Investing in the manufacturing sector can be a smart move for those looking to diversify their portfolio and capitalize on the growth potential of this industry. With numerous companies operating in various sub-sectors, choosing the right manufacturing stocks requires careful consideration and analysis.

In this article, we will explore the key factors to consider when selecting manufacturing stocks, highlight some top-performing companies in this sector, and discuss potential risks and challenges that investors may face.

By the end of this read, you’ll be equipped with valuable knowledge to make informed investment decisions in the manufacturing market.

Overview of the Manufacturing Sector

The manufacturing sector is crucial for economic growth and development. It includes industries like automotive, aerospace, electronics, and pharmaceuticals. These industries transform raw materials into finished goods through processes like assembly and packaging.

Manufacturing companies are adaptable to changing market conditions and technological advancements, making them competitive. Investors have a diverse range of manufacturing stocks to choose from.

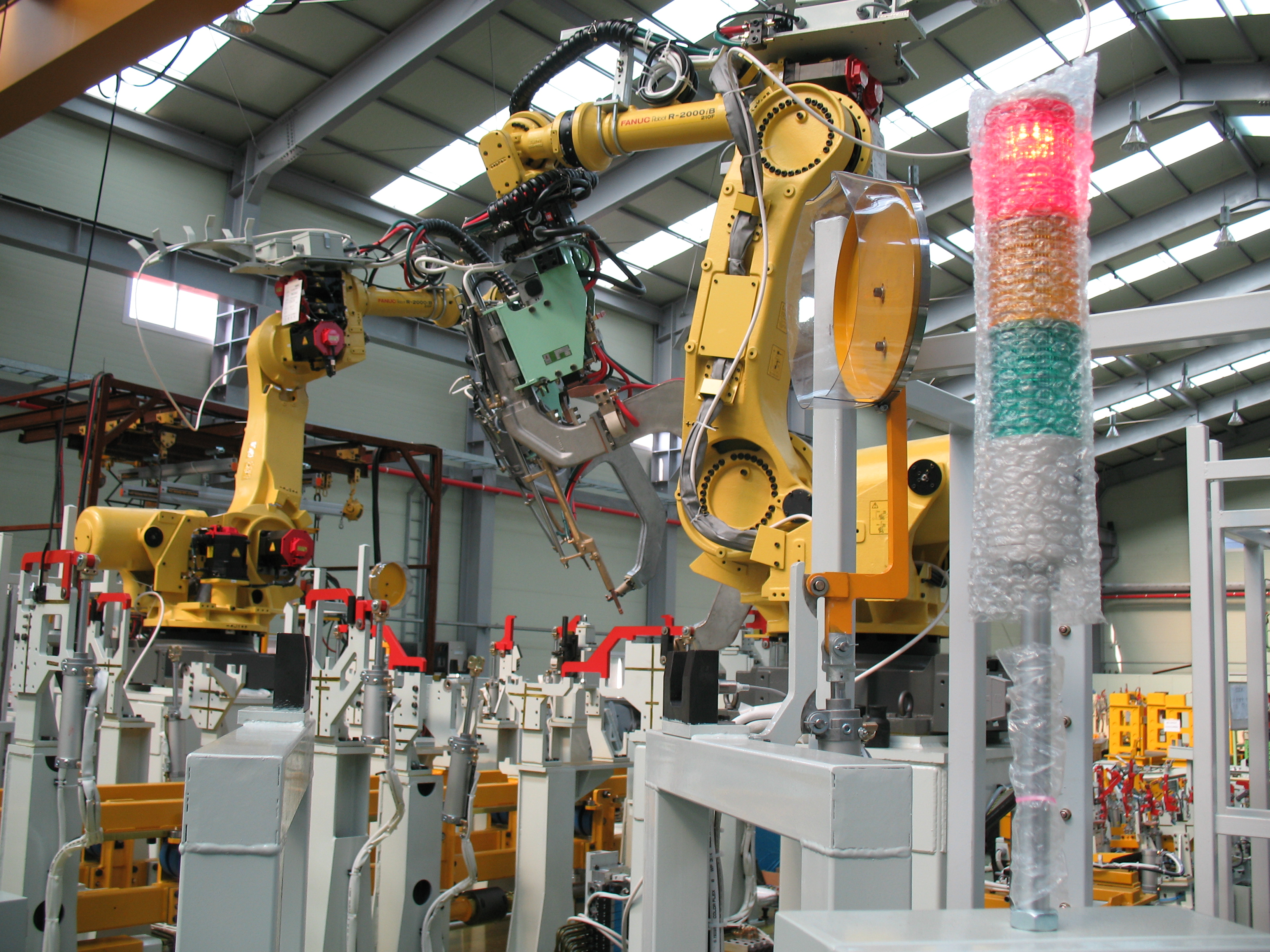

Advancements in technology, such as automation and robotics, have improved productivity and quality standards in manufacturing. The sector also creates job opportunities across various skill sets.

Manufacturers are increasingly adopting sustainable practices to reduce waste generation and conserve energy resources. This aligns with consumer preferences for eco-friendly products.

Overall, the manufacturing sector drives economic growth, offers investment opportunities, creates jobs, and embraces sustainability.

Factors to Consider When Choosing Manufacturing Stocks

When choosing manufacturing stocks, it’s important to consider several factors:

Industry Trends: Stay updated on emerging technologies and trends that can impact manufacturing companies. Companies embracing advancements like automation and AI are likely to provide better returns.

Financial Performance: Analyze a company’s financial health, including revenue growth, profitability ratios, debt levels, and cash flow stability. A financially stable company is positioned for long-term success.

Market Position: Look for companies with a competitive advantage, strong brand recognition, and a solid customer base. Dominant market players or niche operators tend to outperform competitors.

