Investing in the energy industry has always been an attractive option for those looking to diversify their portfolio and capitalize on the growing demand for alternative fuel sources. One sector within this industry that has been gaining significant attention is LNG (liquefied natural gas) shipping.

As the need for cleaner energy sources continues to rise, the importance of LNG as a viable solution cannot be overstated.

In this article, we will take a closer look at LNG shippers stocks and explore their role in transporting LNG across the globe. We will also delve into some key players in this sector, such as Enbridge Inc., Golar LNG Limited, Sempra, and South Jersey Industries, Inc., evaluating their potential for growth and long-term profitability.

But before we dive into specific companies, let’s first understand what LNG is and why it holds such significance in the energy industry.

Explanation of LNG (liquefied natural gas) and Its Importance in the Energy Industry

Liquefied natural gas (LNG) is a clear, colorless liquid form of natural gas that is cooled to around -260 degrees Fahrenheit (-162 degrees Celsius). This cooling process reduces its volume by about 600 times, making it easier to transport and store.

The conversion of natural gas into LNG allows for more efficient transportation over long distances through specialized carriers known as LNG shippers.

Benefits of LNG include enhanced transportation efficiency, cost-effectiveness, flexible storage options, and reduced environmental impact. LNG enables larger volumes of natural gas to be transported in a single shipment, resulting in decreased transportation costs.

It can be stored until needed, providing flexibility for strategic planning and utilization during peak demand periods. Additionally, LNG produces fewer greenhouse gas emissions compared to other fossil fuels, aligning with global efforts to reduce carbon footprints.

In summary, LNG plays a vital role in the energy industry due to its unique characteristics and benefits. It facilitates efficient long-distance transportation, offers cost savings, provides storage flexibility, and contributes to environmental sustainability.

Introduction to LNG Shippers and Their Role in Transporting LNG

LNG shippers play a vital role in the global supply chain by transporting liquefied natural gas (LNG) from production facilities to end-users worldwide. These specialized vessels maintain low temperatures required for the stable transit of LNG.

Loading at liquefaction plants or export terminals, they unload at regasification terminals near consumers. Converted back into its gaseous state, the gas is then distributed through pipelines to power plants, industries, and residential areas, meeting global energy demands effectively.

Growing Market Demand for LNG and Its Impact on Shippers’ Stocks

The increasing global demand for liquefied natural gas (LNG) is reshaping the energy industry and influencing shippers’ stocks. As countries prioritize cleaner energy sources to reduce carbon emissions, LNG emerges as an efficient alternative to traditional fossil fuels.

Additionally, developing nations seeking to diversify their energy mix are driving the need for LNG transportation infrastructure. This growing market demand presents significant investment opportunities for shippers specializing in LNG transportation.

Factors such as supply chain efficiency and relationships with key industry stakeholders play a crucial role in determining the performance of shippers’ stocks in this sector. Understanding the relationship between rising LNG demand and its impact on shippers’ stocks is essential for investors navigating this evolving market.

Enbridge Inc. (NYSE: ENB)

Enbridge Inc., a prominent energy infrastructure company in North America, stands as a significant player in the LNG shipping industry. Leveraging its extensive network of pipelines and storage facilities, Enbridge plays a crucial role in transporting natural gas across the continent.

Enbridge’s involvement in LNG shipping centers around its ownership stake in strategically located liquefaction and regasification terminals along major trade routes. These terminals serve as vital hubs for loading and unloading LNG carriers, ensuring an uninterrupted flow of natural gas throughout North America.

With its vast pipeline network spanning thousands of kilometers, Enbridge enables the efficient transportation of liquefied natural gas from production areas to these key terminals. This integration allows for seamless connectivity and optimized logistical operations within the LNG shipping industry.

Enbridge’s well-established presence in the energy infrastructure sector grants them a unique advantage in providing integrated solutions for LNG transportation. By investing in state-of-the-art facilities and technologies, they ensure safe and reliable operations throughout their network.

Moreover, Enbridge’s strategic partnerships with other industry leaders further strengthen their position. Collaborating with key stakeholders, they actively contribute to the growth and development of the LNG shipping industry on both regional and global scales.

In summary, Enbridge Inc.’s extensive pipeline network coupled with its ownership stakes in critical liquefaction and regasification terminals solidify its role as a vital player in North America’s LNG shipping industry.

