In today’s fast-paced world, the banking industry is constantly evolving to meet the needs of businesses and individuals alike. One of the latest innovations in the field of banking is Novo Bank invoicing, which has revolutionized the way investors manage their finances.

In this article, we will explore what Novo Bank is, how Novo Bank invoicing works, and the benefits it offers to investors.

What is Novo Bank?

Novo Bank is a digital bank that simplifies financial management for small businesses and startups. Operating entirely online through a user-friendly mobile app or website, Novo offers real-time access to accounts and seamless transaction capabilities.

With tailored solutions and advanced security measures, Novo empowers entrepreneurs to take control of their finances and focus on business growth.

The Rise of Novo Bank Invoicing

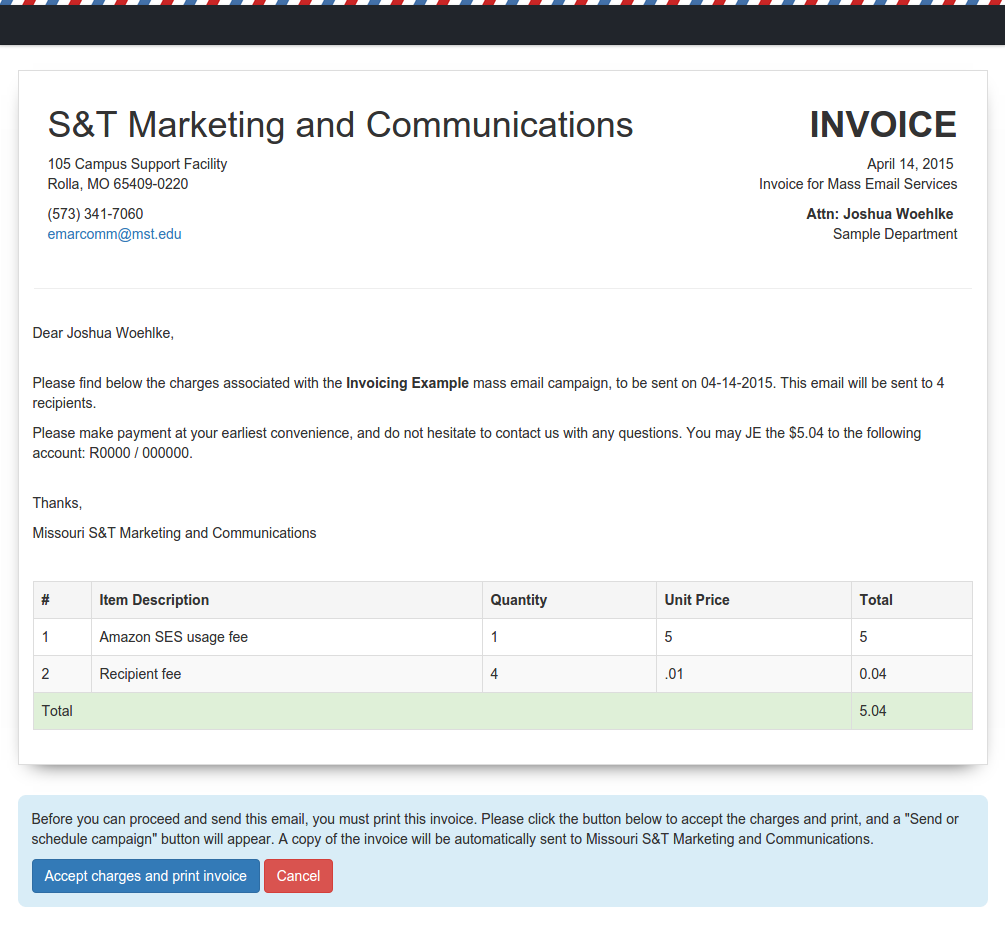

In today’s digital age, managing finances efficiently is crucial for investors. This is where Novo Bank invoicing comes into play, revolutionizing the way individuals handle their financial transactions. Novo Bank offers a seamless solution that allows users to send invoices, receive payments, and track cash flow effortlessly.

Gone are the days of manually managing invoices or relying on outdated systems that hinder productivity. Novo Bank invoicing streamlines the entire process by automating invoice processing and providing real-time access to funds. This innovative feature empowers investors with greater control over their financial transactions.

With Novo Bank invoicing, investors can say goodbye to the frustrations of traditional banking methods. By eliminating manual entry errors and reducing the time spent on administrative tasks, this cutting-edge solution frees up valuable time for investors to focus on more important aspects of their business.

