Investing has always been a popular avenue for individuals looking to grow their wealth and secure their financial future. However, in recent years, there has been a significant shift in the way people approach investing. Traditional investment companies are no longer the only players in the game.

Trading firms have emerged as powerful entities that are changing the investing landscape.

Exploring the Growing Popularity of Trading Firms

Trading firms, also known as prop shops, have gained immense popularity among investors and traders. These firms trade using their own capital, making them more agile and adaptive to market conditions. The increasing accessibility of technology and financial markets has played a significant role in their rise.

With advanced trading software and platforms, individuals now have greater access to real-time market data and analysis tools, empowering them to actively manage their investments. Prop shops also offer learning opportunities and attractive compensation structures, further adding to their appeal.

As these firms continue to evolve, they are becoming a prominent force in the trading world.

Understanding their role in the investing world

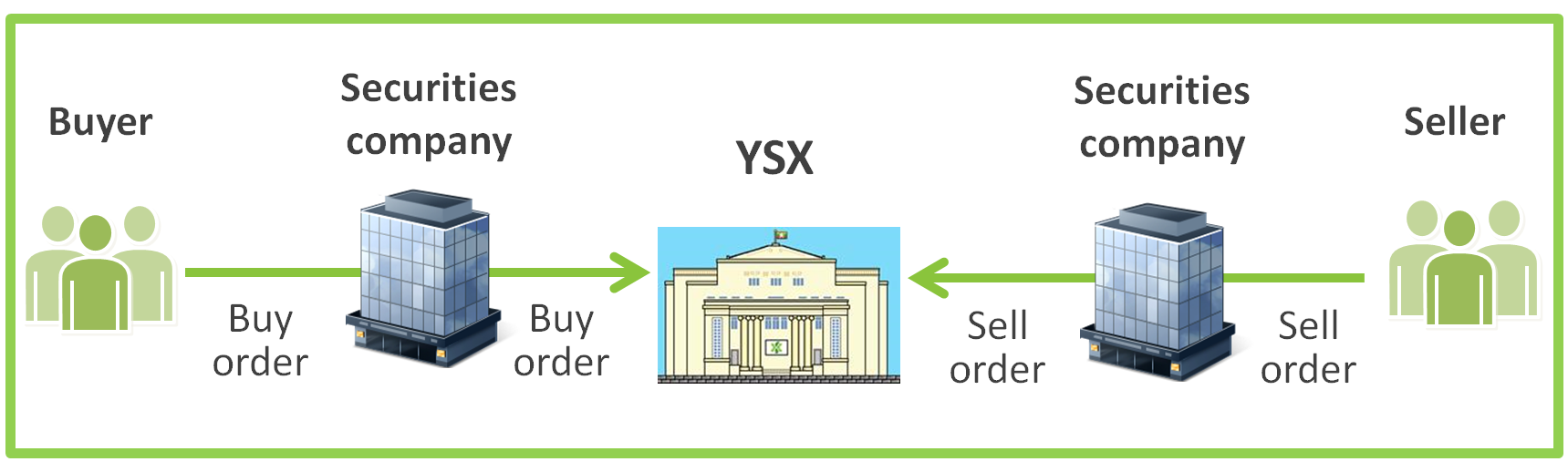

Trading firms are essential players in the investing world. They provide liquidity and enhance market efficiency by actively buying and selling securities, ensuring a ready market for investors to trade. These firms also contribute to price discovery by analyzing market trends and identifying mispriced assets.

Additionally, trading firms serve as training grounds for aspiring traders, offering valuable hands-on experience and mentorship from seasoned professionals. What sets trading firms apart is their active participation, focus on liquidity provision, commitment to price discovery, and nurturing of future traders.

Their role is crucial in maintaining a smooth and profitable investing environment.

