Investing in the stock market can be a complex and challenging endeavor. With countless investment options available, it can be difficult to navigate through the noise and identify opportunities that align with your investment goals. One emerging trend in the investing world is the rise of lithium batteries and their impact on various industries.

In this article, we will explore the concept of lithium battery index funds, their benefits, and how they can be an attractive option for investors looking to capitalize on the growing popularity of lithium batteries.

Introduction to Lithium Battery Index Funds

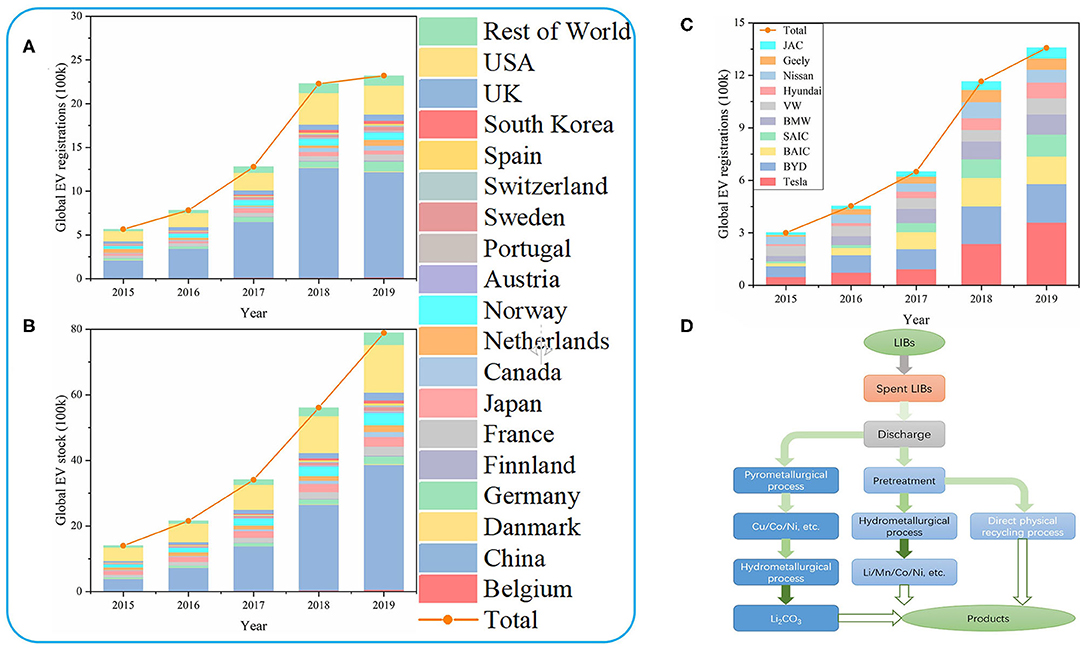

Lithium battery index funds replicate the performance of market indexes and provide investors with exposure to a diversified portfolio of stocks in the lithium battery sector. With the rising demand for electric vehicles (EVs) and renewable energy storage, lithium batteries have become crucial.

Investing in a lithium battery index fund allows individuals to capitalize on this growing industry while minimizing risk through diversification. These funds offer opportunities for long-term growth as governments worldwide focus on reducing carbon emissions and transitioning towards clean energy sources.

The Rise of Lithium Batteries

The demand for lithium batteries is skyrocketing due to the surge in electric vehicles (EVs) and the need for renewable energy storage. EVs offer lower costs, reduced environmental impact, and improved efficiency, leading major automakers to increase production. This drives the demand for lithium batteries as they are essential for powering EVs.

Additionally, as solar and wind power become prominent sources of electricity, there is a pressing need to store excess energy. Lithium batteries provide an efficient solution for storing renewable energy.

Investors can benefit from this trend by investing in index funds that offer exposure to companies involved in manufacturing lithium batteries and developing battery technologies. Diversification benefits further reduce risks and potential stable returns over time.

The rise of lithium batteries is fueled by sustainable transportation and clean energy transitions, making it a promising industry with significant growth potential.

Understanding Lithium Battery Index Funds

Lithium battery index funds aim to replicate the performance of a specific market index that focuses on companies involved in the lithium battery industry. These funds provide a diversified portfolio without the need for individual stock selection and management.

By investing in a lithium battery index fund, investors gain exposure to multiple sectors within the industry, including battery manufacturers, raw material suppliers, and technology innovators.

The benefits of investing in these funds compared to individual stocks are threefold. Firstly, diversification helps reduce risk by spreading investments across multiple companies. Secondly, they tend to have lower expense ratios, enhancing long-term returns.

Lastly, investing in a lithium battery index fund follows a passive investment strategy, eliminating the need for constant monitoring and active decision-making associated with individual stock selection.

Additionally, these funds offer ease of entry and exit as they are traded on major stock exchanges like any other publicly listed security. This liquidity provides flexibility for investors adjusting their holdings based on market conditions or personal financial goals.

Understanding how lithium battery index funds work and their benefits is crucial for investors interested in capitalizing on the growth potential of the lithium battery industry.

Stay tuned for Part II of this article series where we will delve into evaluating these funds and provide tips for successful investing!

[lyte id=’GuTio_-pEgM’]