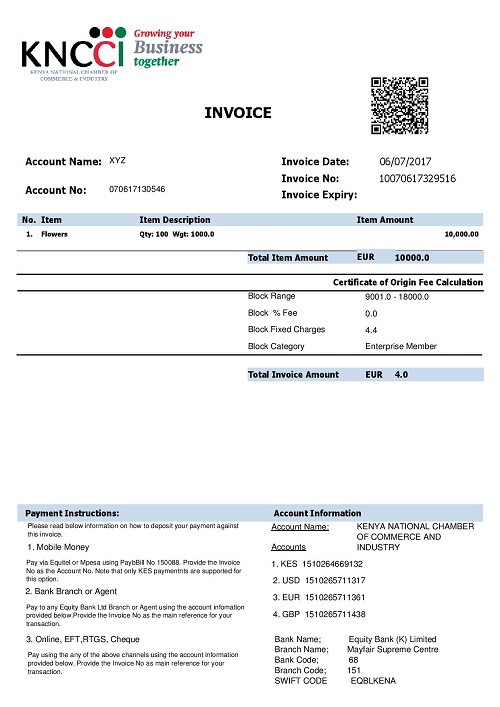

One of the key advantages of Novo Bank invoicing is its simplicity. Users can easily create professional-looking invoices within minutes, complete with customizable templates that reflect their brand identity. Additionally, tracking payments becomes effortless as Novo Bank provides real-time updates on outstanding invoices and payment statuses.

Furthermore, Novo Bank invoicing ensures efficient cash flow management. Investors can seamlessly integrate this feature with their existing accounting software or utilize Novo’s intuitive dashboard for comprehensive insights into their financial health.

This level of transparency enables informed decision-making and empowers investors to stay on top of their cash flow effortlessly.

How Novo Bank Invoicing Works

Novo Bank invoicing simplifies payments by allowing investors to create professional invoices with just a few clicks. Clients can make payments directly through the Novo platform, instantly reflecting in the investor’s account balance for improved cash flow management.

The user-friendly interface saves time, while customizable templates and secure transactions enhance professionalism and security. Consolidated payment information simplifies record-keeping, empowering investors to focus on business growth and efficient financial operations.

Novo Bank invoicing is a game-changer for streamlined payments and enhanced cash flow management.

Streamlined Payment Processes

Novo Bank offers streamlined payment processes that simplify financial management for investors. With instant payment notifications, investors receive real-time updates when clients or customers make payments, eliminating the need for manual tracking and reducing delays.

Automated invoice processing further enhances efficiency by automating tasks such as creating templates, scheduling reminders, and processing recurring invoices. These features save time, reduce errors, and empower investors to make informed decisions about their finances and investment opportunities.

Novo Bank’s streamlined payment processes optimize cash flow management and enhance the overall financial management experience for investors.

Enhanced Cash Flow Management

Novo Bank invoicing offers features that enhance cash flow management. Investors have real-time access to funds, allowing them to make timely investments and cover expenses without delay. All transactions are digitally recorded for accurate expense tracking, simplifying tax preparation and providing insights into spending patterns.

Novo Bank invoicing seamlessly integrates with financial tools, automating processes and providing a comprehensive view of finances. Customizable invoice templates allow for professional branding and improved payment efficiency. With these features, investors can optimize their cash flow management and make informed financial decisions.