Differentiating factors setting trading firms apart from traditional investment companies

Trading firms stand out from traditional investment companies through several distinct factors. Firstly, while investment firms manage client funds, trading firms use their own capital, granting them greater flexibility and the ability to take more significant risks.

Secondly, trading firms rely on advanced technology and algorithms for lightning-fast trade execution, allowing them to capitalize on even the smallest market inefficiencies. Lastly, trading firms specialize in specific markets or strategies rather than maintaining diversified portfolios like traditional investment companies.

This focused approach enables them to develop expertise and achieve higher returns in their chosen areas. These factors give trading firms a unique edge in the financial industry.

The Benefits of Working with a Trading Firm

Working with a trading firm offers several advantages for investors looking to grow their wealth. These firms provide access to advanced technology, allowing investors to make informed decisions based on real-time market data.

Additionally, partnering with multiple trading firms enables diversification across different strategies and markets, reducing overall risk while optimizing returns.

With their specialized expertise, trading firms have the potential to generate higher returns compared to traditional investment companies by capitalizing on market inefficiencies and profit opportunities.

| Benefit | Description |

|---|---|

| Advanced Technology | Trading firms invest in state-of-the-art platforms and infrastructure, providing access to cutting-edge tools and analysis for informed decision-making. |

| Diversification | Partnering with multiple trading firms allows investors to spread their portfolios across different strategies and markets, reducing risk and optimizing returns. |

| Potential for Higher Returns | Trading firms’ specialized expertise enables them to generate higher returns by capitalizing on market inefficiencies and profit opportunities. |

Overview of the typical structure and operations within a trading firm

Trading firms operate with a hierarchical structure, comprising various departments that collaborate to achieve objectives. The trading desk executes trades based on strategies, monitoring market conditions for profitable opportunities. The research and analysis team provides valuable insights by conducting in-depth market research.

Risk management assesses and mitigates potential risks associated with trades or strategies. Collaboration and effective communication between these departments are crucial for seamless operations within a trading firm.

Examining the Key Decision-Makers and Roles within a Trading Firm

In a trading firm, key decision-makers oversee different aspects of the business. The Chief Investment Officer (CIO) is responsible for the overall investment strategy. The Head Trader manages the trading desk and executes trades, while the Risk Manager assesses and manages risks.

These roles are crucial in shaping strategies, ensuring compliance, and protecting capital.

Understanding the Crucial Role Risk Management Plays in Ensuring Sustainable Profits

Risk management is vital for trading firms to achieve sustainable profits. It involves identifying, analyzing, and mitigating potential risks that could harm a firm’s financial stability. Robust risk management practices protect capital and minimize the chances of significant losses.

Effective risk management begins with identifying and assessing potential risks from market volatility, economic downturns, regulatory changes, or operational failures. Trading firms then develop strategies to mitigate these risks.

Key elements of risk management include establishing risk assessment frameworks, quantifying and prioritizing risks, implementing mitigation strategies such as diversification and hedging techniques, maintaining open communication channels between departments, and regularly monitoring and reviewing risk management practices.

In summary, by proactively managing risks through analysis, mitigation strategies, communication, and continuous monitoring, trading firms can safeguard their financial stability and increase the likelihood of sustainable profits.

Exploring Risk Management Techniques Utilized by Trading Firms

Trading firms employ various risk management techniques to safeguard their investments and navigate volatile markets. Diversification is one such technique, involving spreading investments across multiple markets or strategies to reduce the impact of any single trade or market event.

Position sizing is another important aspect, where firms allocate capital based on risk-reward profiles to manage exposure. Stop-loss orders set predefined exit points for trades, limiting potential losses if prices move unfavorably.

By combining these techniques and continuously monitoring risk levels, trading firms protect their long-term profitability while navigating market uncertainties. Their innovative approaches and focus on risk management make them attractive options for investors seeking growth and diversification opportunities.

Conduct thorough research to find reputable trading firms that align with your investment objectives.

[lyte id=’MEK5zQqV1Ys’]