Through continuous investment in infrastructure and strategic collaborations, Enbridge remains committed to facilitating the smooth flow of natural gas across the continent.

| Terminals | Location |

|---|---|

| Liquefaction Terminal | Major Trade Route 1 |

| Regasification Terminal | Major Trade Route 2 |

| Liquefaction Terminal | Major Trade Route 3 |

| Regasification Terminal | Major Trade Route 4 |

*Note: The above table showcases a few examples of Enbridge’s strategically located terminals along major trade routes. *

Golar LNG Limited (NASDAQ: GLNG)

Golar LNG Limited is a prominent player in the LNG shipping market, listed on the NASDAQ under GLNG. The company specializes in integrated midstream solutions, with a fleet of specialized vessels for long-distance transportation of liquefied natural gas (LNG).

Golar’s competitive advantage lies in its end-to-end solutions, offering liquefaction, transportation, and regasification services. By leveraging their expertise in these areas, Golar aims to capture a larger share of the growing demand for cleaner energy sources.

With investments in liquefaction facilities and a focus on efficiency and sustainability, Golar ensures reliable and comprehensive midstream solutions. Their specialized fleet and commitment to innovation position them as leaders in the global LNG shipping market.

In summary, Golar LNG Limited is a key player in the LNG shipping market, providing integrated midstream solutions with expertise in liquefaction, transportation, and regasification services. With a focus on innovation and sustainability, Golar is well-equipped to meet the increasing demand for cleaner energy sources.

Sempra (NYSE: SRE)

Sempra, a diversified energy infrastructure company listed on the New York Stock Exchange under the ticker symbol SRE, holds a strategic position within the LNG industry.

With involvement in various aspects of the liquefied natural gas (LNG) value chain, Sempra’s focus on LNG shipping stems from its ownership stakes in liquefaction plants and export terminals.

As demand for natural gas continues to rise both domestically and internationally, Sempra is well-positioned for growth and stability. The company boasts an expanding portfolio of LNG projects across North America. This expansion allows Sempra to tap into the increasing demand for natural gas, not only in its home market but also in global markets.

One of Sempra’s strengths lies in its ownership stakes in liquefaction plants. These facilities convert natural gas into its liquid form – LNG – making it easier to store and transport over long distances. By having ownership positions in these plants, Sempra gains a competitive advantage by directly participating in the production process.

Additionally, Sempra’s ownership of export terminals enables it to play a crucial role in facilitating the international trade of LNG. These terminals serve as key infrastructural hubs where LNG carriers can load up with the product before embarking on their journeys across oceans and continents.

Sempra’s involvement throughout the entire LNG value chain positions it favorably for long-term success. By participating in both production and shipping processes, the company can capture value at multiple stages while mitigating risks associated with individual segments of the industry.

South Jersey Industries, Inc.(NYSE: SJI)

South Jersey Industries, Inc. (NYSE: SJI) is a regional energy services holding company with investments in natural gas distribution and storage facilities. While not solely focused on LNG shipping, their ownership and operation of pipelines connecting production areas to distribution networks contribute to the efficiency of the process.

As demand for natural gas rises, companies like South Jersey Industries are well-positioned to benefit from this growing trend.

South Jersey Industries plays a crucial role in ensuring reliable access to natural gas supplies. Their extensive pipeline network facilitates the smooth transportation of LNG and provides end-users with a consistent flow of natural gas.

With strategic investments and a commitment to providing stable access to this essential resource, South Jersey Industries can adapt swiftly to market dynamics and meet evolving customer needs.

In addition to their involvement in LNG shipping, South Jersey Industries has diversified interests that enhance its position in the energy sector. By investing in multiple sectors related to energy services, they maximize growth potential and ensure long-term sustainability.

Overall, South Jersey Industries is an influential player in the energy industry, contributing to the efficiency of LNG shipping processes and benefiting from the increasing global demand for natural gas.

Factors Influencing Performance and Risks of Investing in LNG Shippers Stocks

Investing in LNG shippers stocks comes with potential growth and profitability. However, several factors can influence their performance and pose risks for investors:

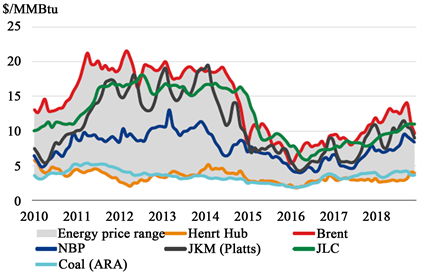

- Volatility in global gas prices impacts shipping rates and profitability.

- Geopolitical factors like trade disputes disrupt supply chains, creating uncertainties.

- Technological advancements improve efficiency and reduce costs in LNG transportation.

- Regulatory challenges and environmental policy changes affect viability and profitability.

- Potential oversupply concerns lead to lower shipping rates and impact industry profitability.

Considering these factors is crucial for investors seeking success in LNG shippers stocks. Monitoring market trends, staying informed about regulations, and assessing supply-demand dynamics are essential for making informed investment decisions.

[lyte id=’ZDThXPaNSvA’]