Investing in the mining industry can be a lucrative venture, but it often comes with operational risks and market volatility. However, there is an alternative investment option that allows investors to reap the rewards of mining without facing these challenges: mining royalty stocks.

In this article, we will delve into the world of mining royalty stocks, exploring their definition, how they differ from traditional mining stocks, and why they are gaining popularity among investors.

We will also discuss the advantages of investing in mining royalty stocks, highlight some top-performing companies in this sector, and provide valuable tips for successful investing.

So, if you’re interested in learning more about this exciting investment opportunity and how it can help diversify your portfolio while providing steady cash flow and potential substantial returns, keep reading!

Definition and Explanation of Mining Royalty Stocks

Mining royalty stocks offer investors exposure to the mining industry through royalties on mineral production. Instead of owning shares in a specific mine or company, investors purchase royalties on the future output of certain mines or mineral properties.

These royalties entitle investors to a percentage of the revenue generated by the mine’s production. Shareholders receive regular royalty payments based on the volume or value of minerals extracted. This investment provides diversification, passive income, and potential long-term growth opportunities in the mining sector.

Investors should consider factors such as the quality of underlying mines, track record of mining companies, and payment structures when evaluating different mining royalty stocks. Overall, investing in these stocks offers an alternative way to participate in the profitable mining industry.

How They Differ from Traditional Mining Stocks

Investing in mining royalty stocks offers a unique advantage compared to traditional mining stocks. With royalty stocks, investors don’t own physical assets or have involvement in day-to-day operations, reducing operational risks and market volatility.

Unlike traditional mining stocks that are influenced by factors like operational efficiency and commodity prices, royalty stocks provide a stable income stream unaffected by these variables. This makes them an attractive option for risk-averse investors seeking stable returns in the mining sector.

Additionally, holding royalties on multiple properties across different commodities provides diversification benefits and mitigates the risk of any single mine or project underperforming.

Explanation of Royalty Structures and Agreements

Mining royalty structures and agreements define how royalties are paid to investors based on mineral sales. The two common types of royalties are Net Smelter Return (NSR) and Net Profits Interest (NPI).

NSR royalties are a percentage of revenue after deducting costs like transportation and refining. Investors benefit directly from the mine’s production value.

NPI royalties entitle investors to a percentage of profits after deducting all costs, including operational expenses and taxes. This allows investors to share in the mine’s profitability.

Terms can vary, including provisions like minimum payments or production thresholds. Understanding these structures is crucial for mining companies and investors, as they determine financial benefits. NSR offers exposure to production value, while NPI provides a share in profitability.

Overall, these agreements establish fair relationships between mining companies and royalty holders.

Discussion of Different Types of Royalties

Apart from NSR and NPI royalties, other types of mining royalties are worth mentioning:

-

Gross Overriding Royalties: Investors receive a fixed percentage of the gross revenue from mineral sales, without deductions for costs or expenses. This type is commonly used in oil and gas projects.

-

Production Payment Royalties: Investors receive an upfront payment in exchange for a specific amount or volume of extracted minerals. Once the predetermined amount is reached, the royalty terminates.

These alternative royalty structures provide flexibility and tailored benefits for investors and mining companies. Understanding these options allows individuals to align their investment strategies with their financial goals in the mining sector.

Factors Affecting Royalty Payments

Mining royalty stocks offer stable cash flow, but there are several factors that can impact royalty payments. Fluctuations in commodity prices directly influence royalties, as they are typically based on a percentage of mineral sales revenue.

Changes in production levels due to operational issues or resource depletion can also affect royalty payments. Additionally, higher operational costs like rising energy prices or labor expenses can reduce the profitability of mining operations and subsequently impact royalty payments.

