educational resources, you can strengthen your understanding of investments and make more informed decisions in the dynamic world of finance. Empower yourself with knowledge to achieve your investment goals.

The Power Portfolio 2023: Your Journey Begins Now!

Congratulations on reaching the end of this article! You’re now ready to embark on your journey towards building a powerful portfolio for 2023. Building a strong portfolio takes time, patience, and discipline. Apply the key principles discussed, adapt your strategy when needed, and set yourself on the path to financial success.

Take action now and start working towards your financial goals through investing. Remember that investing comes with risks, so stay informed, be disciplined, and seek professional advice when necessary.

Continuous learning is crucial for building a successful power portfolio. Stay updated with market trends and opportunities by engaging with reputable resources and industry experts.

Diversification is another key factor. Spread your investments across different asset classes to reduce risk exposure and increase potential returns.

Maintain discipline throughout your investment journey. Avoid impulsive decisions based on short-term fluctuations and follow a well-defined plan that aligns with your long-term objectives.

Seeking professional guidance can provide valuable insights into optimizing your power portfolio. Financial advisors can assess your situation, identify suitable opportunities, and provide ongoing support.

[lyte id=’DeUsqZ3LV30′]