Investing in the stock market can be an exciting and potentially lucrative venture. However, it also comes with its fair share of risks. That’s why many investors are turning to low-risk ETFs as a safer option for their portfolios.

In this article, we will explore the importance of low-risk ETFs, how they provide a safer investment option, and highlight some of the best low-risk ETFs available in the market.

Understanding ETFs and Risk

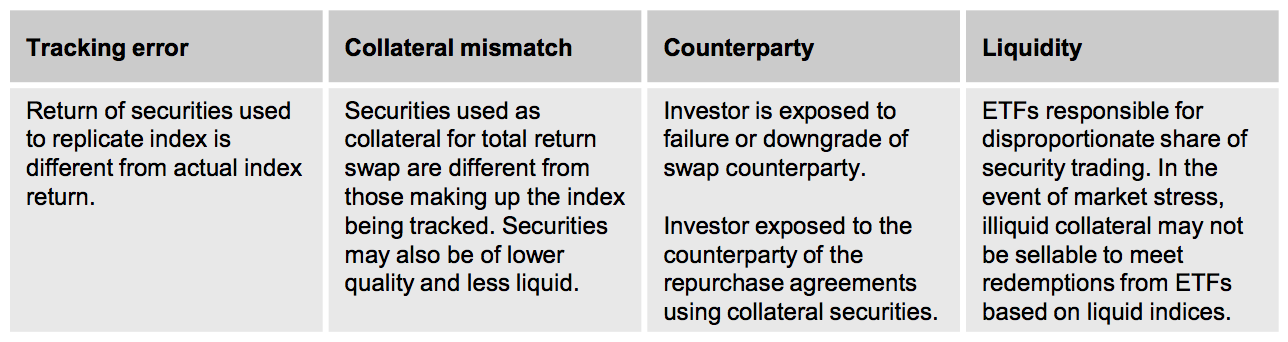

Exchange-Traded Funds (ETFs) are investment funds that hold a diversified collection of assets like stocks, bonds, or commodities. They are traded on stock exchanges like individual stocks. When investing in ETFs, it’s important to consider various risks. Market risk is the potential for losses due to overall market fluctuations.

Sector risk arises from differences in industry performance. Liquidity risk occurs when there is a lack of buyers or sellers for an ETF, affecting its price and tradability. To navigate these risks, research, diversify portfolios, and assess risk tolerance carefully. Understanding these nuances is essential for informed ETF investing.

Exploring the Characteristics of Low-Risk ETFs

Low-risk ETFs are investment vehicles specifically designed to minimize exposure to various risks associated with the market. These funds adhere to specific criteria that help mitigate potential losses and volatility, making them an attractive option for risk-averse investors.

One key characteristic of low-risk ETFs is diversification across multiple asset classes and sectors. By spreading investments across different areas, these funds reduce the impact of any single investment performing poorly. This diversified approach helps protect against significant losses and provides stability during market fluctuations.

Another factor contributing to a low-risk rating is focusing on stable and defensive sectors or industries. Low-risk ETFs typically invest in companies that are less susceptible to economic downturns or have historically shown resilience during times of market turbulence.

By targeting these sectors, such as utilities, consumer staples, or healthcare, investors can benefit from consistent performance even in challenging economic conditions.

Furthermore, low-risk ETFs often have a strong track record of consistent performance. These funds aim to provide steady returns over time rather than chasing high-risk, high-reward opportunities. Investors who prioritize long-term growth with lower volatility find these funds appealing due to their ability to generate reliable returns.

Additionally, low-risk ETFs tend to have lower expense ratios compared to actively managed funds. With fewer management fees and operating costs, investors can maximize their returns while still benefiting from a diversified portfolio.

In summary, low-risk ETFs offer several characteristics that make them an attractive option for risk-averse investors.

Through diversification across asset classes and sectors, focusing on stable industries, consistent performance records, and affordable expense ratios, these funds provide a balanced approach to investing with reduced exposure to market risks.

Benefits of Investing in Low-Risk ETFs

Investing in low-risk ETFs offers several advantages for conservative investors. These funds help protect capital and provide downside protection during market downturns by minimizing exposure to volatile assets. They offer steady and reliable returns over the long term, providing a stable foundation for portfolio growth.