User-Friendly Interface

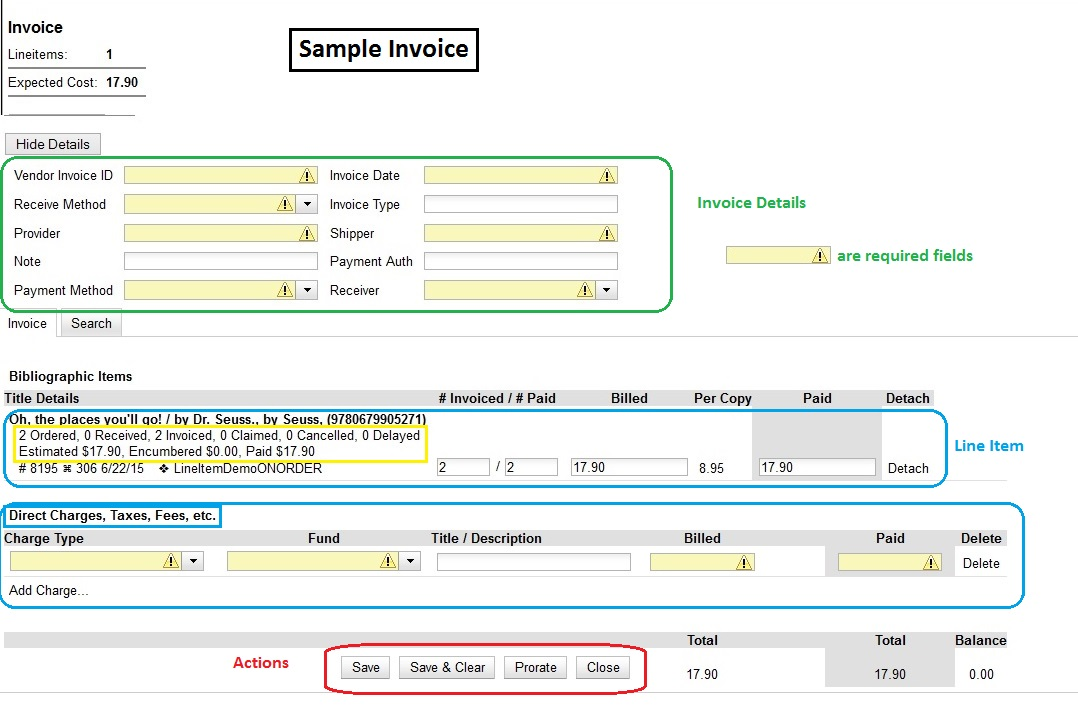

Novo Bank’s commitment to providing a seamless and intuitive user experience is evident in its user-friendly interface. The carefully designed layout ensures that users can easily navigate through the platform without feeling overwhelmed by complex features or information overload.

At the heart of Novo Bank’s user-friendly interface is its intuitive dashboard. The dashboard serves as the central hub where users can access key financial information at a glance. With a clean and organized design, users can quickly locate important data such as invoices, payments received, and account balances.

This streamlined approach saves time and eliminates the hassle of searching through multiple screens to find crucial information.

One of the standout features of Novo Bank’s user-friendly interface is its customizable settings and preferences. Recognizing that each investor has unique needs, Novo Bank allows users to personalize their experience according to their branding and operational requirements.

From invoice templates to payment reminders, users have full control over how they present themselves to clients and manage their invoicing process.

The ability to customize settings not only enhances the user experience but also adds a professional touch to interactions with clients. By aligning the platform with their branding, investors can maintain consistency across all communication channels and reinforce their brand identity.

Integration with Accounting Software

In the fast-paced world of finance, seamless integration with accounting software has become essential for businesses to streamline their operations and stay ahead of the game.

Novo Bank recognizes this need and offers a robust solution that seamlessly integrates with popular accounting software, ensuring smooth data synchronization between platforms.

With Novo Bank’s invoicing system, manual data entry becomes a thing of the past. By integrating with well-known accounting software, such as QuickBooks or Xero, financial information is automatically synchronized in real-time. This not only eliminates the risk of errors or discrepancies but also saves valuable time for investors.

The time-saving benefits are immeasurable. Instead of spending hours tediously entering data into different systems, investors can focus on more strategic tasks that drive their business forward. The automation provided by Novo Bank’s integration with accounting software allows for efficient transfer and processing of financial data.

Accuracy is another significant advantage of this integration. By automating the transfer of financial information, the chances of human error are greatly reduced. This ensures that financial reports and analyses are based on accurate data, enabling businesses to make informed decisions confidently.

Novo Bank’s commitment to providing a seamless integration experience extends beyond just convenience and accuracy; it also prioritizes compatibility with various accounting software options. Whether you use cloud-based solutions or desktop applications, Novo Bank’s invoicing system can adapt to your existing setup effortlessly.

Account Setup

In the fast-paced world of investing, setting up your account efficiently is crucial. Novo Bank provides a seamless and user-friendly process to get you started on your investment journey. The first step is to create a Novo Bank account, which can be done by visiting their website or downloading the mobile app from an app store.

Once there, you will need to go through a straightforward registration process where you will be asked to provide basic personal and business information.

After successfully registering, it’s time to set up your business profile within the Novo Bank platform. This step is essential as it allows investors to showcase their company’s identity and establish credibility.

You’ll be prompted to enter details such as your company name, logo, contact information, and any other relevant business details that will help potential investors understand who you are and what you do.

Having a well-curated business profile not only enhances your professional image but also makes it easier for interested parties to connect with you. By providing accurate and comprehensive information about your company, you increase the chances of attracting potential investors who align with your goals.

Novo Bank understands the importance of efficient account setup for its users. Their streamlined process ensures that investors can quickly establish their presence on the platform, allowing them to focus on what truly matters – exploring investment opportunities and growing their businesses.

To summarize, creating a Novo Bank account is a simple process that involves registering with basic personal and business information. Setting up a detailed business profile further enhances your credibility as an investor and increases your chances of attracting like-minded individuals or organizations for potential partnerships or investments.

With Novo Bank’s user-friendly platform, getting started has never been easier.

[lyte id=’46LWD33lBm8′]