Lithium, once obscure, is now crucial in our evolving world. With the rise of electric vehicles (EVs), renewable energy storage, and portable devices, the demand for lithium has surged. EVs and renewable energy systems require efficient batteries, driving up lithium consumption.

Additionally, portable electronics rely on compact and long-lasting lithium-ion batteries. This demand has led to soaring lithium stock values and fierce competition among mining companies. The future demand for lithium remains high as these industries continue to expand.

Explanation of How Lithium Stocks Have Become Popular in the Investing World

The popularity of lithium stocks in the investing world is driven by several key factors. Firstly, as countries commit to reducing their carbon footprint and transitioning to clean energy sources, the demand for lithium-ion batteries has surged.

These batteries require significant amounts of lithium, creating opportunities for companies involved in lithium mining, production, and battery technologies.

Secondly, government policies and incentives promoting electric vehicles have further fueled the demand for lithium stocks. As EV adoption increases, so does the need for lithium-ion batteries to power these vehicles.

Thirdly, investors recognize that sustainable technologies and green solutions are not only environmentally responsible but also economically viable. This positive sentiment surrounding clean energy investments positions lithium stocks as an attractive option for long-term growth.

Lastly, ongoing advancements in battery technology contribute to investor confidence in the potential of lithium stocks. Researchers are continuously improving battery performance and efficiency, creating opportunities for companies specializing in battery technologies.

In summary, the popularity of lithium stocks stems from increasing global demand for clean energy solutions, government initiatives promoting electric vehicles, growing awareness about sustainable investments, and continuous advancements in battery technology.

These factors make investing in lithium stocks a compelling choice with significant growth potential.

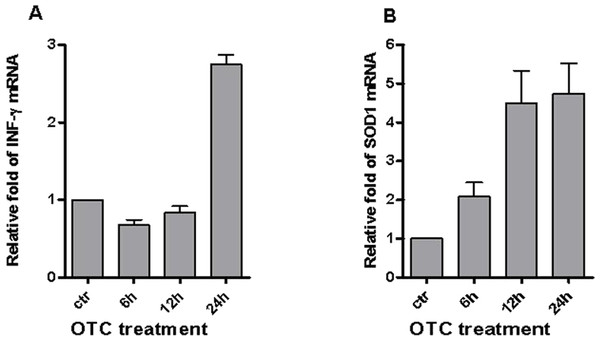

Definition and Explanation of OTC Stocks

Over-the-Counter (OTC) stocks are securities traded directly between parties without being listed on traditional exchanges like NYSE or NASDAQ. They are typically associated with smaller companies that don’t meet listing requirements or choose not to go through the process of becoming publicly traded on major exchanges.

OTC stocks offer flexibility but carry risks due to limited regulation and potential volatility. Prices can be more susceptible to manipulation and speculation. Investing in OTC stocks requires careful research and due diligence.

While OTC stocks present opportunities for growth, investors should exercise caution. Limited financial information makes thorough research essential before making investment decisions.

In summary, OTC stocks provide an alternative avenue for trading securities outside formal exchanges. They offer potential growth but come with increased risk and require diligent research.

Advantages and Disadvantages of Investing in OTC Stocks

Investing in Over-the-Counter (OTC) stocks has advantages and disadvantages compared to traditional exchanges. One advantage is the potential for early-stage investments in promising companies before they gain widespread recognition. OTC stocks are also less regulated, which can provide more flexibility and potentially higher returns.

However, investing in OTC stocks carries risks such as encountering fraudulent companies and limited liquidity. Thorough research and due diligence are crucial when considering OTC stocks as part of your investment strategy.

Overview of the Lithium Industry and Its Growth Prospects

The lithium industry has seen significant growth due to the increasing demand for lithium-ion batteries in multiple sectors. Governments worldwide are supporting the adoption of electric vehicles and renewable energy sources, driving the demand for lithium.

This presents a promising opportunity for investors looking to capitalize on this growing market. Electric vehicles, renewable energy storage, and consumer electronics are major contributors to the rising demand for lithium.

Advancements in battery technology and ongoing research into alternative battery chemistries further boost the industry’s growth prospects.

Analysis of why lithium stocks are gaining attention from investors

Lithium stocks are capturing the interest of investors for several reasons. Firstly, the anticipated surge in demand for electric vehicles is driving substantial growth in the lithium market. Additionally, advancements in battery technology and energy storage systems are creating new applications for lithium beyond EVs.

Moreover, governments worldwide are actively investing in renewable energy infrastructure, further boosting the demand for lithium batteries. The combination of these factors has attracted investors seeking to capitalize on the expanding lithium industry.

| Factors Contributing to Attention |

|---|

| Anticipated growth of EV market |

| Advancements in battery technology |

| Government support for clean energy |

Company 1: Description, Background, and Recent Performance

One notable OTC lithium stock worth considering is Company 1. Specializing in lithium mining operations, they have a strong track record of delivering high-quality products to meet market demands.

Key factors driving their success include strong partnerships with major battery manufacturers, efficient production capabilities resulting in competitive pricing, and strategic expansion into emerging markets with high growth potential.

However, investing in Company 1 carries certain risks. These include volatility in lithium prices due to market fluctuations, regulatory challenges and environmental concerns related to mining operations, and competition from other lithium producers entering the market.

It is important for investors to carefully evaluate these risks alongside the company’s performance when considering an investment in Company 1.

Company 2: Description, Background, and Recent Performance

Company 2 is a leading player in the lithium industry, specializing in innovative energy storage solutions. They have positioned themselves as a global leader by focusing on lithium battery technologies and sustainable initiatives.

This OTC lithium stock offers significant growth opportunities. Company 2 has plans for international expansion into markets with increasing renewable energy adoption. Collaborations with major automakers to develop advanced battery systems for electric vehicles also present promising prospects.

Additionally, diversification into clean energy sectors like solar power storage provides further avenues for growth.

Investors should be aware of potential challenges that could impact the stock’s performance. Technological advancements by competitors pose a risk of outpacing Company 2’s offerings. Dependence on government policies supporting clean energy initiatives and potential supply chain disruptions are also factors to consider.

In summary, Company 2’s focus on lithium battery technologies and their strategic initiatives make them an attractive option for investors looking to tap into the OTC lithium stock market’s potential growth. However, it is important to be mindful of the challenges they may face in a competitive landscape and changing regulatory environment.

[lyte id=’PIHdX7ClQdI’]