Pair trading is a popular and effective investment strategy that involves simultaneously buying and selling two related securities to profit from their relative price movements. While this strategy has been around for decades, advancements in technology have now made it easier than ever to implement and manage.

Pair trading software plays a crucial role in automating the pair trading process, providing real-time data analysis, statistical modeling, and trade execution functionalities.

In this article, we will explore the benefits of pair trading, understand how pair trading software works, discuss factors to consider when selecting the right software, and delve into successful pair trading strategies facilitated by these powerful tools.

If you’re looking to maximize your investment returns and take your portfolio to new heights, then it’s time to embrace the power of pair trading software.

Definition and Basic Principles of Pair Trading

Pair trading involves identifying two correlated securities and taking advantage of temporary divergences in their performance. Traders simultaneously take long and short positions, capitalizing on the belief that if one security outperforms the other, it will likely revert back to its mean value, generating potential profits.

This strategy requires thorough research, accurate correlation analysis, and effective risk management. Pair trading offers the flexibility to profit in various market conditions and can be applied both for short-term trades and longer-term investments.

Differentiating pair trading from traditional investing strategies

Pair trading sets itself apart from traditional investing strategies by focusing on capturing relative performance between two correlated securities, regardless of overall market conditions.

While traditional strategies rely on identifying undervalued stocks and expecting future appreciation, pair trading does not depend on market direction for profits.

Traditional investing involves buying undervalued or promising stocks with the hope that they will increase in value over time. This approach requires thorough analysis of individual companies, industry trends, and market sentiment. Investors aim to profit from the potential growth of these stocks.

In contrast, pair trading evaluates the relationship between two correlated securities and looks for opportunities where they diverge in relative performance. It allows traders to potentially generate profits irrespective of overall market conditions.

This means that even during periods of volatility or uncertainty, pair traders can still capitalize on diverging movements between the two securities.

Pair trading offers advantages over traditional strategies. Firstly, it provides opportunities for profit in both bullish and bearish markets. While traditional investors may struggle to find profitable opportunities during market downturns, pair traders can still benefit from relative price movements between correlated assets.

Secondly, pair trading can help reduce exposure to broader market risks by focusing on relative price movements rather than overall market direction. This makes it an attractive strategy for diversifying portfolios and minimizing exposure to macroeconomic factors.

In summary, while traditional investing looks for individual stock appreciation, pair trading differentiates itself by capturing relative performance between correlated securities. It offers potential profits regardless of market conditions and helps mitigate broader market risks.

Understanding these distinctions allows investors to make informed decisions about which approach aligns best with their investment goals and risk tolerance.

The Potential Benefits of Pair Trading for Maximizing Investment Returns

Pair trading offers several advantages over traditional investing strategies. Firstly, it can provide consistent returns even during volatile market conditions by relying on relative performance rather than absolute market direction.

Secondly, pair trading allows for risk reduction through diversification, as traders hold long and short positions in two different securities simultaneously. Additionally, pair trading can generate profits regardless of overall market movements, making it an attractive strategy for minimizing risk while actively participating in the market.

Overall, these benefits make pair trading a valuable option for maximizing investment returns.

Overview of Pair Trading Software and its Role in Automating the Pair Trading Process