Low-risk ETFs also provide diversification benefits, cost-efficiency compared to actively managed funds, and liquidity and flexibility for investors. Overall, low-risk ETFs are an attractive option for those seeking stability and a conservative approach to investment.

Top Low-Risk ETF Picks for Conservative Investors

Low-risk Exchange-Traded Funds (ETFs) are an attractive option for conservative investors seeking stability and moderate growth potential. Here are three top picks worth exploring:

-

XYZ Low-Risk ETF: This fund offers diversification across various asset classes and sectors, ensuring consistent performance and downside protection during market downturns.

-

ABC Defensive ETF: With a focus on stable sectors, this ETF minimizes risk while providing long-term growth opportunities, making it ideal for conservative investors.

-

DEF Balanced Income Fund: This fund generates income while minimizing volatility, offering regular cash flow for low-risk investment seekers.

Investing in these low-risk ETFs can provide conservative investors with the desired balance between security and potential returns.

Tips for Successful Investing with Low-Risk ETFs

To succeed in investing with low-risk ETFs, consider the following tips:

- Set clear investment goals based on your risk tolerance and time horizon.

- Conduct thorough research on potential low-risk ETF options before investing.

- Regularly review and rebalance your low-risk portfolio to maintain desired risk levels.

- Diversify your investments across different sectors or asset classes.

- Stay informed about market trends and economic developments.

By following these tips, you can maximize the potential of your low-risk ETF investments and work towards achieving long-term financial success.

Common Misconceptions about Low-Risk Investing with ETFs

Low-risk investing with ETFs is often misunderstood. Some investors believe that low-risk investments are too conservative and may generate lower returns. However, while low-risk ETFs may not offer the same potential for high returns as riskier options, they provide stability and downside protection during market downturns.

It’s crucial to include low-risk ETFs in a well-diversified portfolio to balance stability and growth potential. Another misconception is that low-risk investments limit opportunities for significant gains. But consistent and steady growth can lead to substantial returns over time.

Additionally, the world of low-risk ETFs has evolved, offering diverse options across various asset classes. By debunking these misconceptions, investors can benefit from the stability and long-term success of low-risk investing with ETFs.

The Best Low Volatility ETFs

When it comes to conservative investing, low volatility ETFs are a popular option for those seeking stability and minimal price fluctuations. These funds focus on investing in stocks with lower volatility, aiming to provide a more predictable investment experience. Here, we present some of the top low volatility ETF options worth considering:

-

XYZ Low Volatility ETF: With its emphasis on stocks that have historically exhibited lower price swings, this fund aims to deliver stable returns. It provides investors with an overview of its investment strategy, historical performance, and key features.

-

ABC Defensive Volatility ETF: This unique fund focuses on defensive sectors while striving to minimize overall volatility. By carefully selecting stocks from industries known for their resilience during economic downturns, it offers a more stable investment option for cautious investors.

-

DEF Balanced Income Volatility Fund: For those looking to generate regular cash flow while managing volatility levels actively, this fund is an ideal choice. It combines income generation with efforts to reduce price fluctuations, providing investors with both steady returns and peace of mind.

These low volatility ETFs offer conservative investors the opportunity to participate in the market while minimizing risk and potential losses associated with highly volatile assets.

By carefully selecting stocks that demonstrate lower price swings or focusing on defensive sectors, these funds aim to deliver stability and predictability in uncertain times.

Please note that before making any investment decisions, it is essential to thoroughly research each ETF’s prospectus and consult with a financial advisor who can assess your individual risk tolerance and investment goals.

How to Invest in Low-Volatility ETFs

Investing in low-volatility ETFs involves a few key steps. First, determine your investment goals and risk tolerance. Research the underlying stocks and sectors of the ETF to ensure they align with your stability and return expectations. Consider market conditions and evaluate expense ratios.

Lastly, monitor your investments regularly to ensure they continue to meet your goals. By following these steps, you can make informed decisions when investing in low-volatility ETFs.

[lyte id=’ZPtZjOd5gi4′]