Explosive stocks, with their potential for remarkable returns, captivate investors seeking hidden gems. These stocks have the power to turn small investments into substantial sums. In this article, we will explore strategies to identify these explosive stocks and uncover the factors contributing to their success.

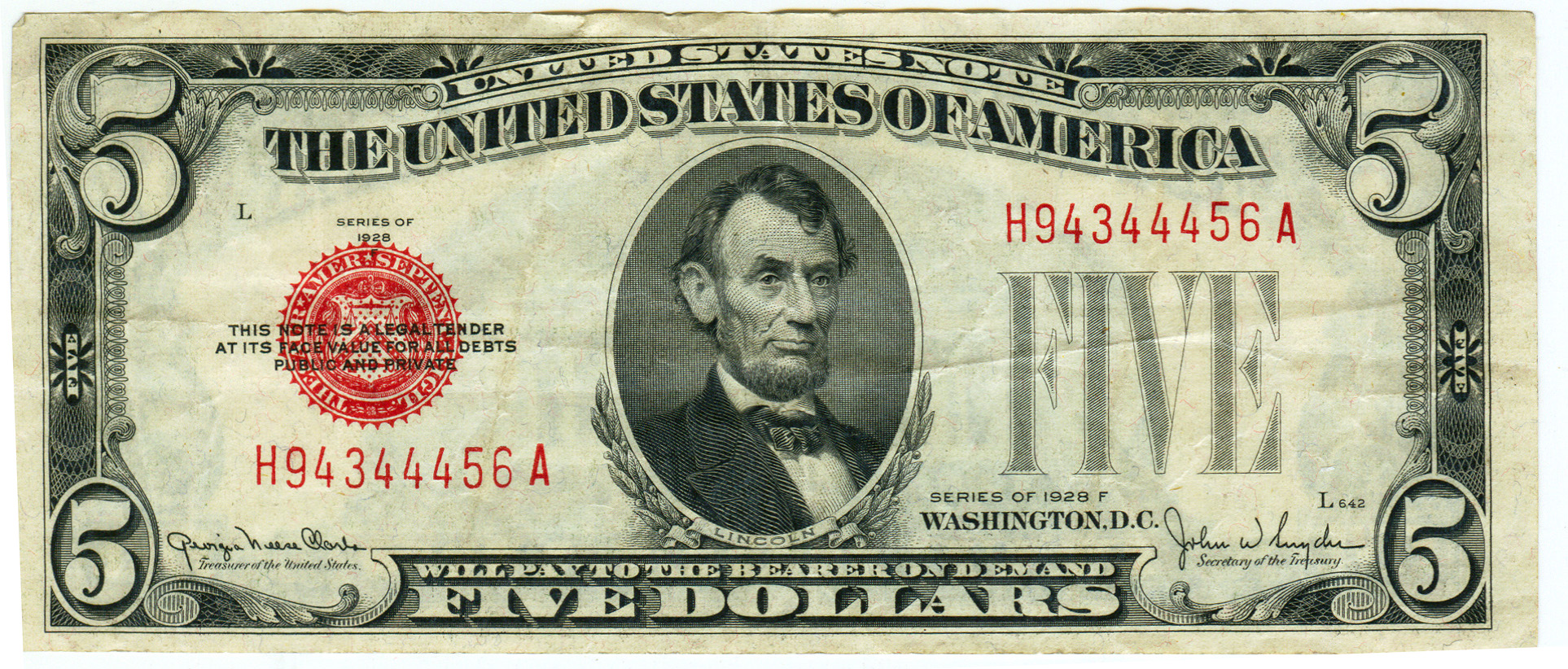

Imagine investing just $5 in a stock and watching it soar to extraordinary heights. While this dream scenario may seem far-fetched, there are indeed stocks that have achieved explosive growth. By understanding key elements like disruptive technologies and emerging trends, investors can position themselves to seize these lucrative opportunities.

Identifying companies with innovative products or services that can revolutionize industries is crucial. Additionally, staying ahead of emerging trends and monitoring market sentiment helps uncover hidden gems primed for growth.

Diligent research practices and analysis of financial statements, management teams, industry competition, and market trends are essential for identifying potential explosive stocks.

In the following sections, we will explore specific strategies and techniques to enhance your ability to uncover these hidden gems. From fundamental analysis to technical indicators, we will provide valuable insights to support your quest for explosive investment prospects.

Embark on this exploration with us as we uncover the story behind these captivating investment opportunities and reveal the secrets behind their potential for remarkable returns.

Understanding Explosive Stocks: Unlocking Their Potential

Explosive stocks, characterized by rapid and significant value increases over a short period, have the potential to generate substantial returns.

These high-growth opportunities outperform other investments due to factors like market trends, industry growth potential, innovative products/services, strong financial performance, and positive news/developments.

By understanding these factors and conducting thorough research, investors can identify explosive stocks and unlock their potential for significant gains.