Management Team: Evaluate the experience, track record, and strategic vision of the management team. Capable leaders can navigate challenges and capitalize on opportunities effectively.

Global Exposure: Assess a company’s global presence and diversification. International operations provide access to new markets but also come with geopolitical risks and supply chain impacts.

Considering these factors helps investors make informed decisions aligned with their goals and risk tolerance in the ever-evolving manufacturing sector.

Top-Performing Manufacturing Stocks

Consider these top-performing manufacturing stocks for potential investment:

-

Tesla Inc. (TSLA): With its revolutionary electric vehicles, Tesla dominates the automotive industry and continues to expand its market share.

-

Boeing Co. (BA): Despite recent setbacks, Boeing remains a key player in aerospace, benefiting from increasing global travel demand and defense spending.

-

Johnson & Johnson (JNJ): Known for healthcare products, J&J excels in pharmaceuticals and medical devices, offering a diverse product portfolio and strong financial performance.

-

Intel Corporation (INTC): As a major semiconductor chip manufacturer, Intel powers advancements in telecommunications and computing.

Thorough research is crucial before investing in any specific stock, as past performance does not guarantee future results.

Potential Risks and Challenges in the Manufacturing Sector

Investing in manufacturing stocks can bring significant returns, but it is not without risks and challenges. Economic cycles can impact demand for manufactured goods, leading to lower revenues during downturns. Supply chain disruptions caused by natural disasters or global events like pandemics can disrupt production capabilities.

Regulatory changes related to safety, environment, and labor laws can increase costs and affect efficiency. Additionally, technological advancements pose a threat to traditional manufacturing processes and business models. Staying informed about these risks is crucial for making informed investment decisions in the manufacturing sector.

Conclusion

Investing in manufacturing stocks requires careful consideration of industry trends, financial performance, market position, management team capabilities, and global exposure. Economic cycles, supply chain disruptions, regulatory changes, and technological disruption can impact both individual stocks and the overall sector’s performance.

[lyte id=’tMUh089_vyI’]