Understanding these factors is crucial for investors considering mining royalty stocks.

| Factors That Can Affect Royalty Payments |

|---|

| 1. Commodity Prices |

| 2. Production Levels |

| 3. Operational Costs |

Steady Cash Flow Without Operational Risks

Investing in mining royalty stocks provides a steady cash flow without exposing investors to operational risks. As royalty holders, they receive regular payments based on mineral production, regardless of operational challenges or fluctuations in commodity prices.

This detachment from day-to-day operations offers security and allows for effective diversification, financial flexibility, and a stable income stream.

Diversification and Exposure to Various Commodities

Investing in mining royalty stocks offers diversification benefits by providing exposure to a broad range of commodities. These royalty companies hold interests in multiple mines or mineral properties across different regions, allowing investors to benefit from various resource markets and mitigate concentration risk.

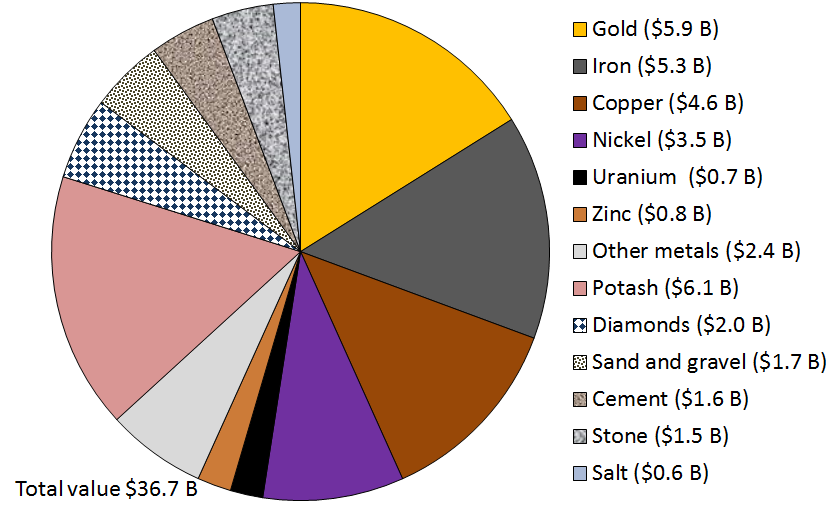

By investing in mining royalty stocks, investors can access a diverse array of commodities, including precious metals, base metals, and energy-related resources. This broad exposure helps protect against downturns in specific commodity markets.

Furthermore, mining royalty companies’ global presence allows for exposure to different geographical regions. Investors can tap into resource markets with varying supply and demand dynamics, increasing the potential for favorable returns.

In addition to diversification, investing in mining royalty stocks also offers potential growth opportunities when new discoveries occur within their portfolio. As these companies hold royalties on mineral properties, they stand to benefit from new deposits being developed.

Overall, investing in mining royalty stocks provides diversification and exposure to various commodities and geographic locations. This approach enhances portfolio resilience while offering potential growth through new discoveries.

Potential for Substantial Returns

Investing in mining royalty stocks can offer investors the potential for substantial returns. As production levels increase or commodity prices rise, royalty payments have the opportunity to grow significantly over time.

Even if one mine underperforms, royalties may still flow from other successful mines within the portfolio, providing a stable cash flow. By strategically selecting mining royalty stocks with promising growth prospects, investors can capitalize on both consistent income and long-term capital appreciation potential.

Consider these top-performing mining royalty companies:

| Company Name | Description |

|---|---|

| ABC Royalties | This company has a diverse portfolio of successful mines across various commodities, consistently generating robust growth in royalty payments. ABC Royalties is known for its sustainable development practices and presents an attractive investment opportunity. |

| XYZ Minerals | With a strong operational performance and focus on innovation, XYZ Minerals stands out in the industry. Investing in this company offers exposure to high-quality assets and the potential for substantial returns. |

Conduct further research to identify other promising opportunities within the mining royalty sector that align with your investment goals. Evaluating factors such as growth prospects, financial stability, and industry reputation will help maximize your chances of achieving significant returns on your investments.

[lyte id=’eDt7pj8gP5s’]