Spotting Explosive Stocks: Strategies for Success

To spot explosive stocks, thorough research and analysis are crucial. Investors should analyze a company’s financial statements, performance metrics, and industry trends. By understanding the company’s fundamentals, investors can assess its growth potential and determine if it is poised for explosive growth.

Analyzing financial statements helps evaluate revenue growth, profitability, and debt levels. Performance metrics like ROI, EPS, and P/E ratio provide insights into a company’s financial health. Monitoring industry trends allows investors to identify companies at the forefront of innovation or those poised to benefit from emerging trends.

Spotting explosive stocks requires a combination of research and staying informed about market conditions. By implementing these strategies, investors increase their chances of successful investments in dynamic markets.

Case Study: Unveiling the Rise of Company X – From $5 to Remarkable Heights

Company X defied expectations by transforming from a humble $5 stock into a powerhouse within the industry, captivating global investors. By examining this case study, we uncover the catalysts behind its extraordinary growth.

Despite its initial modest valuation, Company X experienced an unprecedented rise that demands attention. Through this case study, we gain valuable insights into the elements that propelled its meteoric ascent.

Key factors contributed to Company X’s exceptional trajectory. Groundbreaking product innovations established them as industry leaders while strategic partnerships expanded their reach and solidified their position. Sound financial management and effective marketing strategies further fueled their success.

By dissecting these catalysts, investors can gain valuable lessons in identifying future explosive stocks. This case study serves as a blueprint for recognizing companies with potential for exponential growth.

Promising Sectors: Where Explosive Growth Opportunities Lie

Investors seeking explosive growth opportunities in the stock market often turn to specific sectors known for their rapid expansion and potential. Technology-driven industries, such as artificial intelligence, blockchain technology, and renewable energy, offer significant prospects for substantial returns.

These sectors continually reshape various industries through innovation, creating opportunities for explosive growth. Additionally, emerging markets with untapped growth potential can provide access to companies on the verge of significant expansion.

By identifying promising companies within these sectors and markets, investors can position themselves to capitalize on explosive growth opportunities.

Investing Strategies for Explosive Stocks on a Budget

Investing in explosive stocks on a budget requires careful risk management. Diversification is an effective strategy that involves spreading investments across different sectors or asset classes to mitigate the risk of any single investment negatively impacting the overall portfolio.

Another strategy is dollar-cost averaging, where investors regularly invest fixed amounts of money into a stock over time, regardless of its price fluctuations. This approach allows investors to buy more shares when prices are low and fewer shares when prices are high, reducing the impact of short-term volatility.

By diversifying investments and implementing dollar-cost averaging, investors can protect themselves from excessive risk while still having exposure to potential high-growth opportunities in the volatile world of explosive stocks.

Managing Risks: Navigating the Volatility of Explosive Stocks

Investing in explosive stocks can be highly rewarding, but it also comes with risks and volatility. To navigate this market successfully, investors must address these challenges head-on.

Understanding the nature of explosive stocks is essential. They often experience significant price fluctuations due to market sentiment, company news, or industry trends. It’s crucial to approach these investments with caution and realistic expectations.

Implementing risk management strategies is vital. Setting realistic expectations helps avoid impulsive decisions based on short-term price movements. Using stop-loss orders allows investors to automatically sell shares at predetermined prices, limiting potential losses during downturns.

Continuous monitoring of investments and diversification across sectors help mitigate risks associated with volatile stocks.

In summary, managing the volatility of explosive stocks requires a proactive and strategic approach to risk management.

By setting realistic expectations, using stop-loss orders, monitoring investments, and diversifying portfolios, investors can protect themselves from inherent risks and increase their chances of long-term success in this dynamic market.

VIII: Insights from Expert Investors: Unveiling Their Secrets to Success

In this section, we interview seasoned investors who have successfully identified and capitalized on explosive stocks. Through these interviews, we uncover their methodologies, key insights, and valuable lessons learned. These experiences provide a wealth of knowledge that can guide aspiring investors in their pursuit of explosive stocks.

The experts emphasize the importance of thorough research and analysis when identifying potential explosive stocks. They consider factors such as a company’s financial health, competitive advantage, and growth potential. They also utilize technical analysis and qualitative assessments to identify patterns and trends in stock price movements.

Risk management is another key aspect highlighted by these experts. They stress the need for clear investment objectives and maintaining a diversified portfolio to mitigate risks. While occasional losses are inevitable, learning from them is crucial for refining investment strategies.

By sharing the methodologies and insights of successful investors, we aim to empower aspiring investors with actionable knowledge. Understanding how professionals approach investing in high-growth stocks can serve as a valuable guide in navigating the dynamic stock market landscape.

In the following sections, we will explore specific case studies that showcase real-life examples of explosive stocks identified by these expert investors. These case studies provide practical insights into how professionals analyze companies, identify growth opportunities, and make informed investment decisions.

[lyte id=’wUNogiAcBXc’]