Investing in real estate has long been considered a lucrative venture. However, not everyone has the means or the desire to invest in physical properties. This is where Real Estate Investment Trusts (REITs) come into play. In this article, we will delve into the world of REITs and explore how investors can build a portfolio of high-yield REITs.

Introduction to REITs

Real Estate Investment Trusts (REITs) are companies that own, operate, or finance income-generating real estate properties. These properties can range from office buildings and shopping malls to apartment complexes and hotels.

By investing in REITs, individuals can gain exposure to the real estate market without having to directly purchase and manage properties themselves.

Dividend yield is a key metric used by investors to evaluate the income potential of an investment. In the context of REITs, dividend yield refers to the annual dividend payment divided by the stock price. It provides insight into how much income an investor can expect relative to their investment.

Investing in REITs offers several advantages, including diversification across different property types and locations, as well as liquidity through trading on stock exchanges. Overall, REITs provide individuals with a convenient way to invest in real estate without the complexities associated with direct property ownership.

Factors Affecting Dividend Yield in REITs

Dividend yield in Real Estate Investment Trusts (REITs) is influenced by various factors. These include financial health, occupancy rates, rental growth prospects, leverage ratio, and management’s ability to generate consistent cash flows.

Market conditions and industry trends also play a significant role, with factors like interest rates, supply and demand dynamics, economic conditions, and regulatory changes impacting property values and rental income. By considering these factors, investors can make informed decisions to maximize their potential income from investing in REITs.

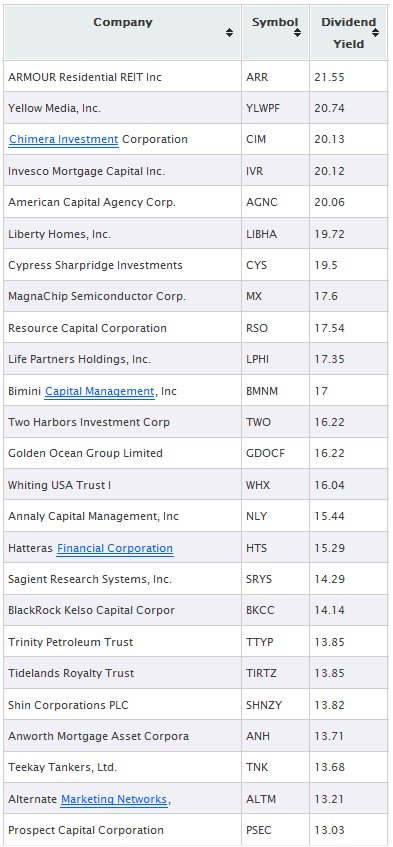

Top 10 REITs with Highest Dividend Yields

In this section, we will explore the top 10 REITs that consistently offer impressive dividend yields to investors. These REITs have proven themselves as reliable income generators, providing attractive returns on investment.

We will delve into the factors behind their high dividend yields, including strong property portfolios, well-managed operations, stable occupancy rates, and strategic investments. By understanding these factors, investors can make informed decisions and potentially uncover new opportunities within the real estate market.

Thorough research is essential before making any investment decisions to ensure a well-diversified portfolio.

Pros and Cons of Investing in High-Yield REITs

Investing in high-yield Real Estate Investment Trusts (REITs) has its advantages and disadvantages. Let’s explore the benefits and drawbacks associated with these investments.

One advantage is the steady income streams from rental dividends, making them appealing for income-focused investors. There is also potential for capital appreciation as real estate properties appreciate over time, offering both current income and long-term returns.

Additionally, high-yield REITs provide diversification benefits by spreading investments across different property types and locations. Professional management ensures effective property operations.

Consider the impact of interest rate fluctuations on high-yield REITs’ profitability. Economic downturns can affect occupancy rates, reducing rental income. Property-specific risks like location, condition, tenant quality, and lease terms should be evaluated before investing.

Lastly, liquidity concerns arise due to limited trading activity on secondary markets.

In summary, investing in high-yield REITs offers steady income, potential growth, diversification, and professional management. However, it’s important to weigh the risks such as interest rates, economic downturns, property-specific factors, and liquidity concerns when making investment decisions.

Strategies for Selecting Strong Dividend Yield REITs

When it comes to selecting strong dividend yield REITs, careful analysis and research are essential. Here are some practical tips to help you make informed investment decisions:

-

Evaluate financial indicators: Analyze metrics like funds from operations (FFO), net operating income (NOI), debt levels, and cash flow to assess the REIT’s financial health and its ability to sustain and grow dividend payments.

-

Assess market conditions: Consider factors such as interest rates, supply and demand dynamics, and regional economic trends to determine which types of properties are likely to generate stable rental income and drive dividend growth.

-

Analyze management strategies: Examine the track record and expertise of the REIT’s management team. Look for value-add strategies, such as property acquisitions or developments that can enhance rental income potential and increase dividends.

-

Identify growth opportunities: Seek out diversified property holdings across different geographic locations or sectors with favorable long-term prospects. Consider upcoming lease expirations or redevelopment plans that could impact rental income potential and subsequent dividend growth.

To bring these strategies to life, we will present case studies showcasing successful investment outcomes resulting from selecting strong dividend yield REITs. By examining real-life examples, you can gain a better understanding of how to apply these strategies in your own investment decisions.

By following these strategies and learning from real-life examples, you can enhance your chances of selecting strong dividend yield REITs that offer attractive dividends and long-term returns.

Tips for Maximizing Dividend Income from REIT Investments

Investors looking to boost their dividend income from REIT investments can implement several effective techniques. These strategies focus on maximizing returns while considering factors such as dividend reinvestment plans, portfolio allocation, and tax-efficient approaches.

One technique for enhancing dividend income is through the use of dividend reinvestment plans. By opting to reinvest dividends instead of receiving them as cash, investors can acquire additional shares in the REIT. This allows for compounding growth over time and potentially increases overall dividend income.

Selective portfolio allocation is another valuable approach. Investors should carefully assess different high-yield REITs and allocate their portfolio based on factors such as historical performance, industry trends, and risk appetite.

By diversifying across multiple high-yield REITs, investors can reduce their exposure to any single investment and potentially increase their overall dividend income.

Considering tax-efficient strategies is also crucial when seeking to maximize dividend income. Investors should be aware of applicable tax laws and regulations, as well as any tax advantages or incentives specific to REIT investments. Utilizing these strategies can help minimize tax liability and optimize after-tax returns.

In summary, maximizing dividend income from REIT investments requires a combination of smart investment decisions and strategic planning.

By employing techniques such as dividend reinvestment plans, selective portfolio allocation, and tax-efficient strategies, investors can enhance their overall returns and enjoy greater dividends from their REIT investments.

Successful Case Studies: High-Yield REIT Investments

In this section, we will present real-life case studies showcasing successful outcomes achieved through high-yield REIT investments. These examples offer valuable insights into the potential rewards of investing in this asset class.

By analyzing the factors that contributed to success or failure in each case, readers can make informed decisions about their own high-yield REIT investments. Through meticulous research, adaptability, and understanding market dynamics, investors can position themselves for success in high-yield REIT investments.

Risks Associated with Investing in High-Dividend Yield REITs

Investing in high-dividend yield REITs comes with its share of risks. Interest rate sensitivity can impact profitability and dividends when rates rise. Real estate market volatility can lead to capital losses. Liquidity risks may limit access to funds during unfavorable conditions.

Regulatory changes can require adjustments and increase compliance costs. Being aware of these risks helps investors make informed decisions and implement strategies for risk mitigation.

[lyte id=’6GC0RodDM1g’]