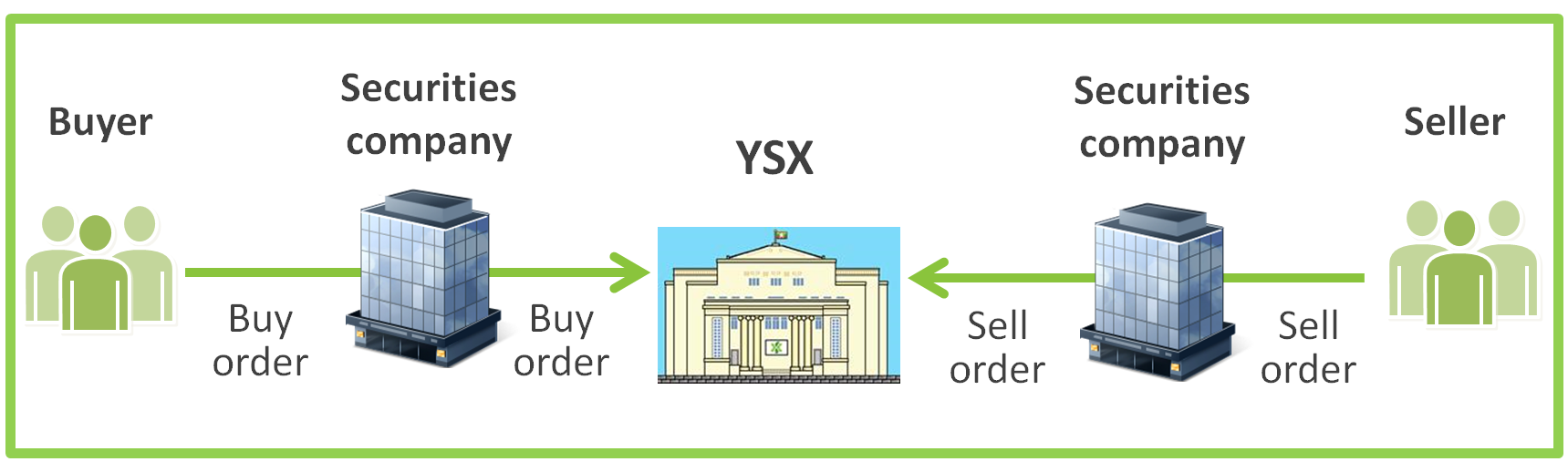

Pair trading software automates and streamlines the pair trading process, revolutionizing how traders approach this strategy. It provides real-time data analysis, statistical modeling, trade execution functionalities, and risk management tools.

By leveraging advanced technology, it saves time, enhances decision-making, increases accuracy, and improves overall performance. Incorporating pair trading software into their toolkit can significantly benefit traders utilizing pair trading strategies.

Key Features and Functionalities of Pair Trading Software

Pair trading software offers a range of powerful tools and capabilities to enhance pair trading strategies. By analyzing real-time market data, utilizing statistical models and algorithms, and providing comprehensive analytical tools, this software helps identify potential pairs with strong correlation or cointegration.

It also enables seamless trade execution across various financial markets and effective position management for risk control. With its features and functionalities, pair trading software empowers traders to make informed decisions and maximize profit potential.

Factors to Consider When Choosing Pair Trading Software

When choosing pair trading software, it’s important to consider several factors that impact its usability and effectiveness.

-

User-friendliness and compatibility: Look for software with an intuitive interface and compatibility with different operating systems.

-

Customization options and pricing models: Choose software that allows customization to suit your trading preferences and offers a pricing model that fits your budget.

-

Reliable customer support: Ensure the software provider offers responsive customer support to address any technical issues or provide assistance when needed.

-

Importance of demo versions and trial periods: Take advantage of these opportunities to test the software’s performance and determine if it aligns with your investment goals.

By considering these factors, you can choose pair trading software that enhances your trading experience and helps you achieve your investment objectives effectively.

Reviewing popular pair trading software options based on user reviews, expert opinions, and performance metrics

To choose the right pair trading software, it’s essential to review user feedback, seek expert opinions, and analyze performance metrics. User reviews provide insights into reliability and customer support, while expert opinions offer valuable perspectives from industry professionals.

Evaluating performance metrics like profitability ratios helps determine a software’s effectiveness. By considering these factors, traders can make an informed decision when selecting pair trading software that aligns with their needs and enhances their strategies.

Identifying suitable pairs for trading using statistical indicators provided by the software

Pair trading involves identifying and exploiting mispricings between related assets. To do this effectively, traders rely on pair trading software that provides a range of statistical indicators. These indicators include cointegration tests, correlation coefficients, mean reversion analysis tools, and volatility measures.

By analyzing these indicators, traders can identify pairs with stable relationships and a high probability of reverting back to their mean values. This information helps them make informed decisions about entry points, exit points, and position sizing.

Pair trading software streamlines the process of choosing suitable pairs for trading by providing valuable statistical insights.

[lyte id=’6AGz0m6bI2g’]